Perspectives on Progress #15

Chloé Darling-Stewart

- New additions to the portfolio include leader in lithium-ion battery production CATL and advertising technology company AppLovin

- Roblox hits new records in daily active users and Zipline reaches new heights with its drone delivery service

- Cloudflare takes a stand against how content is being used with its new 'pay per crawl' model

As with any investment, your capital is at risk.

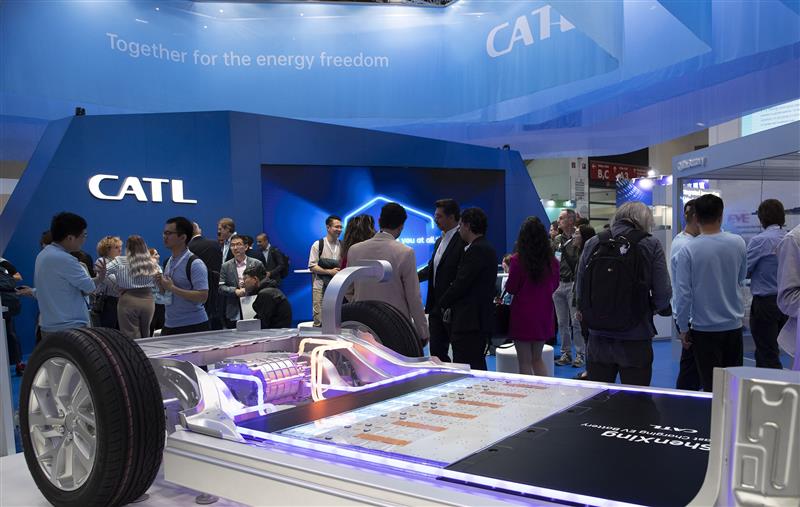

CATL

Powering the Energy Transition

CATL may not be a household name, but its batteries are the driving force behind most of the world’s electric vehicles. As global leader in the production and design of lithium-ion batteries, it plays a pivotal role in the accelerating shift to electrification across transport and energy systems.

We’ve recently taken a new holding in the company. Headquartered in China, CATL has become a national champion in the world's largest EV and electricity market. Its scale, technical depth, and alignment with China’s decarbonisation goals give it a strong domestic foundation. Its batteries also play a growing role in storing renewable energy at grid scale.

With nearly 40 per cent global market share, CATL is well positioned to lead the charge as battery demand soars – driven by EV adoption, energy storage and wider industrial electrification. It's increasingly seen not just as a battery maker, but as critical infrastructure for the electric age.

Its edge lies in its unmatched scale, deep vertical integration and relentless innovation. Partnerships with global carmakers like Volkswagen and Ford reinforce its reach, while continuous advances in battery design are cutting costs, improving performance, and extending its lead.

While based in China, CATL's international presence is growing fast. Yet despite its strategic importance, the market doesn't seem to be fully pricing in its global potential.

As the world electrifies, CATL’s leadership, global relevance and long-term vision position it to power progress for decades to come.

Roblox

"Reimagining the way people come together"

Roblox is no longer just a game – it's one of the world's fastest-growing digital platforms, where millions gather to play, create and connect. What began as a children's gaming hub has evolved into a vibrant social ecosystem with community at its core.

Recent results reflect that transformation: daily active users are up over 40 per cent year-on-year to 112m, and in-game spending has risen by more than 50 per cent. Grow a Garden, its breakout user-created game, surpassed Fortnite with 21m concurrent players – a striking example of network effects in action.

While Roblox's core audience remains 9-12 year olds, older users are staying on and building more complex experiences. This is helping the platform evolve and appeal to a more diverse demographic. They also tend to spend more, strengthening Roblox's long-term economics.

What began as an online children's game is now a powerful flywheel of creativity, entertainment and community. Its continued progress has earned Roblox a place in the Trust’s top 10 holdings.

Zipline

From Shelf to Sky

Zipline is transforming delivery with autonomous drones that move goods with remarkable speed and precision. In partnership with Walmart, it has launched its first full-scale urban rollout in the US, offering 30-minute delivery across Dallas. The service spans a 10-mile radius and covers over 65,000 items – from groceries to household essentials – with what founder Keller Rinaudo Cliffton calls "dinner-plate level precision".

With 90 per cent of Americans living within 10 miles of a Walmart, the potential reach is vast.

Already the world's largest autonomous delivery network, Zipline has flown over 100 million miles and completed more than 1 million deliveries. It was also among the first to gain FAA approval for operations beyond visual line of sight – a key regulatory breakthrough for scaling autonomous logistics.

Originally built for medical deliveries in Africa, Zipline is now bringing precision logistics to American doorsteps. As regulation eases and adoption grows, futuristic delivery is fast becoming everyday convenience.

AppLovin

Behind the Ads

We’ve taken a new position in AppLovin, a leading advertising technology company with a dominant role in mobile gaming – a rapidly expanding corner of the digital economy.

AppLovin helps apps grow, monetise, and reach new users. It places ads inside mobile games, promotes across its network, and uses AI to improve targeting.

At its core is AppDiscovery, a platform that matches apps with the right users. The more it's used, the smarter it gets – creating a powerful feedback loop.

What truly sets AppLovin apart is its culture. In a fast-moving, fiercely competitive space, success often depends on how quickly you can build and scale. Founder-CEO Adam Foroughi hires 'builders', cuts bureaucracy, and sees himself as 'Head of HR', believing culture is too important to delegate.

AppLovin reflects the kind of founder-led ambition and cultural edge we often look for at Scottish Mortgage – where long-term thinking and skin in the game often create the conditions for lasting success.

Cloudflare

"Content's Independence Day"

Cloudflare is the quiet force behind a faster, safer internet. It protects websites from attacks, speeds up traffic, and provides critical infrastructure for nearly a quarter of all online activity.

Now it’s taking a stand on how content is used in the AI era. CEO Matthew Prince recently declared “Content Independence Day”, as Cloudflare launched a new system to block AI bots by default. These bots, or 'crawlers', scan websites to collect data, often to train AI models. Under its new 'pay per crawl' model, publishers can now charge for that access.

For years, the internet has operated on a simple trade: content in exchange for traffic and ad revenue. That deal is breaking down. A crawl from OpenAI is 750x less likely to lead to a human visit than one from Google. AI takes the content, but rarely gives anything back.

Cloudflare’s response is about restoring balance – while continuing to provide the secure, resilient infrastructure that powers the web. As AI rewrites the rules of the internet, Cloudflare is helping to shape the framework.

About the author - Chloé Darling-Stewart

Chloé Darling-Stewart is an Investment Specialist at Baillie Gifford. She joined the firm in 2013 and became part of the Scottish Mortgage Team in 2025. In her role, Chloé helps translate the Scottish Mortgage portfolio into clear, compelling insights for shareholders. She works closely with the investment managers, regularly engages with portfolio companies, and leads in-depth, insightful conversations with shareholders. Before joining the Scottish Mortgage Team, Chloé worked across Baillie Gifford’s regional equity strategies and played a key role in cultivating client relationships in the Nordic and Iberian regions.

Regulatory Information

This content was produced and approved at the time stated and may not have been updated subsequently. It represents views held at the time of production and may not reflect current thinking. Read our Legal and regulatory information for further details.

A Key Information Document is available by visiting our Documents page. Any images used in this content are for illustrative purposes only.

This content does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 (BGA) holds a Type 1 licence from the Securities and Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes and closed-ended funds such as investment trusts to professional investors in Hong Kong.

Baillie Gifford Asia (Singapore) Private Limited (BGAS) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. BGA and BGAS are wholly owned subsidiaries of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

Europe

Scottish Mortgage Investment Trust PLC (the “Company”) is an alternative investment fund for the purpose of Directive 2011/61/EU (the “AIFM Directive”). Baillie Gifford & Co Limited is the alternative investment fund manager (“AIFM”) of the Company and has been authorised for marketing to Professional Investors in this jurisdiction.

This content is made available by Baillie Gifford Investment Management (Europe) Limited (“BGE”), which has been engaged by the AIFM to carry out promotional activities relating to the Company. BGE is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform promotional, advisory and Individual Portfolio Management activities. BGE has passported its authorisations under the mechanisms set out in the AIFM Directive.

Belgium

The Company has not been and will not be registered with the Belgian Financial Services and Markets Authority (Autoriteit voor Financiële Diensten en Markten / Autorité des services et marchés financiers) (the FSMA) as a public foreign alternative collective investment scheme under Article 259 of the Belgian Law of 19 April 2014 on alternative collective investment institutions and their managers (the Law of 19 April 2014). The shares in the Company will be marketed in Belgium to professional investors within the meaning the Law of 19 April 2014 only. Any offering material relating to the offering has not been, and will not be, approved by the FSMA pursuant to the Belgian laws and regulations applicable to the public offering of securities. Accordingly, this offering as well as any documents and materials relating to the offering may not be advertised, offered or distributed in any other way, directly or indirectly, to any other person located and/or resident in Belgium other than to professional investors within the meaning the Law of 19 April 2014 and in circumstances which do not constitute an offer to the public pursuant to the Law of 19 April 2014. The shares offered by the Company shall not, whether directly or indirectly, be marketed, offered, sold, transferred or delivered in Belgium to any individual or legal entity other than to professional investors within the meaning the Law of 19 April 2014 or than to investors having a minimum investment of at least EUR 250,000 per investor.

Germany

The Trust has not offered or placed and will not offer or place or sell, directly or indirectly, units/shares to retail investors or semi-professional investors in Germany, i.e. investors which do not qualify as professional investors as defined in sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB) and has not distributed and will not distribute or cause to be distributed to such retail or semi-professional investor in Germany, this document or any other offering material relating to the units/shares of the Trust and that such offers, placements, sales and distributions have been and will be made in Germany only to professional investors within the meaning of sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB).

Luxembourg

Units/shares/interests of the Trust may only be offered or sold in the Grand Duchy of Luxembourg (Luxembourg) to professional investors within the meaning of Luxembourg act by the act of 12 July 2013 on alternative investment fund managers (the AIFM Act). This document does not constitute an offer, an invitation or a solicitation for any investment or subscription for the units/shares/interests of the Trust by retail investors in Luxembourg. Any person who is in possession of this document is hereby notified that no action has or will be taken that would allow a direct or indirect offering or placement of the units/shares/interests of the Trust to retail investors in Luxembourg.

Switzerland

The Trust has not been approved by the Swiss Financial Market Supervisory Authority (“FINMA”) for offering to non-qualified investors pursuant to Art. 120 para. 1 of the Swiss Federal Act on Collective Investment Schemes of 23 June 2006, as amended (“CISA”). Accordingly, the interests in the Trust may only be offered or advertised, and this document may only be made available, in Switzerland to qualified investors within the meaning of CISA. Investors in the Trust do not benefit from the specific investor protection provided by CISA and the supervision by the FINMA in connection with the approval for offering.

Singapore

This content has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this content and any other content or material in connection with the offer or sale, or invitation for subscription or purchase, of the Trust may not be circulated or distributed, nor may be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor (as defined in Section 4A of the Securities and Futures Act 2001, as modified or amended from time to time (SFA)) pursuant to Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the SFA) pursuant to Section 275(1), or any person pursuant to Section 275(1A), and in accordance with the conditions specified in Section 275 of the SFA, or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Where the Trust is subscribed or purchased under Section 275 by a relevant person which is:

(a) a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or

(b) a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor, securities or securities-based derivatives contracts (each term as defined in Section 2(1) of the SFA) of that corporation or the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferred within six months after that corporation or that trust has acquired the securities pursuant to an offer made under Section 275 except:

(1) to an institutional investor or to a relevant person or to any person arising from an offer referred to in Section 275(1A) or Section 276(4)(c)(ii) of the SFA,

(2) where no consideration is or will be given for the transfer;

(3) where the transfer is by operation of law; or

(4) pursuant to Section 276(7) of the SFA or Regulation 37A of the Securities and Futures (Offers of Investments) (Securities and Securities-based Derivatives Contracts) Regulations 2018.