Tempus AI: the future of cancer care

Claire Shaw – Portfolio Director

Key points

- AI is transforming cancer care by enhancing diagnostics, finding new treatment options and improving care

- AI’s ability to interrogate images at speed offers hope of more timely and accurate diagnoses than current methods

- Tempus AI’s vast clinical and genomic data library aids in cancer research, diagnostics and treatment, presenting a significant growth opportunity

As with any investment, your capital is at risk.

In the fight against cancer, artificial intelligence (AI) is a growing area of interest.

Researchers believe that AI will positively impact the fight against cancer in numerous ways.

Artificial intelligence will:

Tempus AI: the future of cancer care

Cancer research has evolved significantly since a surgeon performed the first mastectomy to treat breast cancer in 1882. By 1950 researchers had linked smoking to lung cancer and in 2010, the US Food and Drug Administration approved a vaccine to treat prostate cancer.

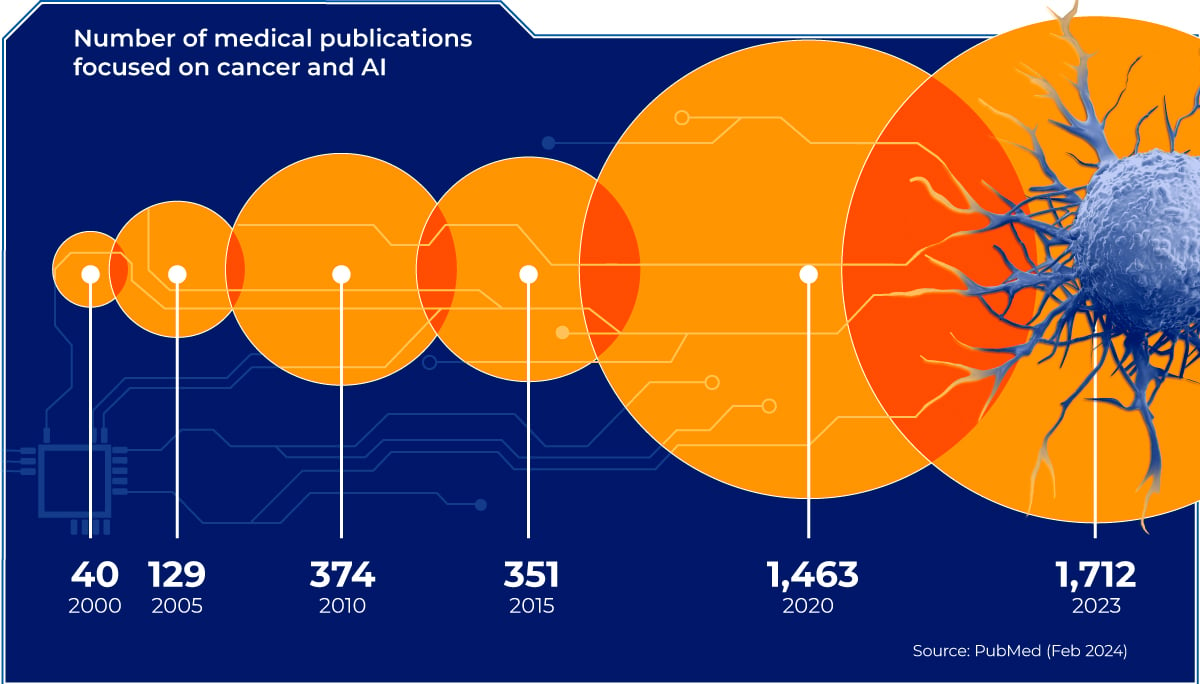

Now, there is another weapon to help fight cancer: artificial intelligence (AI). The volume of scientific literature that covers both AI and cancer has grown substantially over the past two decades, from a small handful in the early 2000s to nearly two thousand in 2022.

What difference can AI make?

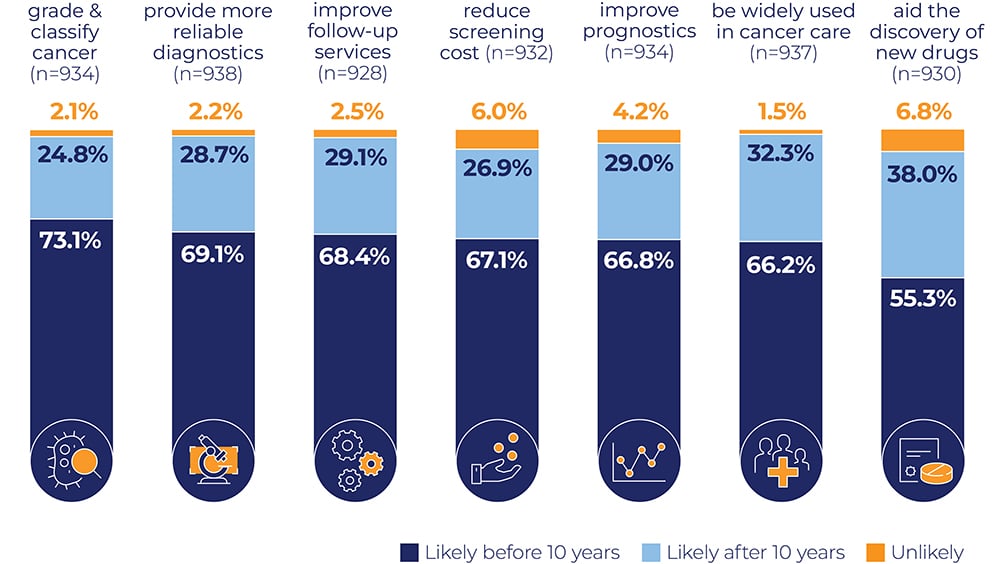

A 2023 study asked authors of peer-reviewed scientific articles on AI and cancer about where AI would have the most impact on the fight against cancer. There was wide agreement that even within the next decade it would inform everything from discovering new cancer treatments to diagnostics and cancer care.

Above all, researchers expect AI to have the most significant near-term impact on grading and classifying cancer through image analysis. A cancer’s grade refers to how abnormal the cell looks, which gives clinicians a better understanding of the disease’s progression.

Following this, researchers believe AI will provide more reliable diagnostics. Cancer research published in November 2023 appears to support these beliefs. It demonstrated that AI flagged up to 18 per cent more early-stage breast cancer than doctors identified.

This suggests that AI has the potential to spot a significant amount of the 20 per cent or more of cancers that are estimated to be missed during current non-AI screening. Excitingly, the AI tool required only half the time a human would typically spend reading a breast cancer scan, offering hope of more timely diagnoses.

The future of cancer

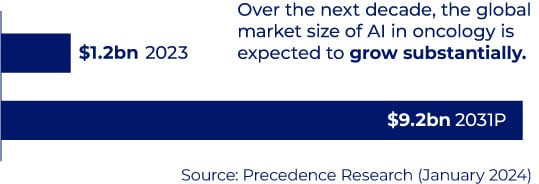

Analysts project that the global market size of AI in oncology could grow from $891mn in 2022 to $10.7bn in 2032. As the owner of the world’s largest library of clinical and genomic data, including a database of over 6 million patient records, Tempus is well-positioned to capitalise on this opportunity.

Tempus is doing so by taking large and complex datasets and making them easier for researchers and clinical staff to access and explore. This is necessary because the data held on medical records is largely unstructured making it difficult to pull out useful information without the help of AI.

Tempus uses AI to process the records in its database so that medical staff can interrogate them and better diagnose and treat cancer and other diseases.

However, it is not just clinicians that benefit from the insights generated by its AI-driven database, as it should also improve cancer research and the discovery of new drugs and treatment options.

Pharmaceutical companies that subscribe to its data library can better understand how effective their current treatments are and find potential new cancer treatments. The overall penetration of Tempus’ tests remains low, which could lead to a persuasive long-term growth opportunity for the company.

Tempus sits at the intersection of two exciting trends – genomic profiling and artificial intelligence-driven health data. By advancing precision medicine through the practical application of AI in healthcare, Tempus equips the medical research community and allows physicians to make near real-time, data-driven decisions to deliver personalised patient care.

Scottish Mortgage first invested in Tempus AI as a private company in 2018. It listed on the NASDAQ in June 2024, raising over $400mn at a valuation of over $6bn.

Looking forward, we remain excited by the company. We maintain a high conviction in its ability to offer extreme long-term returns, by using AI to transform cancer care.

This infographic was produced in collaboration with Visual Capitalist.

PubMed data shows the number of publications where cancer and AI are both a major topic, using the following search: (neoplasms[majr] NOT benign) AND (artificial intelligence[majr]). Data for the second chart is from Cabral et al. (2023). Future of Artificial Intelligence Applications in Cancer Care: A Global Cross-Sectional Survey of Researchers. Current Oncology 30(3), 3432-3446. The Cabral et al. survey was conducted between 24 October - 4 November 2022 with researchers who had published an article on AI and cancer between 20 September 2020 and 20 September 2022. Numbers may not sum to 100 due to rounding.

About the author - Claire Shaw

Portfolio Director

Claire Shaw is a portfolio director and plays a prominent role in servicing Scottish Mortgage’s UK shareholder base. Before joining in 2019, she spent over a decade as a fund manager with a focus on managing European equity portfolios for a global client base. With a background in analysing companies and communicating investment ideas, Claire is also responsible for creating engaging content that makes the Scottish Mortgage portfolio accessible to all its shareholders. Beyond that, she works closely with the managers, meeting with portfolio companies and conducting in-depth portfolio discussions with shareholders.

Regulatory Information

This content was produced and approved at the time stated and may not have been updated subsequently. It represents views held at the time of production and may not reflect current thinking. Read our Legal and regulatory information for further details.

A Key Information Document is available by visiting our Documents page. Any images used in this content are for illustrative purposes only.

This content does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 (BGA) holds a Type 1 licence from the Securities and Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes and closed-ended funds such as investment trusts to professional investors in Hong Kong.

Baillie Gifford Asia (Singapore) Private Limited (BGAS) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. BGA and BGAS are wholly owned subsidiaries of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

Europe

Scottish Mortgage Investment Trust PLC (the “Company”) is an alternative investment fund for the purpose of Directive 2011/61/EU (the “AIFM Directive”). Baillie Gifford & Co Limited is the alternative investment fund manager (“AIFM”) of the Company and has been authorised for marketing to Professional Investors in this jurisdiction.

This content is made available by Baillie Gifford Investment Management (Europe) Limited (“BGE”), which has been engaged by the AIFM to carry out promotional activities relating to the Company. BGE is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform promotional, advisory and Individual Portfolio Management activities. BGE has passported its authorisations under the mechanisms set out in the AIFM Directive.

Belgium

The Company has not been and will not be registered with the Belgian Financial Services and Markets Authority (Autoriteit voor Financiële Diensten en Markten / Autorité des services et marchés financiers) (the FSMA) as a public foreign alternative collective investment scheme under Article 259 of the Belgian Law of 19 April 2014 on alternative collective investment institutions and their managers (the Law of 19 April 2014). The shares in the Company will be marketed in Belgium to professional investors within the meaning the Law of 19 April 2014 only. Any offering material relating to the offering has not been, and will not be, approved by the FSMA pursuant to the Belgian laws and regulations applicable to the public offering of securities. Accordingly, this offering as well as any documents and materials relating to the offering may not be advertised, offered or distributed in any other way, directly or indirectly, to any other person located and/or resident in Belgium other than to professional investors within the meaning the Law of 19 April 2014 and in circumstances which do not constitute an offer to the public pursuant to the Law of 19 April 2014. The shares offered by the Company shall not, whether directly or indirectly, be marketed, offered, sold, transferred or delivered in Belgium to any individual or legal entity other than to professional investors within the meaning the Law of 19 April 2014 or than to investors having a minimum investment of at least EUR 250,000 per investor.

Germany

The Trust has not offered or placed and will not offer or place or sell, directly or indirectly, units/shares to retail investors or semi-professional investors in Germany, i.e. investors which do not qualify as professional investors as defined in sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB) and has not distributed and will not distribute or cause to be distributed to such retail or semi-professional investor in Germany, this document or any other offering material relating to the units/shares of the Trust and that such offers, placements, sales and distributions have been and will be made in Germany only to professional investors within the meaning of sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB).

Luxembourg

Units/shares/interests of the Trust may only be offered or sold in the Grand Duchy of Luxembourg (Luxembourg) to professional investors within the meaning of Luxembourg act by the act of 12 July 2013 on alternative investment fund managers (the AIFM Act). This document does not constitute an offer, an invitation or a solicitation for any investment or subscription for the units/shares/interests of the Trust by retail investors in Luxembourg. Any person who is in possession of this document is hereby notified that no action has or will be taken that would allow a direct or indirect offering or placement of the units/shares/interests of the Trust to retail investors in Luxembourg.

Switzerland

The Trust has not been approved by the Swiss Financial Market Supervisory Authority (“FINMA”) for offering to non-qualified investors pursuant to Art. 120 para. 1 of the Swiss Federal Act on Collective Investment Schemes of 23 June 2006, as amended (“CISA”). Accordingly, the interests in the Trust may only be offered or advertised, and this document may only be made available, in Switzerland to qualified investors within the meaning of CISA. Investors in the Trust do not benefit from the specific investor protection provided by CISA and the supervision by the FINMA in connection with the approval for offering.

Singapore

This content has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this content and any other content or material in connection with the offer or sale, or invitation for subscription or purchase, of the Trust may not be circulated or distributed, nor may be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor (as defined in Section 4A of the Securities and Futures Act 2001, as modified or amended from time to time (SFA)) pursuant to Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the SFA) pursuant to Section 275(1), or any person pursuant to Section 275(1A), and in accordance with the conditions specified in Section 275 of the SFA, or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Where the Trust is subscribed or purchased under Section 275 by a relevant person which is:

(a) a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or

(b) a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor, securities or securities-based derivatives contracts (each term as defined in Section 2(1) of the SFA) of that corporation or the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferred within six months after that corporation or that trust has acquired the securities pursuant to an offer made under Section 275 except:

(1) to an institutional investor or to a relevant person or to any person arising from an offer referred to in Section 275(1A) or Section 276(4)(c)(ii) of the SFA,

(2) where no consideration is or will be given for the transfer;

(3) where the transfer is by operation of law; or

(4) pursuant to Section 276(7) of the SFA or Regulation 37A of the Securities and Futures (Offers of Investments) (Securities and Securities-based Derivatives Contracts) Regulations 2018.