Starlink: broadband from above

Jane Wakefield

Key points

- Starlink is on a mission to provide a globe-spanning internet service from orbit, using thousands of satellites

- The business is part of SpaceX, a company that plans to eventually transport humans to Mars

- It currently beams high-speed broadband to nearly 2.5 million customers across more than 70 countries

As with any investment, your capital is at risk. This article originally featured in Baillie Gifford's Spring 2024 issue of Trust magazine. Read all the articles here.

Next time you look up at the stars, you might glimpse a chain of lights moving across the night sky. If you didn’t know better, you might mistake them for a string of pearls gliding across the heavens. In fact, they are part of Starlink’s growing constellation of satellites.

This sky-borne train puts earthbound transport to shame, circling the globe in about 90 minutes. And as they do so, they bring high-speed broadband to places that otherwise lack it. Nearly 2.5 million users already subscribe – from remote homes to airlines and camper van owners – across over 70 countries and seven continents. Its goal is to make its signal available to half the world’s population this year.

Starlink is a subsidiary of SpaceX. One of the world’s largest private companies, it has pioneered the commercial space industry. As Scottish Mortgage investment specialist Claire Shaw puts it, the business aims “to rebuild the internet in space” by deploying as many as 42,000 satellites in orbit.

Although unlikely to be competitive in urban areas, satellite broadband can do a great job of filling the gaps left by traditional fixed-line or mobile networks in areas that are either too remote, too mountainous or otherwise inaccessible. Additionally, it can provide a lifeline when war or natural disasters sever regular services.

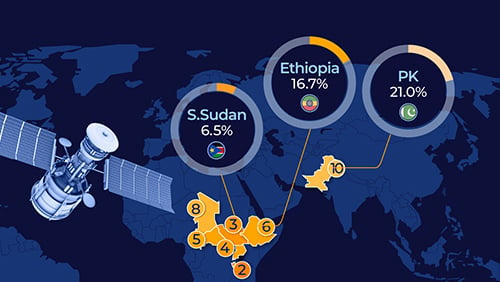

More than a third of the world’s population still lacks internet access, giving the business a huge opportunity. And a head start against a handful of other space-based internet providers makes Starlink well placed to succeed.

Co-founder and chief executive Elon Musk has suggested SpaceX will spin off Starlink with a stock market listing once it “can predict cash flow reasonably well”, but he has denied speculation that it’s working to a 2024 date. Whatever the timeline, his comments indicate that the business is capable of long-term sustainable growth as a standalone entity.

For now, there’s a benefit to being part of a larger firm. Since May 2019, SpaceX’s Falcon 9 rockets have launched more than 5,500 Starlink satellites into the skies. To put that in perspective, until November 2022 the entire space industry had launched fewer than 14,500 satellites since Sputnik in 1957. Or to look at it another way, at the end of 2023 Starlink accounted for more than half of all the active satellites in orbit.

Light-weight satellites

Satellite internet dates back to the 1990s. At first, its connectivity was slow and laggy. Early devices maintained a ‘geostationary orbit’, matching the Earth’s rotation, so they appeared to hover about 22,000 miles above the ground. That distance meant data took a relatively long time to make each journey, causing an issue known as latency.

Starlink’s innovation was to put lots of lighter-weight, smaller satellites much closer to Earth, at heights of just 340 miles. It says subscribers typically get download speeds of between 25 and 220 megabits per second (Mbps), and latency is lower than on some fixed broadband connections. That’s more than adequate for a household to stream Netflix and Spotify, play the online video game Fortnite and make a Zoom call simultaneously, with bandwidth to spare.

The firm provides users with terminals. Their antennae point skywards to establish a connection with its satellites as they pass overhead. The company says the system can withstand bad weather – another problem for satellite broadband in the past – and takes only minutes to set up.

Each satellite has an operational lifespan of about five years and is designed to completely burn up on re-entry into the Earth’s atmosphere, leaving no debris.

“The beauty of Starlink is that it is a relatively fixed-cost business,” Shaw notes. “You know what satellites are up there, and there’s very little incremental cost to run them.” But the firm is driven by more than money, she adds. It aims to bridge the digital divide in an increasingly internet-reliant world.

“The global broadband market is a $1tn a year industry,” Shaw says. “And if Starlink can even get something like 3 per cent of that market, that’s $30bn in revenue each year.”

SpaceX’s chief operating officer, Gwynne Shotwell, is explicit about using Starlink’s revenue to help achieve Musk’s ultimate ambition of reaching Mars.

“SpaceX was created with a mission to make humanity multi-planetary. That’s at the core of the company,” says Shaw. But while it has its eyes on “the pot of gold” at the end of the Mars rainbow, it’s also laser-focused on nearer-term goals, she adds.

“When you look at what SpaceX has achieved in 10 years, it’s phenomenal. It has pretty much 80 per cent of the launch market. And it does it with reusable rockets, an extraordinary feat.”

Expanding access

SpaceX rockets aren’t just sending satellite trains into space. They also transport cargo to the International Space Station on behalf of Nasa. And in a twist, Amazon, founded by Musk’s greatest rival in the commercial space race, Jeff Bezos, has signed a contract to hitch a ride on Falcon 9 for its competing satellite service, Project Kuiper, beginning in 2025.

Starlink also recently agreed a deal with T-Mobile to help end mobile ‘dead zones’ – places without internet coverage – in the US. And in 2023, it started selling its services to customers in Chile via another Scottish Mortgage holding, the Latin American ecommerce giant MercadoLibre, as well as launching services in Nigeria and Kenya.

Starlink isn’t limited to dry land. It is working with Danish shipping giant Maersk to provide connectivity to more than 300 cargo ships, allowing their crews to make high-definition video calls to the company and their families, among other uses.

It also provides humanitarian lifelines. In February 2022, it sent about 50 Starlink terminals to Tonga following a volcanic eruption and tsunami. After the Russian invasion, at Ukraine’s request it supplied more than 20,000 terminals to plug gaps in the country’s damaged communication system.

Recently, Starlink set up a separate division – known as Starshield – specifically intended for government use to support national security efforts.

In 2017, Musk made a passionate case for humanity to have a future “out there among the stars”. Starlink may help achieve that vision, but in the meantime it has huge potential to generate value for those of us remaining earthbound.

Gwynne Shotwell: ground control to Major Musk

If Elon Musk sets SpaceX’s soaring vision, it’s the less familiar figure of Gwynne Shotwell who keeps it on trajectory. She is, according to Time magazine, “living proof that you don’t need a space suit to be a space pioneer”.

Shotwell’s importance to Starlink’s operations – including finance, customer management and government affairs – can’t be overstated.

The former Chrysler engineer has worked with Musk for more than 20 years, longer than any other senior executive. Musk’s biographer, Walter Isaacson, suggests that having a husband with Asperger’s gives Shotwell special understanding of her boss, who has also talked about having the autism-spectrum condition.

In 2008 she became president and chief operating officer after Nasa expressed concerns about Musk dividing that role with running Tesla. “I kind of need a partner,” Isaacson reports him as saying to Shotwell. “Do you want to be president of SpaceX?”

Isaacson suggests “her easy-going assertiveness allows her to speak frankly to Musk without rankling him and to push back against his excesses without nannying him”.

The writer recounts an example from 2019. Impressed by progress on the firm’s planned Starship launch vehicle, Musk ordered the existing Falcon Heavy rocket to be cancelled despite its readiness for commercial use. Panicked executives texted Shotwell, who rushed to the room to get Musk to change his mind. Without Falcon Heavy, the firm couldn’t fulfil its existing military contracts. “Once I gave Elon the context, he agreed he couldn’t do what he wanted,” as she smoothly relates it, and the Falcon Heavy continues to fly.

Course correction achieved, the two have maintained a potent partnership that continues to propel SpaceX to the stars.

Starlink’s parent company SpaceX is also held by The Monks Investment Trust, Edinburgh Worldwide Investment Trust and Baillie Gifford US Growth Trust.

About the author - Jane Wakefield

Jane Wakefield was a technology journalist for two decades, most of which was spent at the BBC. She is now a freelance writer, podcaster, conference host and media trainer.

Regulatory Information

This content was produced and approved at the time stated and may not have been updated subsequently. It represents views held at the time of production and may not reflect current thinking. Read our Legal and regulatory information for further details.

A Key Information Document is available by visiting our Documents page. Any images used in this content are for illustrative purposes only.

This content does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 (BGA) holds a Type 1 licence from the Securities and Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes and closed-ended funds such as investment trusts to professional investors in Hong Kong.

Baillie Gifford Asia (Singapore) Private Limited (BGAS) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. BGA and BGAS are wholly owned subsidiaries of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

Europe

Scottish Mortgage Investment Trust PLC (the “Company”) is an alternative investment fund for the purpose of Directive 2011/61/EU (the “AIFM Directive”). Baillie Gifford & Co Limited is the alternative investment fund manager (“AIFM”) of the Company and has been authorised for marketing to Professional Investors in this jurisdiction.

This content is made available by Baillie Gifford Investment Management (Europe) Limited (“BGE”), which has been engaged by the AIFM to carry out promotional activities relating to the Company. BGE is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform promotional, advisory and Individual Portfolio Management activities. BGE has passported its authorisations under the mechanisms set out in the AIFM Directive.

Belgium

The Company has not been and will not be registered with the Belgian Financial Services and Markets Authority (Autoriteit voor Financiële Diensten en Markten / Autorité des services et marchés financiers) (the FSMA) as a public foreign alternative collective investment scheme under Article 259 of the Belgian Law of 19 April 2014 on alternative collective investment institutions and their managers (the Law of 19 April 2014). The shares in the Company will be marketed in Belgium to professional investors within the meaning the Law of 19 April 2014 only. Any offering material relating to the offering has not been, and will not be, approved by the FSMA pursuant to the Belgian laws and regulations applicable to the public offering of securities. Accordingly, this offering as well as any documents and materials relating to the offering may not be advertised, offered or distributed in any other way, directly or indirectly, to any other person located and/or resident in Belgium other than to professional investors within the meaning the Law of 19 April 2014 and in circumstances which do not constitute an offer to the public pursuant to the Law of 19 April 2014. The shares offered by the Company shall not, whether directly or indirectly, be marketed, offered, sold, transferred or delivered in Belgium to any individual or legal entity other than to professional investors within the meaning the Law of 19 April 2014 or than to investors having a minimum investment of at least EUR 250,000 per investor.

Germany

The Trust has not offered or placed and will not offer or place or sell, directly or indirectly, units/shares to retail investors or semi-professional investors in Germany, i.e. investors which do not qualify as professional investors as defined in sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB) and has not distributed and will not distribute or cause to be distributed to such retail or semi-professional investor in Germany, this document or any other offering material relating to the units/shares of the Trust and that such offers, placements, sales and distributions have been and will be made in Germany only to professional investors within the meaning of sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB).

Luxembourg

Units/shares/interests of the Trust may only be offered or sold in the Grand Duchy of Luxembourg (Luxembourg) to professional investors within the meaning of Luxembourg act by the act of 12 July 2013 on alternative investment fund managers (the AIFM Act). This document does not constitute an offer, an invitation or a solicitation for any investment or subscription for the units/shares/interests of the Trust by retail investors in Luxembourg. Any person who is in possession of this document is hereby notified that no action has or will be taken that would allow a direct or indirect offering or placement of the units/shares/interests of the Trust to retail investors in Luxembourg.

Switzerland

The Trust has not been approved by the Swiss Financial Market Supervisory Authority (“FINMA”) for offering to non-qualified investors pursuant to Art. 120 para. 1 of the Swiss Federal Act on Collective Investment Schemes of 23 June 2006, as amended (“CISA”). Accordingly, the interests in the Trust may only be offered or advertised, and this document may only be made available, in Switzerland to qualified investors within the meaning of CISA. Investors in the Trust do not benefit from the specific investor protection provided by CISA and the supervision by the FINMA in connection with the approval for offering.

Singapore

This content has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this content and any other content or material in connection with the offer or sale, or invitation for subscription or purchase, of the Trust may not be circulated or distributed, nor may be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor (as defined in Section 4A of the Securities and Futures Act 2001, as modified or amended from time to time (SFA)) pursuant to Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the SFA) pursuant to Section 275(1), or any person pursuant to Section 275(1A), and in accordance with the conditions specified in Section 275 of the SFA, or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Where the Trust is subscribed or purchased under Section 275 by a relevant person which is:

(a) a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or

(b) a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor, securities or securities-based derivatives contracts (each term as defined in Section 2(1) of the SFA) of that corporation or the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferred within six months after that corporation or that trust has acquired the securities pursuant to an offer made under Section 275 except:

(1) to an institutional investor or to a relevant person or to any person arising from an offer referred to in Section 275(1A) or Section 276(4)(c)(ii) of the SFA,

(2) where no consideration is or will be given for the transfer;

(3) where the transfer is by operation of law; or

(4) pursuant to Section 276(7) of the SFA or Regulation 37A of the Securities and Futures (Offers of Investments) (Securities and Securities-based Derivatives Contracts) Regulations 2018.