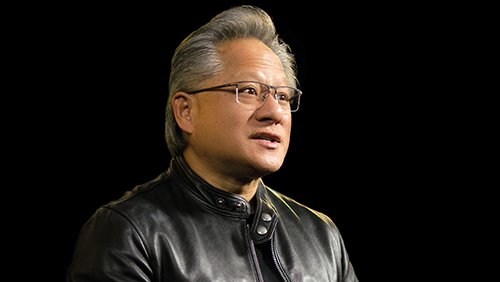

Jensen Huang: NVIDIA’s leader accelerates AI’s advance

Claire Shaw – Portfolio Director

Key Points

- NVIDIA has become one of the world’s pre-eminent tech companies, thanks in part to Jensen Huang’s skill at making long-term plans that pay off

- Many of the recent advances in artificial intelligence are being powered by the firm’s computer chips and associated software

- Its investment in self-driving car technologies and digital biology opens further avenues for growth

As with any investment, your capital is at risk.

Jensen Huang recently celebrated three decades as NVIDIA’s chief executive. It’s a remarkable achievement, particularly given that many recent advances in artificial intelligence (AI) rest on the foundations of long-term decisions he made years ago – decisions that many doubted at the time.

But Huang’s determination to turn adversity to his advantage has been there from the start. Born in Taiwan, he came to the US aged nine alongside his 11-year-old brother, two years ahead of their parents. Unaware of its nature, a relative enrolled them in a school for troubled children.

Huang discovered that his roommate, who was nearly double his age, had recently been released from jail and was recovering from seven stab wounds. Despite the odds, they became friends: Huang taught his companion to read and was in turn introduced to weightlifting, which became a lifelong passion.

Huang co-founded NVIDIA on his 30th birthday in April 1993 after being persuaded to quit another semiconductor firm. The name came from the ‘NV’ label the founders used to title their computer files. The letters stood for ‘next version’ and inspired them to settle on a shortened form of ‘invidia’ – the Latin for envy. The decision also explains the firm’s widespread use of the colour green.

Video game graphics

Huang’s ex-boss thought so highly of him that he arranged an introduction to the venture capital firm Sequoia. The investment company’s founder prized exceptional technologist leaders who were determined to attack big markets with game-changing products and could overcome setbacks. He looked beyond Huang’s clunky pitch and participated in the firm’s initial $2m funding round.

Huang’s goal was to develop a chip to supercharge video game graphics. It didn’t take long for his resilience to be tested.

NVIDIA’s early technology was based on building images from lots of small four-sided shapes, but a decision by Microsoft led to the industry settling on triangles. For this and other reasons, NVIDIA had to scrap plans for its second-generation chip, lay off most of its workers and start again from scratch, putting it months behind rivals.

Huang turned the challenge into an opportunity by daring to design and trial NVIDIA’s chip in software and then go straight to mass production instead of following the usual process of testing and improving hardware prototypes.

The unprecedented gamble paid off. NVIDIA sold more than a million of the chips within four months of their release in 1997. Moreover, because the California-based company had pioneered a way to bring chips to market twice as fast as usual, it outpaced its rivals when it released more powerful successors.

Valuable mistakes

It wouldn’t be the last time Huang “failed forward” – a strategy he describes as taking a chance on something new, admitting when it isn’t working, adjusting and then pressing onwards, becoming better every time.

NVIDIA’s rapid progress led Microsoft to pick it as the graphics chip supplier for its first Xbox console. When the video games machine was launched in 2001, NVIDIA’s revenues surpassed $1bn, making it the fastest semiconductor company to reach the milestone. But Huang had bigger ambitions than the games market alone.

Over the following years, he ploughed huge amounts of money into developing CUDA (compute unified device architecture). In simple terms, CUDA allows developers to use NVIDIA’s graphics processing units (GPUs) to do much more than draw images. The benefit is that GPUs specialise in handling many tasks in parallel, solving complex problems by dividing them into parts and crunching them simultaneously.

CUDA represented a long-term play based on Huang’s belief that GPUs were the key to accelerating scientific discovery. NVIDIA could derive an enduring benefit by being the only firm in its sector to invest deeply in software to unlock that capability.

Artificial intelligence

While specialist researchers found this useful, it didn’t amount to a mass-market opportunity. Then in 2012, the stars aligned. A group of AI researchers made a breakthrough in recognising dogs, boats and other objects in photos, using an NVIDIA-powered neural network – a machine learning system modelled on the human brain.

Spotting the opportunity, NVIDIA extended CUDA, making it easier and faster for others to conduct further AI experiments. Leaps forward in speech recognition, customer recommendation engines and more advanced image recognition followed.

More than three million developers now use CUDA, which works exclusively with NVIDIA’s chips. They have built a huge ecosystem of services around it, making it the industry standard and a bedrock of the company’s competitive advantage.

Scottish Mortgage first invested in NVIDIA in July 2016. It matched our criteria for being an exceptional growth company addressing a huge market opportunity. A large part of the appeal was Huang himself, a founder with a high tolerance for risk regarding projects with potentially huge payoffs.

Over time our appreciation for the stock has grown as we’ve seen NVIDIA’s technology enhance many of our other holdings’ products, including:

- personalised recommendations within Spotify, Netflix and ByteDance’s TikTok

- data centre services from Amazon

- visuals and developer tools for Epic Games’ hit title Fortnite

Generated content

The firm’s stock recently rose to new heights thanks to ‘generative’ AI, which creates text, images and other content at human-like levels. Huang describes last year’s launch of the chatbot ChatGPT as an “inflection point” and its mass adoption as “an iPhone moment”.

It’s too early to know how big the market for generative AI will become. But demand for NVIDIA’s products should continue to benefit from the growing computing power required to train the increasingly complex models involved and the rising number of services that run off them.

Once again, NVIDIA has been quick to adapt. Earlier this year, Huang unveiled DGX Cloud. It provides companies with a way to develop bespoke generative AI models without having to buy their own high-end GPUs.

Instead, they rent use of an ‘AI supercomputer in the cloud’. Huang suggests that companies involved in tackling climate change, drug discovery and chemicals research are among those it will appeal to. And in a very Huang-like fashion, he has partnered with several of the major data centre service providers to offer the service rather than trying to supplant them.

But that’s just the tip of what he describes as a $1tn opportunity to upgrade the sector.

“You’re seeing the beginning of a 10-year transition to basically recycle or reclaim the world’s data centres and build it out as accelerated computing… and the workload is going to be predominantly generative AI,” Huang said in May.

Transport and biology

Looking ahead, transportation has the potential to become a significant revenue stream. Electric cars already feature many more chips than their combustion engine equivalents, and the self-driving future is likely to require additional, higher-end components.

NVIDIA’s Hyperion platform already offers a ‘developer version’ of an energy-efficient in-car computer, in addition to cloud computing facilities to train autonomous driving software and a variety of sensors to help the vehicles make sense of their surroundings. Carmakers can buy the system as a bundle or purchase different parts.

It’s currently a small part of NVIDIA’s business. Still, the firm says it is already working with “several hundred partners”, from large car manufacturers to smaller startups.

Huang also talks up the prospects of a “digital biology revolution”. The idea is that advances in artificial intelligence can be allied to those in genomics to develop new medicines, with NVIDIA’s chips and software accelerating the process.

Both prospects could potentially drive long-term growth at NVIDIA and a range of Scottish Mortgage’s other holdings, including NIO, Nuro, Recursion Pharmaceuticals and Tempus.

Indeed, in July NVIDIA announced it was taking a $50m stake in Recursion and would help the firm train its drug discovery AI models more quickly. Further out, the type of parallel computing Huang pioneered may unlock breakthroughs not yet in sight.

“When technology moves this fast, if you’re not reinventing yourself, you’re just slowly dying,” Huang once remarked. On that basis, NVIDIA is fighting fit thanks to its co-founder’s knack for turning almost every challenge he faces into an opportunity.

Train your own model

Many industries are developing generative AI models, often using NVIDIA’s products, to create and analyse text and images.

Retail: Amazon is developing a large language model to enhance shopping and other experiences on its Alexa-powered smart speakers. A few companies have also started to use AI models to create items from scratch from customers’ text-based descriptions, including T-shirt image designs.

Law: Several startups already offer services built on ChatGPT’s technology to summarise court decisions, highlight risky contract clauses and answer complex case law questions in plain language. But large law firms may decide there’s an advantage in training proprietary models on their archives.

Healthcare: Researchers at New York University have trained a model on clinical notes to predict which hospital patients are at the greatest risk of readmission within a month of being discharged. Others are developing models to develop new drugs and artificially generate body scans to deepen understanding of rare diseases.

Financial services: Bloomberg is developing a model to help users query its vast financial database and track investor sentiment by analysing comments about traded stocks.

Education: Students and teachers are already using various AI models to write and mark homework. But educational institutions are also developing new ones. For example, the University of Zurich has created a tool to help researchers analyse articles written in the country’s four official languages, including Romansh.

Investments with exposure to overseas securities can be affected by changing stock market conditions and currency exchange rates.

About the author - Claire Shaw

Portfolio Director

Claire Shaw is a portfolio director and plays a prominent role in servicing Scottish Mortgage’s UK shareholder base. Before joining in 2019, she spent over a decade as a fund manager with a focus on managing European equity portfolios for a global client base. With a background in analysing companies and communicating investment ideas, Claire is also responsible for creating engaging content that makes the Scottish Mortgage portfolio accessible to all its shareholders. Beyond that, she works closely with the managers, meeting with portfolio companies and conducting in-depth portfolio discussions with shareholders.

Regulatory Information

This content was produced and approved at the time stated and may not have been updated subsequently. It represents views held at the time of production and may not reflect current thinking. Read our Legal and regulatory information for further details.

A Key Information Document is available by visiting our Documents page. Any images used in this content are for illustrative purposes only.

This content does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 (BGA) holds a Type 1 licence from the Securities and Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes and closed-ended funds such as investment trusts to professional investors in Hong Kong.

Baillie Gifford Asia (Singapore) Private Limited (BGAS) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. BGA and BGAS are wholly owned subsidiaries of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

Europe

Scottish Mortgage Investment Trust PLC (the “Company”) is an alternative investment fund for the purpose of Directive 2011/61/EU (the “AIFM Directive”). Baillie Gifford & Co Limited is the alternative investment fund manager (“AIFM”) of the Company and has been authorised for marketing to Professional Investors in this jurisdiction.

This content is made available by Baillie Gifford Investment Management (Europe) Limited (“BGE”), which has been engaged by the AIFM to carry out promotional activities relating to the Company. BGE is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform promotional, advisory and Individual Portfolio Management activities. BGE has passported its authorisations under the mechanisms set out in the AIFM Directive.

Belgium

The Company has not been and will not be registered with the Belgian Financial Services and Markets Authority (Autoriteit voor Financiële Diensten en Markten / Autorité des services et marchés financiers) (the FSMA) as a public foreign alternative collective investment scheme under Article 259 of the Belgian Law of 19 April 2014 on alternative collective investment institutions and their managers (the Law of 19 April 2014). The shares in the Company will be marketed in Belgium to professional investors within the meaning the Law of 19 April 2014 only. Any offering material relating to the offering has not been, and will not be, approved by the FSMA pursuant to the Belgian laws and regulations applicable to the public offering of securities. Accordingly, this offering as well as any documents and materials relating to the offering may not be advertised, offered or distributed in any other way, directly or indirectly, to any other person located and/or resident in Belgium other than to professional investors within the meaning the Law of 19 April 2014 and in circumstances which do not constitute an offer to the public pursuant to the Law of 19 April 2014. The shares offered by the Company shall not, whether directly or indirectly, be marketed, offered, sold, transferred or delivered in Belgium to any individual or legal entity other than to professional investors within the meaning the Law of 19 April 2014 or than to investors having a minimum investment of at least EUR 250,000 per investor.

Germany

The Trust has not offered or placed and will not offer or place or sell, directly or indirectly, units/shares to retail investors or semi-professional investors in Germany, i.e. investors which do not qualify as professional investors as defined in sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB) and has not distributed and will not distribute or cause to be distributed to such retail or semi-professional investor in Germany, this document or any other offering material relating to the units/shares of the Trust and that such offers, placements, sales and distributions have been and will be made in Germany only to professional investors within the meaning of sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB).

Luxembourg

Units/shares/interests of the Trust may only be offered or sold in the Grand Duchy of Luxembourg (Luxembourg) to professional investors within the meaning of Luxembourg act by the act of 12 July 2013 on alternative investment fund managers (the AIFM Act). This document does not constitute an offer, an invitation or a solicitation for any investment or subscription for the units/shares/interests of the Trust by retail investors in Luxembourg. Any person who is in possession of this document is hereby notified that no action has or will be taken that would allow a direct or indirect offering or placement of the units/shares/interests of the Trust to retail investors in Luxembourg.

Switzerland

The Trust has not been approved by the Swiss Financial Market Supervisory Authority (“FINMA”) for offering to non-qualified investors pursuant to Art. 120 para. 1 of the Swiss Federal Act on Collective Investment Schemes of 23 June 2006, as amended (“CISA”). Accordingly, the interests in the Trust may only be offered or advertised, and this document may only be made available, in Switzerland to qualified investors within the meaning of CISA. Investors in the Trust do not benefit from the specific investor protection provided by CISA and the supervision by the FINMA in connection with the approval for offering.

Singapore

This content has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this content and any other content or material in connection with the offer or sale, or invitation for subscription or purchase, of the Trust may not be circulated or distributed, nor may be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor (as defined in Section 4A of the Securities and Futures Act 2001, as modified or amended from time to time (SFA)) pursuant to Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the SFA) pursuant to Section 275(1), or any person pursuant to Section 275(1A), and in accordance with the conditions specified in Section 275 of the SFA, or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Where the Trust is subscribed or purchased under Section 275 by a relevant person which is:

(a) a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or

(b) a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor, securities or securities-based derivatives contracts (each term as defined in Section 2(1) of the SFA) of that corporation or the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferred within six months after that corporation or that trust has acquired the securities pursuant to an offer made under Section 275 except:

(1) to an institutional investor or to a relevant person or to any person arising from an offer referred to in Section 275(1A) or Section 276(4)(c)(ii) of the SFA,

(2) where no consideration is or will be given for the transfer;

(3) where the transfer is by operation of law; or

(4) pursuant to Section 276(7) of the SFA or Regulation 37A of the Securities and Futures (Offers of Investments) (Securities and Securities-based Derivatives Contracts) Regulations 2018.