A Wise Move: Saving When Sending Abroad

Hamish Maxwell – Investment Specialist

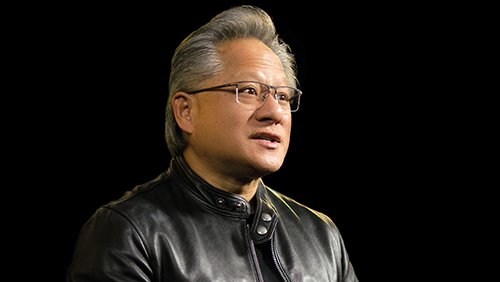

- A written summary of Lawrence Burns' conversation with CEO and co-founder of fintech company and Scottish Mortgage holding, Wise

- Wise’s infrastructure, built from scratch, cuts costs and speeds up international money transfers

- As early shareholders, Scottish Mortgage has supported the company on its long-term mission to revolutionise global money movement

As with any investment, your capital is at risk.

At a party in London in 2007, Estonians Kristo Käärmann and Taavet Hinrikus were sharing their frustrations. Taavet Hinrikus was being paid in euros but lived in the UK, so needed pounds. Kristo Käärmann, meanwhile, had a salary in pounds, but a mortgage in Estonia, so needed Euros.

They both found the process of moving money internationally to be expensive, time-consuming, and lacking in transparency – banks were not forthcoming about their fees, and so the amount of money that would end up on the other side was somewhat of a guessing game.

Both from a computer science background, they saw this arduous process as a “huge host of engineering problems” that decades of underinvestment precluded banks from solving. And so they got to work. What began as two friends meeting each other at the mid-market exchange rate to limit fees, is now Wise, a global fintech platform enabling faster, cheaper, international money movement.

In the final session of Scottish Mortgage’s inaugural digital conference, deputy manager Lawrence Burns was joined by Kristo Käärmann, co-founder and chief executive of Wise.

Watch the full discussion

Hear Lawrence Burns and Wise's co-founder and chief executive on what’s different about the company, which has led 30 million customers to trust it for moving and holding their money.

Scottish Mortgage first invested in the company in 2016 when, then named Transferwise, it was a private company. Since then, progress has been extraordinary. Renamed Wise in 2021, it has 30 million customers and operates in 160 countries and 40 currencies.

In 2016, it handled £7bn in cross-border volume annually. In the last financial year, that rose to £118bn. The company has improved profitability, reducing its fees as it scales up, and has its sights set on moving £1tn annually in the future.

Valuing its customers

For comparison, banks typically charge 2.7 per cent for major currencies and nearly 10 per cent for less mainstream currencies.

Wise’s average fees across all routes and payment methods are around 0.64 per cent. Major currencies can sometimes be less than 0.3 per cent.

“Every day, we’re trying to work out how to serve more people and use cases and make Wise more useful for more customers,” says Käärmann. This customer-centric approach is fundamental to their culture: “We've been very clear to ourselves, that the more value we create for our customers, the more valuable is the company that we’re creating.”

From the rapid growth of the company, it’s clear it is providing something new and better for consumers. However, oftentimes when a company disrupts an established industry, incumbents adapt to try and keep up. But Kaarmann has been surprised to see that not much has changed. The market remains inefficient. “The same opportunity we worked on five years ago hasn’t moved much. Consequently, we are very much at the beginning [of expanding our market share].”

Instead of banks improving their own offering, they have been encouraging their own customers to use Wise. Käärmann remembers the company investigating a sudden spike in Hungarian users. It transpired that managers at a small Hungarian bank had been showing branch customers how to open a Wise account to transact international money transfers rather than via their bank.

This became the inspiration for the Wise platform that now offers its services beyond the retail market. “We open this infrastructure that we've been building for our [retail] customers to all the banks and other institutions in the world so they can get the same experience.”

That’s a win-win for customers, banks, and Wise, says Käärmann.

In addition to removing friction from individuals’ cross-border payments, it increasingly provides solutions for small businesses, such as international invoicing.

“People and businesses hold about $16bn in funds on their Wise accounts. That brings new opportunities and challenges and simultaneously expands our market.”

“The infrastructure that we’re building up, or that we've built and will build puts us in a unique position where no one else can move funds with that efficiency globally.”

Today, “65 per cent of payments arrive in less than 20 seconds in the recipient's account on the other side of the world… That was not possible and that’s not possible under the old technology”.

The case for growth

Our investors focus on long-term growth opportunities, and often this means companies that prioritise investing in the long-term offering for its customers over delivering short-term returns to its financial backers.

Käärmann recognises the value of aligned shareholders: “We have Scottish Mortgage or Baillie Gifford funds who are very long term and they’re very aligned in the [goal of] ‘How do we get to the next trillion [of transfers]?’”

This long-term view enables “the fundamentals of what we’re investing in, how we’re investing in it, and what we’re building remains intact.”

Wise’s growth opportunity remains vast. According to its estimates, it serves roughly 4.5 per cent of the world’s international transfers by volume for individuals. For small businesses, it is approximately between only 0.5 and 1 per cent.

Käärmann suggested the cross-border payments market is over $10tn, of which individuals make up between $2 and $4tn and small- and medium-sized enterprises about $9tn. He hopes continued investment will move the company towards a trillion-dollar volume.

Making a difference

Wise saves its customers between £1.6bn and £2bn a year. “We take pride in that,” he says.

That is why it is transparent about its fees and informs the customer if there's a cheaper route elsewhere. It keeps the company striving to do better for its customers.

“Of course, we will try to change that so that no one is cheaper. But what do we have to lose? At least the customer trusts us and will return next time to check. And hopefully, next time, we’re going to be better.”

With its sights set on expanding its market share and continuing to disrupt the traditional banking sector, Wise is poised for further success.

The company’s progress underscores the power of innovation, customer focus, and strategic growth for Scottish Mortgage’s shareholders. The Trust has accompanied Wise on its journey of turning one man’s frustration into the foundation of global fintech leadership.

About the author - Hamish Maxwell

Investment Specialist

Hamish joined Baillie Gifford in 2017 and is an investment specialist. He joined the Scottish Mortgage Team in 2024 and works closely with the managers, meeting with portfolio companies and conducting in-depth portfolio discussions with shareholders. Alongside this, he creates engaging content which makes the Scottish Mortgage portfolio accessible to all its shareholders. Prior to Scottish Mortgage, Hamish worked on Baillie Gifford's international equities strategies alongside Lawrence Burns. Before Baillie Gifford, Hamish served in the Royal Navy as a Commissioned Officer, including time as a leader in aircraft carriers, mine-hunters, and nuclear submarines. During training, he was awarded top-of-class by HRH Prince Edward. Hamish is a CFA Charterholder, and he achieved an MBA from City, University of London where he received the EU Award.

Regulatory Information

This content was produced and approved at the time stated and may not have been updated subsequently. It represents views held at the time of production and may not reflect current thinking. Read our Legal and regulatory information for further details.

A Key Information Document is available by visiting our Documents page. Any images used in this content are for illustrative purposes only.

This content does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 (BGA) holds a Type 1 licence from the Securities and Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes and closed-ended funds such as investment trusts to professional investors in Hong Kong.

Baillie Gifford Asia (Singapore) Private Limited (BGAS) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. BGA and BGAS are wholly owned subsidiaries of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

Europe

Scottish Mortgage Investment Trust PLC (the “Company”) is an alternative investment fund for the purpose of Directive 2011/61/EU (the “AIFM Directive”). Baillie Gifford & Co Limited is the alternative investment fund manager (“AIFM”) of the Company and has been authorised for marketing to Professional Investors in this jurisdiction.

This content is made available by Baillie Gifford Investment Management (Europe) Limited (“BGE”), which has been engaged by the AIFM to carry out promotional activities relating to the Company. BGE is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform promotional, advisory and Individual Portfolio Management activities. BGE has passported its authorisations under the mechanisms set out in the AIFM Directive.

Belgium

The Company has not been and will not be registered with the Belgian Financial Services and Markets Authority (Autoriteit voor Financiële Diensten en Markten / Autorité des services et marchés financiers) (the FSMA) as a public foreign alternative collective investment scheme under Article 259 of the Belgian Law of 19 April 2014 on alternative collective investment institutions and their managers (the Law of 19 April 2014). The shares in the Company will be marketed in Belgium to professional investors within the meaning the Law of 19 April 2014 only. Any offering material relating to the offering has not been, and will not be, approved by the FSMA pursuant to the Belgian laws and regulations applicable to the public offering of securities. Accordingly, this offering as well as any documents and materials relating to the offering may not be advertised, offered or distributed in any other way, directly or indirectly, to any other person located and/or resident in Belgium other than to professional investors within the meaning the Law of 19 April 2014 and in circumstances which do not constitute an offer to the public pursuant to the Law of 19 April 2014. The shares offered by the Company shall not, whether directly or indirectly, be marketed, offered, sold, transferred or delivered in Belgium to any individual or legal entity other than to professional investors within the meaning the Law of 19 April 2014 or than to investors having a minimum investment of at least EUR 250,000 per investor.

Germany

The Trust has not offered or placed and will not offer or place or sell, directly or indirectly, units/shares to retail investors or semi-professional investors in Germany, i.e. investors which do not qualify as professional investors as defined in sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB) and has not distributed and will not distribute or cause to be distributed to such retail or semi-professional investor in Germany, this document or any other offering material relating to the units/shares of the Trust and that such offers, placements, sales and distributions have been and will be made in Germany only to professional investors within the meaning of sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB).

Luxembourg

Units/shares/interests of the Trust may only be offered or sold in the Grand Duchy of Luxembourg (Luxembourg) to professional investors within the meaning of Luxembourg act by the act of 12 July 2013 on alternative investment fund managers (the AIFM Act). This document does not constitute an offer, an invitation or a solicitation for any investment or subscription for the units/shares/interests of the Trust by retail investors in Luxembourg. Any person who is in possession of this document is hereby notified that no action has or will be taken that would allow a direct or indirect offering or placement of the units/shares/interests of the Trust to retail investors in Luxembourg.

Switzerland

The Trust has not been approved by the Swiss Financial Market Supervisory Authority (“FINMA”) for offering to non-qualified investors pursuant to Art. 120 para. 1 of the Swiss Federal Act on Collective Investment Schemes of 23 June 2006, as amended (“CISA”). Accordingly, the interests in the Trust may only be offered or advertised, and this document may only be made available, in Switzerland to qualified investors within the meaning of CISA. Investors in the Trust do not benefit from the specific investor protection provided by CISA and the supervision by the FINMA in connection with the approval for offering.

Singapore

This content has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this content and any other content or material in connection with the offer or sale, or invitation for subscription or purchase, of the Trust may not be circulated or distributed, nor may be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor (as defined in Section 4A of the Securities and Futures Act 2001, as modified or amended from time to time (SFA)) pursuant to Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the SFA) pursuant to Section 275(1), or any person pursuant to Section 275(1A), and in accordance with the conditions specified in Section 275 of the SFA, or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Where the Trust is subscribed or purchased under Section 275 by a relevant person which is:

(a) a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or

(b) a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor, securities or securities-based derivatives contracts (each term as defined in Section 2(1) of the SFA) of that corporation or the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferred within six months after that corporation or that trust has acquired the securities pursuant to an offer made under Section 275 except:

(1) to an institutional investor or to a relevant person or to any person arising from an offer referred to in Section 275(1A) or Section 276(4)(c)(ii) of the SFA,

(2) where no consideration is or will be given for the transfer;

(3) where the transfer is by operation of law; or

(4) pursuant to Section 276(7) of the SFA or Regulation 37A of the Securities and Futures (Offers of Investments) (Securities and Securities-based Derivatives Contracts) Regulations 2018.