Perspectives on Progress #6

Claire Shaw – Investment Specialist

Ben James – Portfolio Director

- Climeworks is set to benefit from the US Department of Energy’s up to $1.2bn investment in direct air capture projects.

- Beauty and wellness company ODDITY successfully IPO’d in July 2023.

- Operational updates from MercadoLibre, Delivery Hero and Pinduoduo suggest they are well-placed to capitalise on the significant opportunities ahead of them.

As with any investment, your capital is at risk.

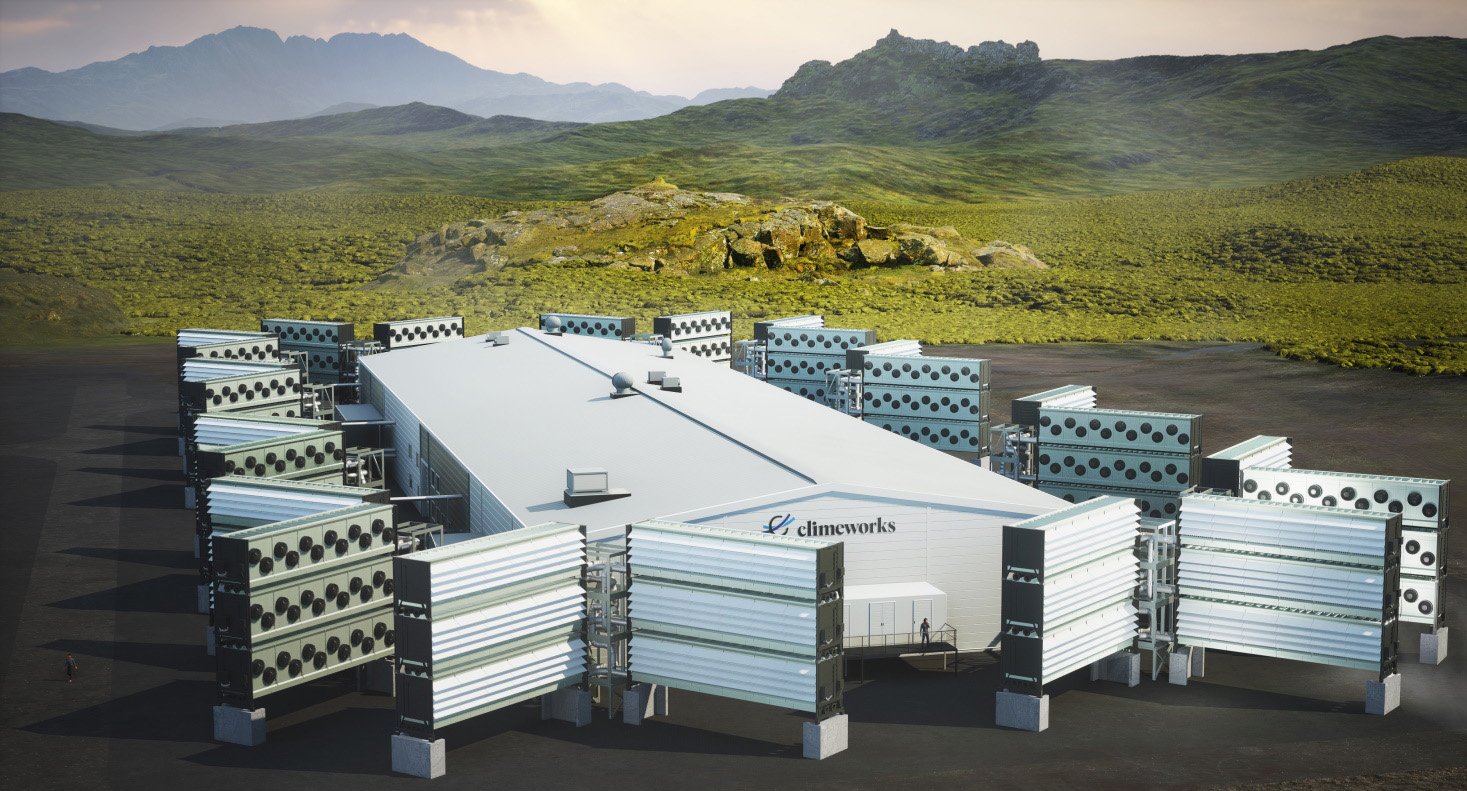

Climeworks

Removing CO2 from America’s atmosphere

The Swiss company is spearheading global initiatives for carbon dioxide removal via direct air capture (DAC). It recently received a ‘Notification of Selection’ from the US Department of Energy as one of the companies set to benefit from an up to $1.2bn investment into this emerging technology. Worsening climate change and inadequate efforts to cut emissions have thrust carbon removal into the spotlight. UN scientists estimate that billions of tons of carbon must be sucked out of the atmosphere annually to meet global warming targets. As part of Biden’s Bipartisan Infrastructure Law, this investment will fund America’s first two DAC hubs – one in Texas and one in Louisiana. Each project will capture an estimated one million metric tons or more of carbon dioxide per year initially. Climeworks’ technology will be deployed in Project Cypress in Louisiana. This project is expected to create approximately 2,300 jobs in the area and has set a goal of 10 per cent of the overall workforce coming from the fossil fuel industry.

Since its founding in 2009 by engineers Christoph Gebald and Jan Wurzbacjer, Climeworks has established the world’s first, and to date only, commercial DAC facility – Orca – which operates in Iceland. The company already boasts a wealth of multinationals among its customer base, including Microsoft, UBS and Shopify.

While DAC is still an industry in its early days, US Energy Secretary Jennifer Granholm said, “If we deploy this at scale, this technology can help us make serious headways towards our net zero emissions goals.”

To learn more about Climeworks and its mission to limit global warming, check out our short film which you can find here.

ODDITY

A makeover for the IPO scene

The Scottish Mortgage portfolio saw its first IPO in 18 months in July when private holding ODDITY went public on the NASDAQ. ODDITY’s successful listing bucks last year’s trend, which saw only a few IPOs across the entire market, suggesting that some positive sentiment is returning to the US economy.

ODDITY is using technology to transform the beauty industry. Its expanding proprietary data set and machine learning enable it to deliver high-quality, science-backed products and accurate recommendations. For example, one of ODDITY’s brands is the makeup line IL MAKIAGE. It uses a combination of AI-powered quizzes and the camera on your smartphone to successfully select the ideal foundation match for any skin type.

Unsurprisingly, 40 per cent of ODDITY’s staff are technologists.

We invested when ODDITY was still private after the founders selectively approached us as potential long-term shareholders to assist its growth. ODDITY’s profitable growth is rare for a direct-to-consumer company, and we look forward to it iteratively launching more brands with equally enormous sales potential over the coming years.

MercadoLibre

$10bn in gross merchandise volume achieved

MercadoLibre, the largest ecommerce and fintech ecosystem in Latin America, continues to deliver impressive fundamental growth and has surpassed $10 billion in quarterly gross merchandise volume (GMV) for the first time in the company’s history. Chief executive, Marcos Galperin, commented that the consumer in Latin America has rebounded heavily after the pandemic and its leadership position in the region has been going from “strength to strength”.

Growth in markets such as Brazil and Mexico stand out, and this is despite intense competition across the continent. MercadoLibre's first-mover advantage, expansive logistics network and the stickiness of its fintech ecosystem have also prevented foreign challengers like Amazon and Sea Limited's Shopee from gaining a meaningful foothold in Latin America.

At a time when other ecommerce giants around the globe are shedding staff, MercadoLibre continues investing in its business by adding headcount to build out an even more robust logistics network to provide faster and cheaper deliveries across the region to its consumers.

Delivery Hero

Delivering cause for optimism

The last few years have been challenging for the food delivery company Delivery Hero. While it benefited significantly during the Covid-19 lockdowns of 2020 and 2021, its share price fell sharply in 2022 as economies reopened, and inflation and interest rate concerns weighed heavily on growth companies in general. This led to the company forecasting slowing growth in the short term.

Despite the adverse market reaction in 2022, chief executive, Niklas Östberg, committed to the companyʼs long-term investment plan. Positive signals are starting to come through in the numbers.

It recently achieved adjusted operating profits and forecasts stronger-than-expected revenue growth for the rest of 2023.

As the largest food delivery network outside of China, Östbergʼs long-term committed approach is rare, and the opportunity for Delivery Hero remains vast.

Pinduoduo

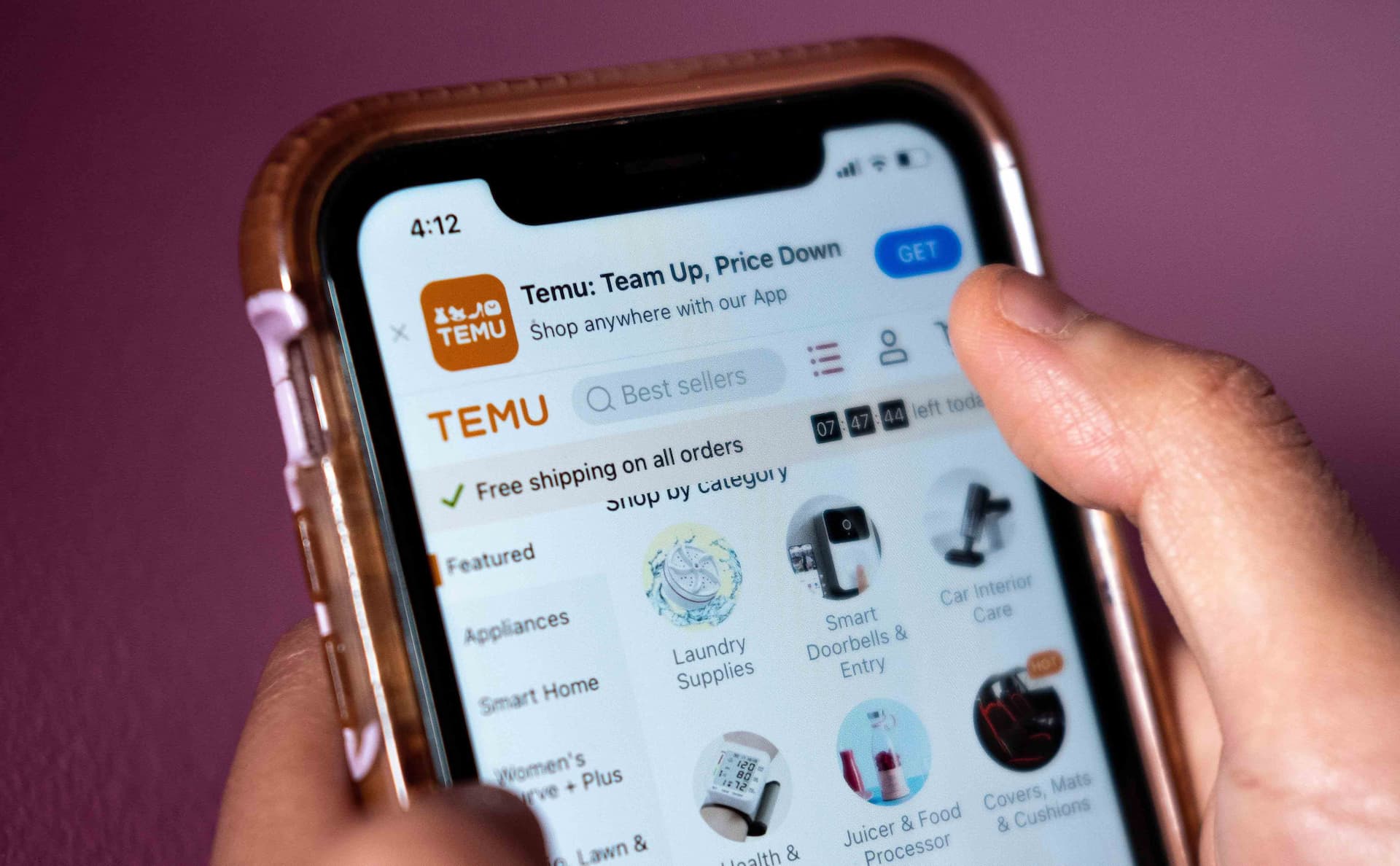

The rise of Temu

While scrolling through your Instagram stories recently, you may have seen Temu products pop up on your feed. You may not know, but Temu is run by Chinese ecommerce giant Pinduoduo (PDD), and its recent growth has been nothing short of explosive. Temu officially launched internationally in September 2022 and has gone from $3 million GMV to $400 million GMV a month by April 2023.

The Temu app has been topping the most downloaded free app charts globally this year as it has expanded across different countries and regions. PDD is spending aggressively as it expands beyond its core domestic Chinese customer. So much so that Meta management recently highlighted “Chinese advertisers reaching customers in other markets” to explain its stronger ad revenues. Through heavily discounted products, gamification and smart social marketing, Temuʼs price and selection are astonishing. We are excited to see how PDD continues to capitalise on the significant overseas opportunity in front of it.

Scottish Mortgage Annual Past Performance To 30 June each year (net %)

| 2019 | 2020 | 2021 | 2022 | 2023 |

| 0.7 | 55.4 | 62.8 | -46.1 | -6.3 |

Source: Morningstar, share price, total return, sterling

Past performance is not a guide to future returns.

The trust invests in overseas securities. Changes in the rates of exchange may also cause the value of your investment (and any income it may pay) to go down or up.

The trust invests in emerging markets where difficulties in dealing, settlement and custody could arise, resulting in a negative impact on the value of your investment.

The trust has a significant investment in private companies. The trust’s risk could be increased as these assets may be more difficult to sell, so changes in their prices may be greater.

About the author - Claire Shaw

Investment Specialist

Claire joined Baillie Gifford in 2019 as an investment specialist for the Scottish Mortgage Investment Trust. Prior to this since 2014, she was a portfolio manager of European Small and Mid Caps at SYZ Asset Management and previously spent six years at Franklin Templeton on the European Equities team. Claire holds a First Class MA (Honours) degree in Geography from the University of Aberdeen and a Masters (MSc) in Research from the University of Edinburgh.

About the author - Ben James

Portfolio Director

Ben James is a portfolio director serving Scottish Mortgage’s shareholder base. Ben joined the Scottish Mortgage team in 2023 and has worked with Tom Slater as the US equity investment specialist at Baillie Gifford since 2015. A former soldier, he developed a passion for the power of investment to drive progress during his overseas deployments. Ben works closely with the managers, meeting with portfolio companies and conducting in-depth portfolio discussions with shareholders. Alongside this, he creates engaging content that makes the Scottish Mortgage portfolio accessible to all its shareholders.

Regulatory Information

This content was produced and approved at the time stated and may not have been updated subsequently. It represents views held at the time of production and may not reflect current thinking. Read our Legal and regulatory information for further details.

A Key Information Document is available by visiting our Documents page. Any images used in this content are for illustrative purposes only.

This content does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 (BGA) holds a Type 1 licence from the Securities and Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes and closed-ended funds such as investment trusts to professional investors in Hong Kong.

Baillie Gifford Asia (Singapore) Private Limited (BGAS) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. BGA and BGAS are wholly owned subsidiaries of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

Europe

Scottish Mortgage Investment Trust PLC (the “Company”) is an alternative investment fund for the purpose of Directive 2011/61/EU (the “AIFM Directive”). Baillie Gifford & Co Limited is the alternative investment fund manager (“AIFM”) of the Company and has been authorised for marketing to Professional Investors in this jurisdiction.

This content is made available by Baillie Gifford Investment Management (Europe) Limited (“BGE”), which has been engaged by the AIFM to carry out promotional activities relating to the Company. BGE is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform promotional, advisory and Individual Portfolio Management activities. BGE has passported its authorisations under the mechanisms set out in the AIFM Directive.

Belgium

The Company has not been and will not be registered with the Belgian Financial Services and Markets Authority (Autoriteit voor Financiële Diensten en Markten / Autorité des services et marchés financiers) (the FSMA) as a public foreign alternative collective investment scheme under Article 259 of the Belgian Law of 19 April 2014 on alternative collective investment institutions and their managers (the Law of 19 April 2014). The shares in the Company will be marketed in Belgium to professional investors within the meaning the Law of 19 April 2014 only. Any offering material relating to the offering has not been, and will not be, approved by the FSMA pursuant to the Belgian laws and regulations applicable to the public offering of securities. Accordingly, this offering as well as any documents and materials relating to the offering may not be advertised, offered or distributed in any other way, directly or indirectly, to any other person located and/or resident in Belgium other than to professional investors within the meaning the Law of 19 April 2014 and in circumstances which do not constitute an offer to the public pursuant to the Law of 19 April 2014. The shares offered by the Company shall not, whether directly or indirectly, be marketed, offered, sold, transferred or delivered in Belgium to any individual or legal entity other than to professional investors within the meaning the Law of 19 April 2014 or than to investors having a minimum investment of at least EUR 250,000 per investor.

Germany

The Trust has not offered or placed and will not offer or place or sell, directly or indirectly, units/shares to retail investors or semi-professional investors in Germany, i.e. investors which do not qualify as professional investors as defined in sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB) and has not distributed and will not distribute or cause to be distributed to such retail or semi-professional investor in Germany, this document or any other offering material relating to the units/shares of the Trust and that such offers, placements, sales and distributions have been and will be made in Germany only to professional investors within the meaning of sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB).

Luxembourg

Units/shares/interests of the Trust may only be offered or sold in the Grand Duchy of Luxembourg (Luxembourg) to professional investors within the meaning of Luxembourg act by the act of 12 July 2013 on alternative investment fund managers (the AIFM Act). This document does not constitute an offer, an invitation or a solicitation for any investment or subscription for the units/shares/interests of the Trust by retail investors in Luxembourg. Any person who is in possession of this document is hereby notified that no action has or will be taken that would allow a direct or indirect offering or placement of the units/shares/interests of the Trust to retail investors in Luxembourg.

Switzerland

The Trust has not been approved by the Swiss Financial Market Supervisory Authority (“FINMA”) for offering to non-qualified investors pursuant to Art. 120 para. 1 of the Swiss Federal Act on Collective Investment Schemes of 23 June 2006, as amended (“CISA”). Accordingly, the interests in the Trust may only be offered or advertised, and this document may only be made available, in Switzerland to qualified investors within the meaning of CISA. Investors in the Trust do not benefit from the specific investor protection provided by CISA and the supervision by the FINMA in connection with the approval for offering.

Singapore

This content has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this content and any other content or material in connection with the offer or sale, or invitation for subscription or purchase, of the Trust may not be circulated or distributed, nor may be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor (as defined in Section 4A of the Securities and Futures Act 2001, as modified or amended from time to time (SFA)) pursuant to Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the SFA) pursuant to Section 275(1), or any person pursuant to Section 275(1A), and in accordance with the conditions specified in Section 275 of the SFA, or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Where the Trust is subscribed or purchased under Section 275 by a relevant person which is:

(a) a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or

(b) a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor, securities or securities-based derivatives contracts (each term as defined in Section 2(1) of the SFA) of that corporation or the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferred within six months after that corporation or that trust has acquired the securities pursuant to an offer made under Section 275 except:

(1) to an institutional investor or to a relevant person or to any person arising from an offer referred to in Section 275(1A) or Section 276(4)(c)(ii) of the SFA,

(2) where no consideration is or will be given for the transfer;

(3) where the transfer is by operation of law; or

(4) pursuant to Section 276(7) of the SFA or Regulation 37A of the Securities and Futures (Offers of Investments) (Securities and Securities-based Derivatives Contracts) Regulations 2018.