Innovation and growth march to their own drumbeat

Tom Slater – Manager, Scottish Mortgage

Key Points

- From lightbulbs to generative artificial intelligence, technological progress often powers greater prosperity

- As time passes, falling costs and additional capabilities help companies and individuals use innovations to greater effect

- By combining innovations in different ways, companies can create new products and deliver for their shareholders

Modern genome sequencing labs rely on decades of advances in computing, automation and DNA analysis.

As with any investment, your capital is at risk.

Innovators draw on past discoveries to develop their ideas. Then companies combine them to create new products.

Take Moderna’s mRNA vaccines. The firm pioneered a way to teach cells to trigger an immune response by building on earlier work. And it relies on genomic sequencing, cloud computing and other technologies to engineer its treatments for Covid, cancer and other diseases.

Each technological breakthrough unlocks a multitude of novel combinations, strengthening the drumbeat of innovation. And that drumbeat also benefits from the fact that some technologies advance exponentially.

For example, a regular doubling of computing power helped drive progress over the past 60 years. And artificial intelligence’s accelerated pace of development holds promise for the decades ahead. Adoption rates also appear to be speeding up, as evidenced by the ChatGPT chatbot amassing 100 million users in just two months.

Innovation’s drumbeat didn’t result from low interest rates or cheap money, and it will continue regardless of current economic gyrations. Over the long term, this should lead to productivity gains and economic growth. Scottish Mortgage seeks to fill its portfolio with companies that either will gain sustainable advantage from innovation-led change or have assets that will rise in value as a result.

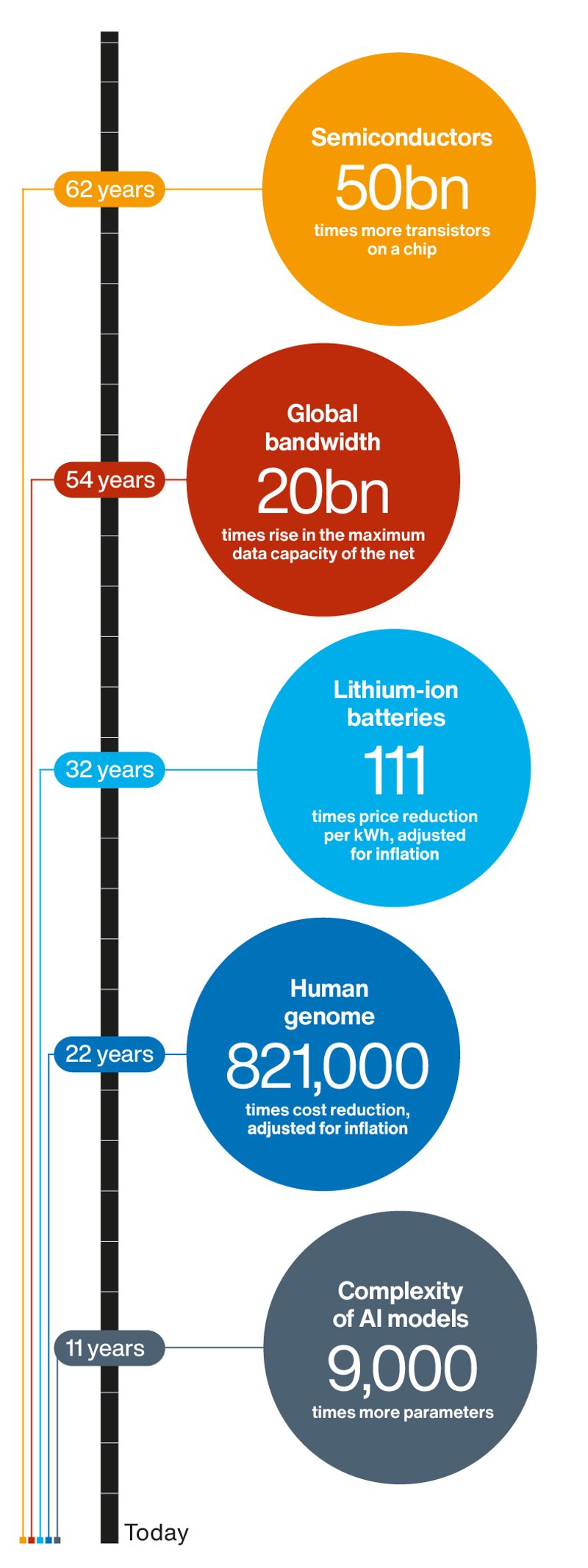

Technologies scale over time

Semiconductors

1961: Fairchild microchip had four transistors

2023: NVIDIA GH200 Grace Hopper super chip has 200bn transistors

Global bandwidth

1969: Internet’s precursor ARPANET was initially limited to 50 kilobits per second of capacity

2023: Internet bandwidth reaches 997 terabits per second

Lithium-ion batteries

1991: First commercial li-ion battery cost $7,523 per kWh

2023: Li-ion batteries cost $152 per kWh

Human genome

2001: It cost $95m to sequence one human genome

2023: Illumina’s NovaSeq X sequences human genome for $200

Complexity of AI models

2012: AlexNet image recognition model had 60m parameters (variables controlling its behaviour)

2023: Google’s PaLM model has 540bn parameters

Sources: Alphabet, BloombergNEF, computerhistory.org, Illumina, NVIDIA, Our World In Data, Telegeography.

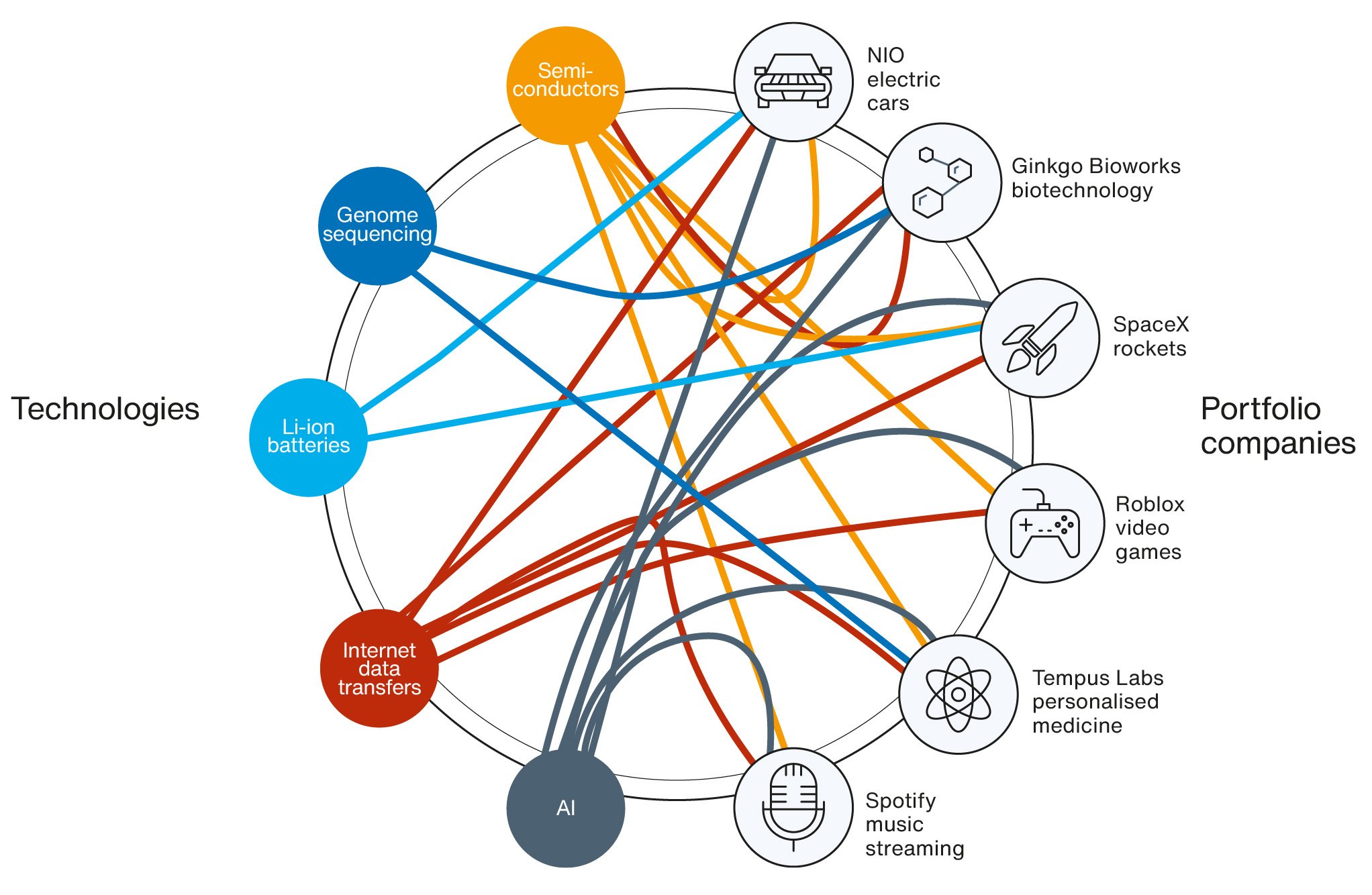

The alchemy of innovation

How some of our portfolio companies combine technologies

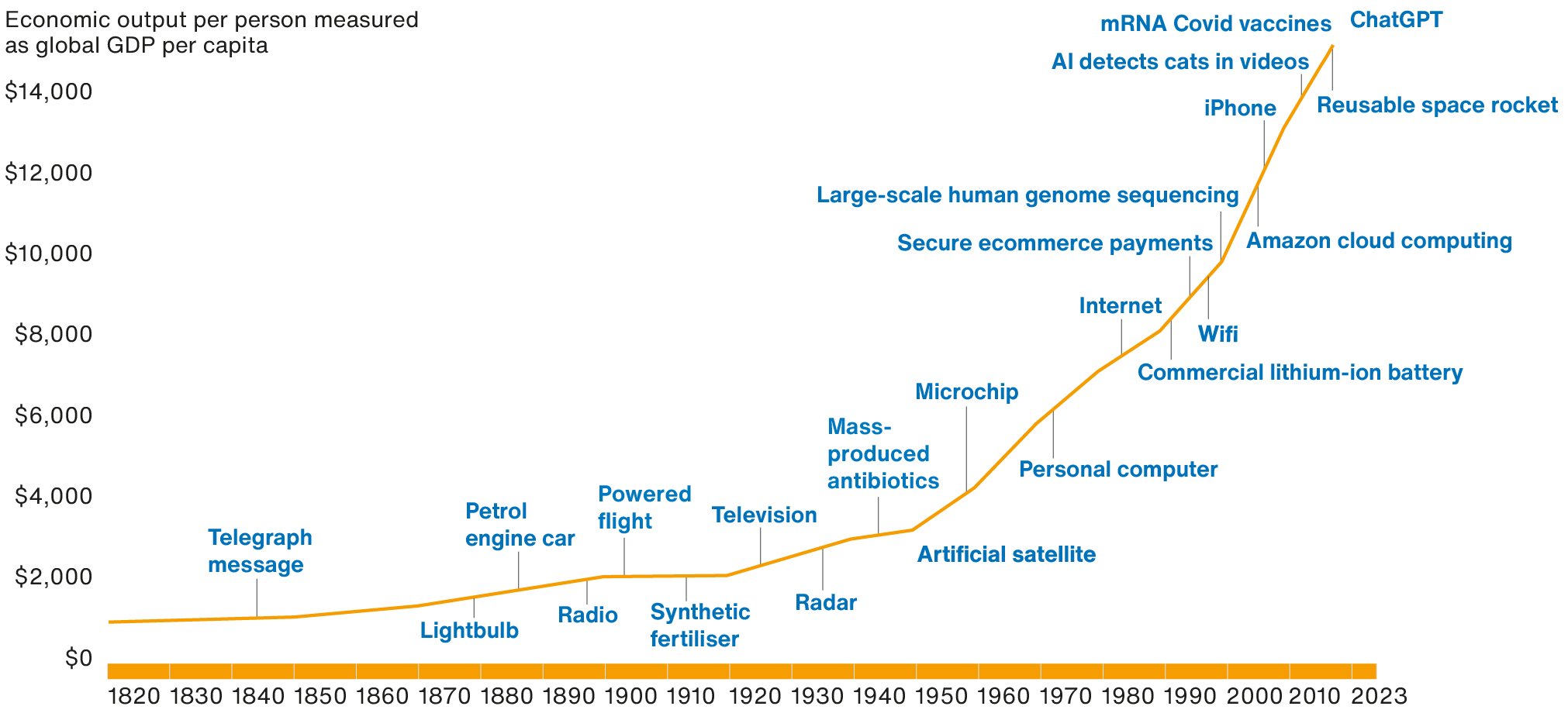

Progress powers prosperity

Global gross domestic product (GDP) per capita adjusted for inflation and differences in costs of living between countries. Data shown in US dollars at 2011 prices.

Sources: Our World In Data, Maddison Project Database 2020 (Bolt and van Zanden, 2020).

1844: Samuel Morse demonstrates the telegraph by sending the message “what hath God wrought” in code.

1879: Thomas Edison creates an incandescent carbon filament electric light bulb in his New Jersey lab.

1886: Carl Benz reveals the first car powered by a gasoline engine to the public and applies for a patent.

1897: Guglielmo Marconi sends the radio message, “can you hear me”, across the Bristol Channel, which his colleagues receive.

1903: In North Carolina, brothers Wilbur and Orville Wright achieve the first sustained flight of a powered aircraft.

1913: BASF starts making fertiliser at a German factory using the Haber-Bosch process, which combines nitrogen and hydrogen, helping farmers to increase crop yields.

1926: John Logie Baird gives the world’s first public demonstration of television in London.

1935: Sir Robert Watson-Watt demonstrates a radar-based system for detecting aircraft to the UK’s Air Ministry.

1944: Pfizer begins large-scale penicillin production in the US, making it the first mass-made antibiotic.

1957: Russia launches Sputnik into orbit, Earth’s first artificial satellite

1958: Texas Instruments engineer Jack Kilby creates the first integrated circuit, which becomes better known as the microchip.

1971: John Blankenbaker builds the Kenbak-1, which many historians later recognise as the first personal computer.

1983: The internet gets established thanks to the creation of the Transfer Control Protocol/Internetwork Protocol (TCP/IP), which gives different computer networks a standard way to communicate.

1991: Sony releases the first commercial lithium-ion battery to power its Handycam video recorder.

1994: Amazon, Pizza Hut and others debut secure ecommerce payment systems, giving customers the confidence to shop online.

1997: Wifi’s launch is marked by the release of the 802.11 protocol, providing wireless data transfer speeds of up to two megabits per second.

1999: The Human Genome Project declares the start of full-scale human genome sequencing after scientists decipher the DNA code of a human chromosome.

2006: Amazon launches its cloud computing business with Elastic Compute Cloud (EC2), which lets customers run their applications remotely on its hardware.

2007: Steve Jobs unveils Apple’s first iPhone and puts it on sale the same year, paving the way to the mass adoption of smartphones.

2012: Scientists at Google train a neural network to recognise when cats appear in YouTube clips, leading to the widespread use of AI to analyse video.

2017: SpaceX launches a ‘pre-flown’ booster – a nine-engine rocket base – into space, allowing the firm to reuse the most expensive parts of its Falcon 9 rockets.

2020: Moderna and Pfizer-BioNTech release Covid-19 vaccines based on messenger ribonucleic acid (mRNA) technology.

2022: OpenAI launches ChatGPT, sparking widespread use of its generative artificial intelligence chatbot, which can respond to a wide range of text-based queries.

About the author - Tom Slater

Manager, Scottish Mortgage

Tom Slater is manager of Scottish Mortgage. He joined Baillie Gifford in 2000 and became a partner of the firm in 2012. Tom joined the Scottish Mortgage team as deputy manager in 2009, before assuming the role of Manager in 2015. Beyond that, he is the head of the US Equities team and a member of another long-term growth equity strategy. During his time at Baillie Gifford, Tom has also worked in the Developed Asia and UK Equity teams. Tom’s investment interest is focused on high-growth companies both in listed equity markets and as an investor in private companies. He graduated BSc in Computer Science with Mathematics from the University of Edinburgh in 2000.

Regulatory Information

This content was produced and approved at the time stated and may not have been updated subsequently. It represents views held at the time of production and may not reflect current thinking. Read our Legal and regulatory information for further details.

A Key Information Document is available by visiting our Documents page. Any images used in this content are for illustrative purposes only.

This content does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 (BGA) holds a Type 1 licence from the Securities and Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes and closed-ended funds such as investment trusts to professional investors in Hong Kong.

Baillie Gifford Asia (Singapore) Private Limited (BGAS) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. BGA and BGAS are wholly owned subsidiaries of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

Europe

Scottish Mortgage Investment Trust PLC (the “Company”) is an alternative investment fund for the purpose of Directive 2011/61/EU (the “AIFM Directive”). Baillie Gifford & Co Limited is the alternative investment fund manager (“AIFM”) of the Company and has been authorised for marketing to Professional Investors in this jurisdiction.

This content is made available by Baillie Gifford Investment Management (Europe) Limited (“BGE”), which has been engaged by the AIFM to carry out promotional activities relating to the Company. BGE is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform promotional, advisory and Individual Portfolio Management activities. BGE has passported its authorisations under the mechanisms set out in the AIFM Directive.

Belgium

The Company has not been and will not be registered with the Belgian Financial Services and Markets Authority (Autoriteit voor Financiële Diensten en Markten / Autorité des services et marchés financiers) (the FSMA) as a public foreign alternative collective investment scheme under Article 259 of the Belgian Law of 19 April 2014 on alternative collective investment institutions and their managers (the Law of 19 April 2014). The shares in the Company will be marketed in Belgium to professional investors within the meaning the Law of 19 April 2014 only. Any offering material relating to the offering has not been, and will not be, approved by the FSMA pursuant to the Belgian laws and regulations applicable to the public offering of securities. Accordingly, this offering as well as any documents and materials relating to the offering may not be advertised, offered or distributed in any other way, directly or indirectly, to any other person located and/or resident in Belgium other than to professional investors within the meaning the Law of 19 April 2014 and in circumstances which do not constitute an offer to the public pursuant to the Law of 19 April 2014. The shares offered by the Company shall not, whether directly or indirectly, be marketed, offered, sold, transferred or delivered in Belgium to any individual or legal entity other than to professional investors within the meaning the Law of 19 April 2014 or than to investors having a minimum investment of at least EUR 250,000 per investor.

Germany

The Trust has not offered or placed and will not offer or place or sell, directly or indirectly, units/shares to retail investors or semi-professional investors in Germany, i.e. investors which do not qualify as professional investors as defined in sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB) and has not distributed and will not distribute or cause to be distributed to such retail or semi-professional investor in Germany, this document or any other offering material relating to the units/shares of the Trust and that such offers, placements, sales and distributions have been and will be made in Germany only to professional investors within the meaning of sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB).

Luxembourg

Units/shares/interests of the Trust may only be offered or sold in the Grand Duchy of Luxembourg (Luxembourg) to professional investors within the meaning of Luxembourg act by the act of 12 July 2013 on alternative investment fund managers (the AIFM Act). This document does not constitute an offer, an invitation or a solicitation for any investment or subscription for the units/shares/interests of the Trust by retail investors in Luxembourg. Any person who is in possession of this document is hereby notified that no action has or will be taken that would allow a direct or indirect offering or placement of the units/shares/interests of the Trust to retail investors in Luxembourg.

Switzerland

The Trust has not been approved by the Swiss Financial Market Supervisory Authority (“FINMA”) for offering to non-qualified investors pursuant to Art. 120 para. 1 of the Swiss Federal Act on Collective Investment Schemes of 23 June 2006, as amended (“CISA”). Accordingly, the interests in the Trust may only be offered or advertised, and this document may only be made available, in Switzerland to qualified investors within the meaning of CISA. Investors in the Trust do not benefit from the specific investor protection provided by CISA and the supervision by the FINMA in connection with the approval for offering.

Singapore

This content has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this content and any other content or material in connection with the offer or sale, or invitation for subscription or purchase, of the Trust may not be circulated or distributed, nor may be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor (as defined in Section 4A of the Securities and Futures Act 2001, as modified or amended from time to time (SFA)) pursuant to Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the SFA) pursuant to Section 275(1), or any person pursuant to Section 275(1A), and in accordance with the conditions specified in Section 275 of the SFA, or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Where the Trust is subscribed or purchased under Section 275 by a relevant person which is:

(a) a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or

(b) a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor, securities or securities-based derivatives contracts (each term as defined in Section 2(1) of the SFA) of that corporation or the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferred within six months after that corporation or that trust has acquired the securities pursuant to an offer made under Section 275 except:

(1) to an institutional investor or to a relevant person or to any person arising from an offer referred to in Section 275(1A) or Section 276(4)(c)(ii) of the SFA,

(2) where no consideration is or will be given for the transfer;

(3) where the transfer is by operation of law; or

(4) pursuant to Section 276(7) of the SFA or Regulation 37A of the Securities and Futures (Offers of Investments) (Securities and Securities-based Derivatives Contracts) Regulations 2018.