All in good time: investing in artificial intelligence

Ben James – Portfolio Director

Key Points

- Artificial intelligence (AI) marks a major computing paradigm shift that Scottish Mortgage has been thinking about for decades

- OpenAI has democratised AI, which is driving changes in software development, autonomous driving and pharmaceuticals, with more advances anticipated

- Scottish Mortgage invests in companies across the AI value chain, from NVIDIA and ASML to Amazon Web Services and Recursion Pharmaceuticals

"Artificial intelligence is like the weather. Everybody talks about it, but nobody knows what to do about it."

Professor Ryszard S. Michalski, machine learning pioneer

As with any investment, your capital is at risk.

What would you have invested in at the beginning of the PC era in 1977? Or at the beginning of the internet or smartphone eras? These are helpful thought experiments in times of significant technological change.

At the risk of hyperbole, this year’s breakthroughs in Artificial Intelligence (AI) suggest we could be at the start of another computing paradigm akin to the PC, internet or smartphone.

We have been commenting on the progress in AI for some time, and we remain deeply curious about it.

The most noteworthy recent breakthrough has been the success of OpenAI in making AI technology available to non-technical users with the release of ChatGPT. The service signed up a hundred million users in just two months as engineers and entrepreneurs recognised the potential of this computational approach.

AI can augment human software programmers and enhance productivity, and we can expect AI services to write most computer code in the future. The implications of AI-generated student essays are less encouraging and only a minor example of the governance challenges these systems will create.

AI will transform many parts of the economy. But it would be foolhardy to make specific predictions. Therefore, we have time to study and learn as companies incorporate the technology into their products and services.

It is likely most companies will tell us that AI is good for them, but they won’t all be correct. At the same time, it will substantially increase the value of the service other companies can provide.

Amid the AI hype, patience and a long-term mindset are key in deciphering signals from the noise.

AI and the Scottish Mortgage Portfolio today

We can confidently say that AI systems will require a lot of silicon. OpenAI has suggested that the computing power needed to run the latest models doubles every 14 weeks.

Our holding NVIDIA is a key supplier and enjoys formidable advantages, as the chip technology it has built over decades for computer games has proven ideally suited for AI computation. Around 90 per cent of generative AI programmes are trained using NVIDIA chips.

The semiconductor industry depends on another of our holdings, ASML. Its exceptional engineering produces cutting-edge chips, and AI is just one driver of the strong demand we anticipate over the next decade.

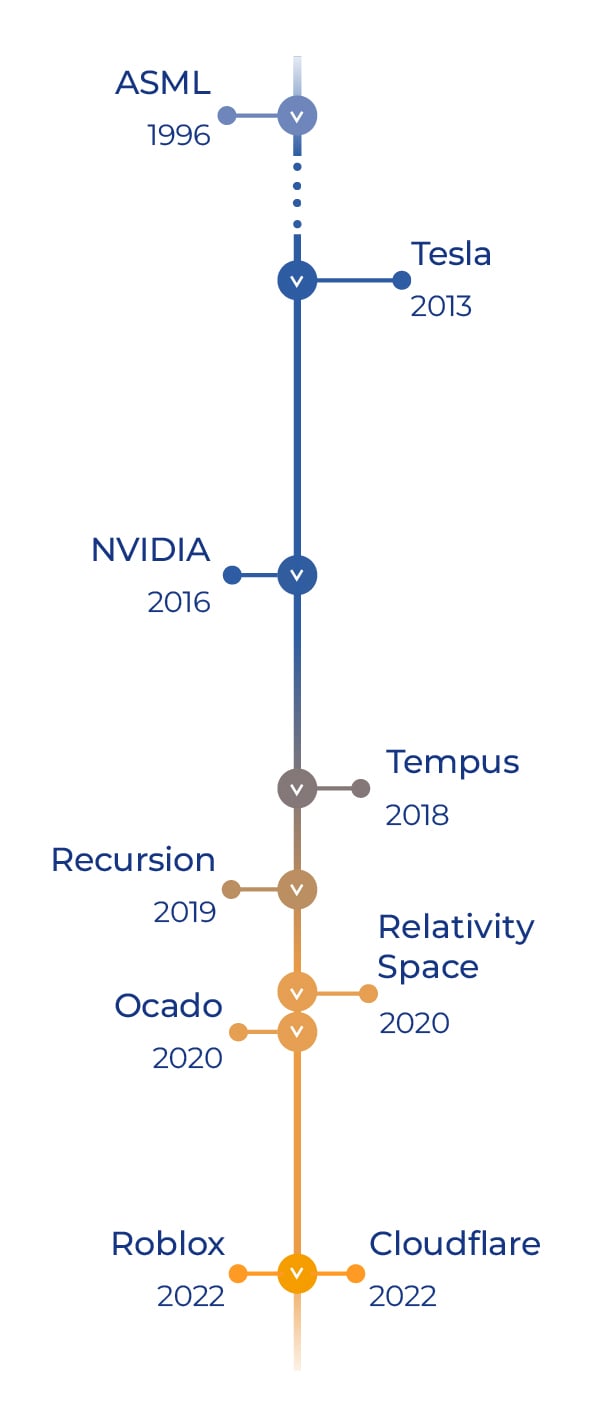

In the great AI gold rush, beyond the ‘picks and shovels’ makers of NVIDIA and ASML, Scottish Mortgage is exposed to diverse companies across the AI value chain (see graphic).

These include Amazon Web Services, on whose cloud much of AI computing is done, and cloud services and enterprise solutions that operate on top of the cloud, such as Cloudflare and Snowflake.

Many industry solutions already use AI, such as Aurora Innovation (autonomous driving), Horizon Robotics (AI solutions), Recursion Pharmaceuticals (drug discovery) and Tempus Labs (cancer treatment).

Consumer-facing services such as ByteDance (owner of TikTok) and the digital marketing and metaverse companies we hold, such as Roblox, are also experimenting with AI.

We also have small holdings in venture funds WI Harper and Arch Ventures, which invest in companies developing AI technology.

And it may surprise some to learn that Tesla is currently one of the largest AI companies in the world. This year, it rolled out initial access to its full self-driving software in the US.

The software has now driven 150 million autonomous miles, providing a vast data advantage over the rest of the automotive industry. The system’s capability is already impressive, but the pace of improvement will be most important over time.

New vehicle sales will face headwinds from higher interest rates in the short run. Still, electric vehicles continue to gain share and Tesla, as the market leader, has the scale and profitability to invest and grow in challenging conditions.

In the long run, its software and AI capabilities will be deployed to a much more extensive fleet of vehicles, and others will struggle to compete.

Value Chain

Investment Timeline

We first invested in ASML in 1996, Amazon in 2003, Tesla in 2013 and NVIDIA in 2016. In short, we’ve been thinking about this for a long time.

Informed thinking

And not on our own; some of the best minds from industry and academia have helped shape our thinking.

We continue to engage with the computer scientists driving the industry, from Geoffrey Hinton, one of the godfathers of AI and ex-Google, Kai Yu of Horizon Robotics and Emad Mostaque (Stability AI) to Sam Altman (OpenAI) and Jensen Huang (NVIDIA).

There is a Baillie Gifford Chair in AI Ethics at the Edinburgh Futures Institute. And we are sponsoring the programme director role on Responsible Artificial Intelligence at the Leverhulme Centre for the Future of Intelligence, University of Cambridge.

The future of AI

AI and machine learning are penetrating multiple industries, from commerce and healthcare to finance and transport. As we have said, any company not leveraging advances in software, machine learning, and AI will experience significant headwinds to growth.

While we are wary of making any firm predictions of how AI might transform society, what is almost guaranteed is that companies, tools and services will be built using this technology that will exceed our wildest imagination.

Our access to some of the leading minds working on this, in both the public and private space, helps us keep up to speed with developments and understand how they may impact our lives. We will continue to patiently seek opportunities to invest in this progress on our shareholders’ behalf.

About the author - Ben James

Portfolio Director

Ben James is a portfolio director serving Scottish Mortgage’s shareholder base. Ben joined the Scottish Mortgage team in 2023 and has worked with Tom Slater as the US equity investment specialist at Baillie Gifford since 2015. A former soldier, he developed a passion for the power of investment to drive progress during his overseas deployments. Ben works closely with the managers, meeting with portfolio companies and conducting in-depth portfolio discussions with shareholders. Alongside this, he creates engaging content that makes the Scottish Mortgage portfolio accessible to all its shareholders.

Regulatory Information

This content was produced and approved at the time stated and may not have been updated subsequently. It represents views held at the time of production and may not reflect current thinking. Read our Legal and regulatory information for further details.

A Key Information Document is available by visiting our Documents page. Any images used in this content are for illustrative purposes only.

This content does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 (BGA) holds a Type 1 licence from the Securities and Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes and closed-ended funds such as investment trusts to professional investors in Hong Kong.

Baillie Gifford Asia (Singapore) Private Limited (BGAS) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. BGA and BGAS are wholly owned subsidiaries of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

Europe

Scottish Mortgage Investment Trust PLC (the “Company”) is an alternative investment fund for the purpose of Directive 2011/61/EU (the “AIFM Directive”). Baillie Gifford & Co Limited is the alternative investment fund manager (“AIFM”) of the Company and has been authorised for marketing to Professional Investors in this jurisdiction.

This content is made available by Baillie Gifford Investment Management (Europe) Limited (“BGE”), which has been engaged by the AIFM to carry out promotional activities relating to the Company. BGE is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform promotional, advisory and Individual Portfolio Management activities. BGE has passported its authorisations under the mechanisms set out in the AIFM Directive.

Belgium

The Company has not been and will not be registered with the Belgian Financial Services and Markets Authority (Autoriteit voor Financiële Diensten en Markten / Autorité des services et marchés financiers) (the FSMA) as a public foreign alternative collective investment scheme under Article 259 of the Belgian Law of 19 April 2014 on alternative collective investment institutions and their managers (the Law of 19 April 2014). The shares in the Company will be marketed in Belgium to professional investors within the meaning the Law of 19 April 2014 only. Any offering material relating to the offering has not been, and will not be, approved by the FSMA pursuant to the Belgian laws and regulations applicable to the public offering of securities. Accordingly, this offering as well as any documents and materials relating to the offering may not be advertised, offered or distributed in any other way, directly or indirectly, to any other person located and/or resident in Belgium other than to professional investors within the meaning the Law of 19 April 2014 and in circumstances which do not constitute an offer to the public pursuant to the Law of 19 April 2014. The shares offered by the Company shall not, whether directly or indirectly, be marketed, offered, sold, transferred or delivered in Belgium to any individual or legal entity other than to professional investors within the meaning the Law of 19 April 2014 or than to investors having a minimum investment of at least EUR 250,000 per investor.

Germany

The Trust has not offered or placed and will not offer or place or sell, directly or indirectly, units/shares to retail investors or semi-professional investors in Germany, i.e. investors which do not qualify as professional investors as defined in sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB) and has not distributed and will not distribute or cause to be distributed to such retail or semi-professional investor in Germany, this document or any other offering material relating to the units/shares of the Trust and that such offers, placements, sales and distributions have been and will be made in Germany only to professional investors within the meaning of sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB).

Luxembourg

Units/shares/interests of the Trust may only be offered or sold in the Grand Duchy of Luxembourg (Luxembourg) to professional investors within the meaning of Luxembourg act by the act of 12 July 2013 on alternative investment fund managers (the AIFM Act). This document does not constitute an offer, an invitation or a solicitation for any investment or subscription for the units/shares/interests of the Trust by retail investors in Luxembourg. Any person who is in possession of this document is hereby notified that no action has or will be taken that would allow a direct or indirect offering or placement of the units/shares/interests of the Trust to retail investors in Luxembourg.

Switzerland

The Trust has not been approved by the Swiss Financial Market Supervisory Authority (“FINMA”) for offering to non-qualified investors pursuant to Art. 120 para. 1 of the Swiss Federal Act on Collective Investment Schemes of 23 June 2006, as amended (“CISA”). Accordingly, the interests in the Trust may only be offered or advertised, and this document may only be made available, in Switzerland to qualified investors within the meaning of CISA. Investors in the Trust do not benefit from the specific investor protection provided by CISA and the supervision by the FINMA in connection with the approval for offering.

Singapore

This content has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this content and any other content or material in connection with the offer or sale, or invitation for subscription or purchase, of the Trust may not be circulated or distributed, nor may be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor (as defined in Section 4A of the Securities and Futures Act 2001, as modified or amended from time to time (SFA)) pursuant to Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the SFA) pursuant to Section 275(1), or any person pursuant to Section 275(1A), and in accordance with the conditions specified in Section 275 of the SFA, or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Where the Trust is subscribed or purchased under Section 275 by a relevant person which is:

(a) a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or

(b) a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor, securities or securities-based derivatives contracts (each term as defined in Section 2(1) of the SFA) of that corporation or the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferred within six months after that corporation or that trust has acquired the securities pursuant to an offer made under Section 275 except:

(1) to an institutional investor or to a relevant person or to any person arising from an offer referred to in Section 275(1A) or Section 276(4)(c)(ii) of the SFA,

(2) where no consideration is or will be given for the transfer;

(3) where the transfer is by operation of law; or

(4) pursuant to Section 276(7) of the SFA or Regulation 37A of the Securities and Futures (Offers of Investments) (Securities and Securities-based Derivatives Contracts) Regulations 2018.