Lawrence Burns: Manager Review

Lawrence Burns – Deputy manager, Scottish Mortgage

- Outliers defy norms, using unique strategies to achieve extraordinary success

- Companies like SpaceX and Amazon focus on long-term growth, seizing vast market opportunities

- Adaptability is key; successful outliers evolve with changing global dynamics

The Anatomy of an Outlier

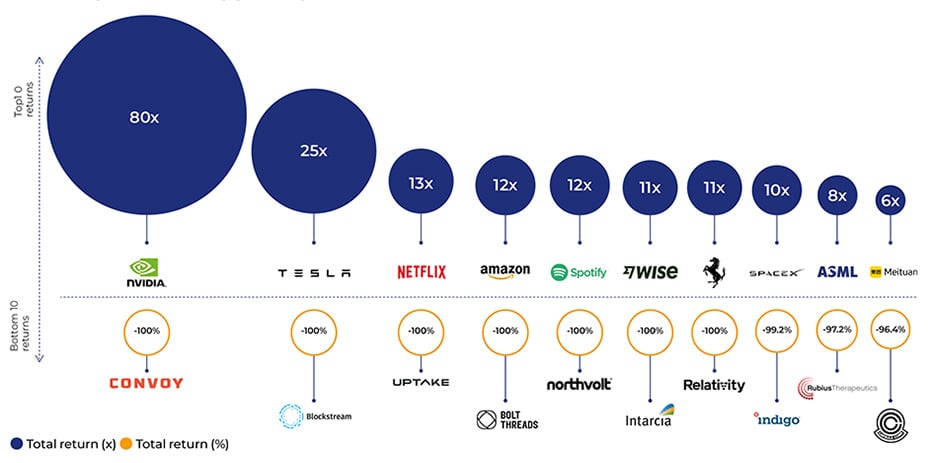

Most companies simply do not matter. Research shows that only a small number of companies make investing in the stock market worthwhile. These companies are outliers that exploit the asymmetric pay-off structure of equities: uncapped upside yet mathematically bounded downside.

Whether the world is serene or chaotic, our objective remains the same: to find and invest in extraordinary companies capable of delivering outlier returns.

As with any investment, your capital is at risk.

Asymmetric Returns

The Scope for Uncapped Upside and Bounded Downside

Finding outliers is a challenging endeavour. They are, by definition, very rare, whilst their characteristics are heterogeneous. Define the parameters of your search too narrowly, and you risk missing out on a new generation of outliers that might look very different from those of the past.

It is therefore important for us to be open-minded about the sources of growth, maturity, financial characteristics and nature of operational excellence that lead to outlier outcomes.

Outliers can be young, fast-growing companies, such as Chinese ecommerce giant PDD, which is still less than 10 years old. PDD falls just outside our top ten outliers, but has still delivered a 6x return for shareholders since its IPO in 2018.

This has been achieved through explosive growth, compounding revenues on average over 110 per cent each year while going from heavily loss-making to generating $15bn in profit last year.

Outliers can also be much older businesses with less explosive but steadier, more resilient growth. Ferrari celebrated its 85th birthday last year, but was still able to deliver an 11x return for Scottish Mortgage shareholders over the decade.

Since we invested in 2015, the company has grown the number of cars it sells each year by less than 7 per cent, but with incredible pricing power, rising margins, and the market’s growing appreciation of both the resilience and duration of demand for its products has still delivered outlier returns.

We believe the portfolio today has a diverse range of potential outliers. With companies founded across the globe, from Stockholm to São Paulo to Singapore. The nature of the growth is also diverse, from rockets to digital banking apps to the most coveted handbags in the world.

We would be wary of being too prescriptive as to the characteristics of outliers, but there are several commonalities we have observed over the years:

1. Outliers are Unconventional

It is not possible to achieve extraordinary outcomes through ordinary methods. Therefore, the strategy, culture and leaders of outliers usually appear as unorthodox.

In the case of SpaceX, to dramatically lower launch costs, it took a radically different approach. It sought to make rockets reusable. To accelerate innovation, it rejected the traditional aerospace approach of extensive planning and validation before building a prototype.

Instead, it adopted an iterative approach of rapidly building prototypes, testing them, analysing the results and implementing improvements in subsequent designs.

In practice, this has meant early test flights, which have often ended in spectacular explosions. Traditional aerospace companies go to great lengths to avoid public failures, whilst SpaceX broadcasts them live to global audiences and frames them as valuable learning opportunities.

This approach to learning has allowed the company to develop rockets in a fraction of the time and at a fraction of the cost of their competitors.

Backing unconventional companies can look prescient when they are successful, but when they fail, you usually end up looking very foolish. However, a willingness to look foolhardy is a necessary requirement for investing in outliers.

2. Outliers are Long-Term Focused

It takes many years, not quarters, to seize large market opportunities and for formidable competitive advantages to form. To succeed, outliers are focused on these long-term outcomes, not maximising value creation over the short or even medium term.

For much of its history, Amazon’s approach to profitability defied stock market conventions. The company chose not to make profits for many years and instead constantly reinvested back into the business.

This long-term approach allowed the company to build out its delivery infrastructure, deepening its competitive moat, seed new business areas such as Amazon Web Services, and deter others who did want to make a profit from competing against them.

Many of the companies we invest in are founder-run because such a leadership structure enables long-term decision making. Others, like Ferrari and Hermès, benefit from multi-generational family ownership to provide a long-term perspective.

The Hermès family owners have even committed not to sell any shares until 2041 at the earliest. We find it pleasing to own companies that can make us appear short-term by comparison.

3. Outliers Address Large Opportunities

Unsurprisingly, outliers need a large market opportunity. This allows a company to grow to multiples of its current size. Wise, the UK-based financial technology company, facilitated £68bn in cross-border transfers in just 6 months last year. However, it still served less than 5 per cent of the consumer cross-border market and less than 1 per cent of the business cross-border market.

The company’s mission is thus to create the financial infrastructure capable of serving not billions but trillions. It has ample space to grow and to continue its outlier journey.

The most rewarding outliers have what we call multiple acts. Having achieved success in one large market, they leverage their advantages to be successful in another. Amazon started as an online book seller but leveraged its ecommerce business to build its cloud services business.

Today, Amazon Web Services contributes 70 per cent of Amazon’s operating profit. NVIDIA started out producing graphics chips for PC gamers before investing heavily and presciently in artificial intelligence.

Mercadolibre started as a Latin American ecommerce platform. However, to reduce the friction of completing transactions when few people had credit or even debit cards, it developed a payment platform and started offering credit.

It leveraged the relationship with its ecommerce customers and its data insights from their purchases to offer a broad range of financial services.

Today, its fintech revenues exceed 40 per cent of the business. It may even have a third act emerging as an advertising platform, leveraging the data its ecommerce and fintech platforms provide to tailor adverts to users.

Spotify is leveraging its leading position in music streaming to offer podcasts, audiobooks and is running a pilot program for education content here in the UK. This pattern of multiple acts is repeated again and again amongst the most rewarding outliers.

As business analysts, it requires us to take an imaginative and creative approach to model the possible (never the certain) value of additional acts at a nascent and uncertain stage. The challenge is often to imagine just how valuable an outlier can become.

4. Outliers are Adaptable

Outliers are not static but adapt to both opportunities and challenges. Companies must evolve to changing circumstances because to be static is to become obsolete.

The history of outlier companies is one of adaptation. Meituan started 15 years ago as a Groupon clone, fighting with an estimated 5,000 start-ups in China that were also using the group-buying model. It emerged from the so-called 'Clone Wars' victorious, pivoting the business into food delivery, travel and other services before we eventually invested.

Hermès started as a manufacturer of high-quality equestrian gear for the horse-drawn carriages of noblemen and royalty. It took a century before it produced its first luxury handbag.

When I first met the founder of Bytedance (TikTok’s parent company), it was to talk about its flagship product, Toutiao, a personalised news aggregation app. A precursor to Douyin and TikTok.

The end of the pandemic made even clearer the importance of investing in adaptable organisations. The world changed, demand for digital products and services slowed, and the cost of capital rose as interest rates soared.

A number of the leaders in our portfolio recognised this shift in the external environment and pivoted their companies. Mark Zuckerberg of Meta and Daniel Ek of Spotify both sought to right-size their organisations to the new environment early, focusing on efficiency and profitability.

At the same time, both still invested in new growth areas, with Meta spending billions to develop AI tools such as its large-language AI model Llama, whilst Spotify entered into the audiobook market.

I remember visiting Mercadolibre in Uruguay in 2022, where the management team talked with confidence about the size of future growth opportunities, but also the realisation that profitless growth would no longer be rewarded by the stock market. The pivot to balance growth and profitability has rewarded both them and their shareholders handsomely in the years since that visit.

The world is constantly changing. We cannot predict all the ways in which it will change over our five-to ten-year investment horizon. Right now, no one can even predict what global trade will look like 90 days from now.

However, if we are able to invest in companies with adaptive leaders and cultures, we can at least outsource some of this challenge to them. It is for this reason that we endeavour to back great businesses that are run by people far smarter than ourselves.

Annual Past Performance To 31 March each year (net %)

| 2021 | 2022 | 2023 | 2024 | 2025 | |

| Share Price | 99.0 | -9.5 | -33.6 | 32.5 | 6.0 |

| NAV | 111.2 | -13.2 | -17.8 | 11.5 | 11.4 |

Source: Morningstar, total return, sterling. NAV stands for Net Asset Value.

Past performance is not a guide to future returns.

Risk Factors

Unlisted investments such as private companies, in which the Trust has a significant investment, can increase risk. These assets may be more difficult to sell, so changes in their prices may be greater.

The trust invests in overseas securities. Changes in the rates of exchange may also cause

the value of your investment (and any income it may pay) to go down or up.

About the author - Lawrence Burns

Deputy manager, Scottish Mortgage

Lawrence Burns was appointed deputy manager of Scottish Mortgage in 2021. He joined Baillie Gifford in 2009 and became a partner of the firm in 2020. During his time at the firm, his investment interest has become focused on transformative growth companies. He has been a member of the International Growth Portfolio Construction Group since October 2012 and in 2020 became a manager of Vanguard’s International Growth Fund. Lawrence is also co-manager of the International Concentrated Growth and Global Outliers strategies. Prior to this, he also worked in both the Emerging Markets and UK Equity teams. Lawrence graduated BA in Geography from the University of Cambridge in 2009.

Regulatory Information

This content was produced and approved at the time stated and may not have been updated subsequently. It represents views held at the time of production and may not reflect current thinking. Read our Legal and regulatory information for further details.

A Key Information Document is available by visiting our Documents page. Any images used in this content are for illustrative purposes only.

This content does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 (BGA) holds a Type 1 licence from the Securities and Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes and closed-ended funds such as investment trusts to professional investors in Hong Kong.

Baillie Gifford Asia (Singapore) Private Limited (BGAS) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. BGA and BGAS are wholly owned subsidiaries of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

Europe

Scottish Mortgage Investment Trust PLC (the “Company”) is an alternative investment fund for the purpose of Directive 2011/61/EU (the “AIFM Directive”). Baillie Gifford & Co Limited is the alternative investment fund manager (“AIFM”) of the Company and has been authorised for marketing to Professional Investors in this jurisdiction.

This content is made available by Baillie Gifford Investment Management (Europe) Limited (“BGE”), which has been engaged by the AIFM to carry out promotional activities relating to the Company. BGE is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform promotional, advisory and Individual Portfolio Management activities. BGE has passported its authorisations under the mechanisms set out in the AIFM Directive.

Belgium

The Company has not been and will not be registered with the Belgian Financial Services and Markets Authority (Autoriteit voor Financiële Diensten en Markten / Autorité des services et marchés financiers) (the FSMA) as a public foreign alternative collective investment scheme under Article 259 of the Belgian Law of 19 April 2014 on alternative collective investment institutions and their managers (the Law of 19 April 2014). The shares in the Company will be marketed in Belgium to professional investors within the meaning the Law of 19 April 2014 only. Any offering material relating to the offering has not been, and will not be, approved by the FSMA pursuant to the Belgian laws and regulations applicable to the public offering of securities. Accordingly, this offering as well as any documents and materials relating to the offering may not be advertised, offered or distributed in any other way, directly or indirectly, to any other person located and/or resident in Belgium other than to professional investors within the meaning the Law of 19 April 2014 and in circumstances which do not constitute an offer to the public pursuant to the Law of 19 April 2014. The shares offered by the Company shall not, whether directly or indirectly, be marketed, offered, sold, transferred or delivered in Belgium to any individual or legal entity other than to professional investors within the meaning the Law of 19 April 2014 or than to investors having a minimum investment of at least EUR 250,000 per investor.

Germany

The Trust has not offered or placed and will not offer or place or sell, directly or indirectly, units/shares to retail investors or semi-professional investors in Germany, i.e. investors which do not qualify as professional investors as defined in sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB) and has not distributed and will not distribute or cause to be distributed to such retail or semi-professional investor in Germany, this document or any other offering material relating to the units/shares of the Trust and that such offers, placements, sales and distributions have been and will be made in Germany only to professional investors within the meaning of sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB).

Luxembourg

Units/shares/interests of the Trust may only be offered or sold in the Grand Duchy of Luxembourg (Luxembourg) to professional investors within the meaning of Luxembourg act by the act of 12 July 2013 on alternative investment fund managers (the AIFM Act). This document does not constitute an offer, an invitation or a solicitation for any investment or subscription for the units/shares/interests of the Trust by retail investors in Luxembourg. Any person who is in possession of this document is hereby notified that no action has or will be taken that would allow a direct or indirect offering or placement of the units/shares/interests of the Trust to retail investors in Luxembourg.

Switzerland

The Trust has not been approved by the Swiss Financial Market Supervisory Authority (“FINMA”) for offering to non-qualified investors pursuant to Art. 120 para. 1 of the Swiss Federal Act on Collective Investment Schemes of 23 June 2006, as amended (“CISA”). Accordingly, the interests in the Trust may only be offered or advertised, and this document may only be made available, in Switzerland to qualified investors within the meaning of CISA. Investors in the Trust do not benefit from the specific investor protection provided by CISA and the supervision by the FINMA in connection with the approval for offering.

Singapore

This content has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this content and any other content or material in connection with the offer or sale, or invitation for subscription or purchase, of the Trust may not be circulated or distributed, nor may be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor (as defined in Section 4A of the Securities and Futures Act 2001, as modified or amended from time to time (SFA)) pursuant to Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the SFA) pursuant to Section 275(1), or any person pursuant to Section 275(1A), and in accordance with the conditions specified in Section 275 of the SFA, or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Where the Trust is subscribed or purchased under Section 275 by a relevant person which is:

(a) a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or

(b) a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor, securities or securities-based derivatives contracts (each term as defined in Section 2(1) of the SFA) of that corporation or the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferred within six months after that corporation or that trust has acquired the securities pursuant to an offer made under Section 275 except:

(1) to an institutional investor or to a relevant person or to any person arising from an offer referred to in Section 275(1A) or Section 276(4)(c)(ii) of the SFA,

(2) where no consideration is or will be given for the transfer;

(3) where the transfer is by operation of law; or

(4) pursuant to Section 276(7) of the SFA or Regulation 37A of the Securities and Futures (Offers of Investments) (Securities and Securities-based Derivatives Contracts) Regulations 2018.