Denali Therapeutics: rising to the challenge of brain disease

Claire Shaw – Portfolio Director

Key Points

- Neurodegenerative diseases, including Alzheimer’s and Parkinson’s, are set to affect more people as life expectancies increase

- Denali Therapeutics is developing a range of treatments to tackle brain diseases

- The US firm is developing a new generation of medicines that can effectively treat neurodegenerative diseases

This article is a teaser for the Scottish Mortgage Denali podcast. Listen to the company’s co-founder Ryan Watts speak with Tom Slater about its efforts to solve one of medical science’s toughest problems: developing treatments for the brain.

As with any investment, capital is at risk.

Over the last decade, a large number of big pharmaceutical companies have quit neuroscience.

It’s a puzzling phenomenon when you consider that one in three people born today will develop dementia. Why leave such an important field when the unmet need is so great?

The answer is the huge failure rate in developing treatments for neurodegenerative disease. The disorders affect nerve cells in a patient’s brain and nervous system, damaging or destroying them. This can result in the sufferer losing coordination, mobility, strength, sensation and the ability to speak and breathe. Ultimately, death often follows. Despite huge efforts, many of these conditions remain incurable.

Take Alzheimer’s, for example – one study found that over 99 per cent of drug candidates that made it to clinical trials were found to be no better than a placebo.

Big pharma has spent billions yet has made little progress.

Denali Therapeutics’s CEO Ryan Watts tells Tom Slater why he believes it can succeed where big pharma has failed by creating effective drugs for neurodegenerative diseases, in this episode of Invest in Progress.

Despite all this, Denali Therapeutics, a nimble San Francisco start-up, has dedicated itself to tackling the problem. And for Ryan Watts, the business’s co-founder and CEO, it’s a deeply personal mission.

“I think the first, probably most compelling experience, is that my wife’s family has a history of Alzheimer’s disease,” he explains. “And I remember her grandfather developing Alzheimer’s disease. I thought, ‘maybe there’s an area I should start focusing on.’

“But the driving force for me [was] seeing my own mother start to develop dementia. I know my genetic risk. I know her genetic risk. It’s imputed from mine.”

The blood-brain barrier

Developing brain drugs is notoriously difficult for three reasons:

- Our understanding of the genetic and molecular basis of neurodegenerative diseases is incomplete.

- It’s hard to test if a drug is working because you can’t biopsy the brain in the way you might biopsy a tumour.

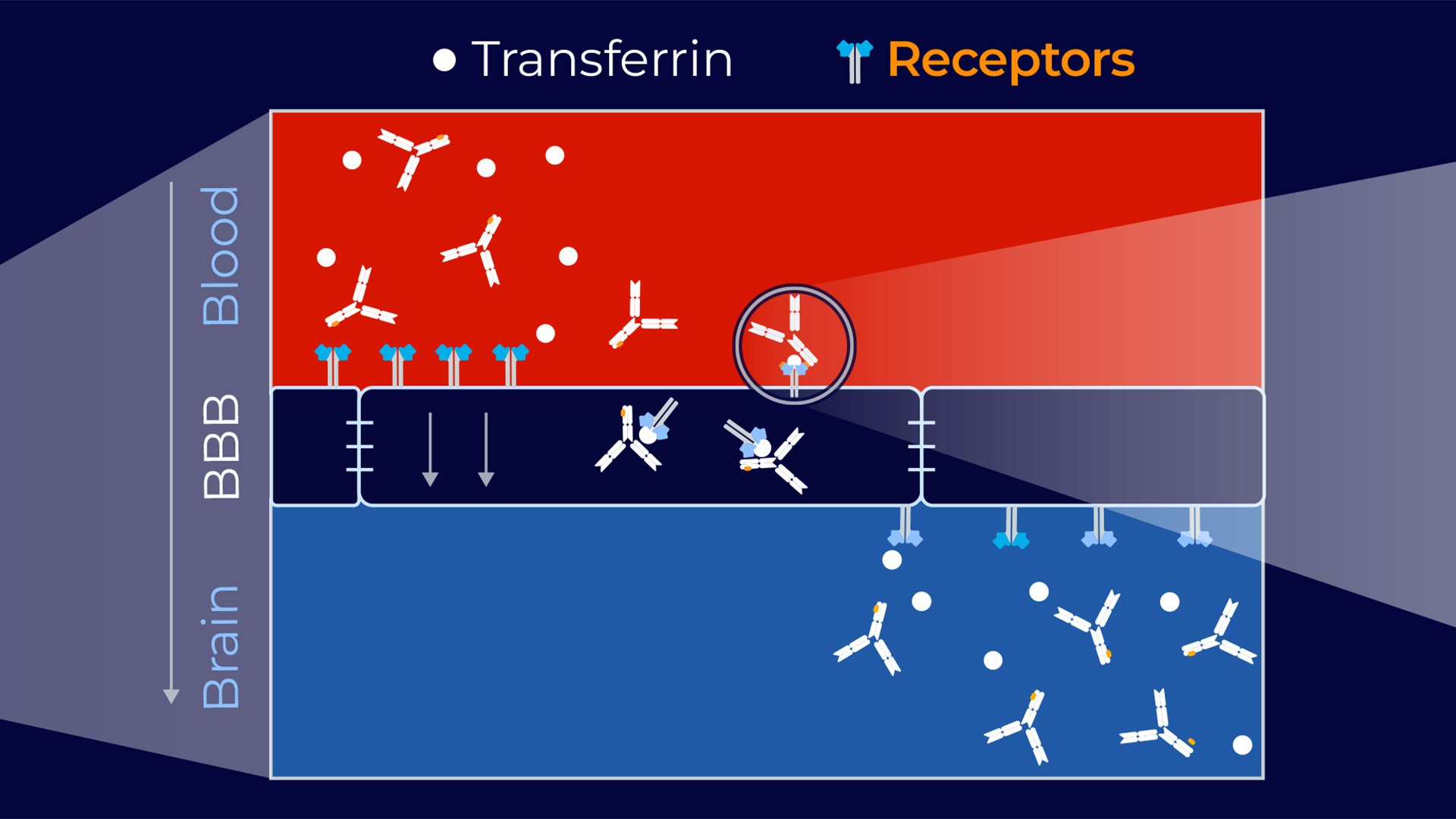

- Once a drug has been developed, it’s tricky to get it into the brain due to a mechanism called the blood-brain barrier. It keeps out harmful chemicals but unfortunately limits the uptake of medicine too.

This third point has been a particular challenge. Natural active transport systems exist to carry some large molecules through, such as sugar or iron. One of Denali’s key achievements is having found a way to harness these to create a ‘transport vehicle technology’ that effectively sneaks through molecules that would otherwise be blocked.

Denali believes it can succeed where others have failed. It’s asking the right questions, solving technical challenges and taking bigger risks than its competitors. But, counterintuitively, what’s also essential to its progress is that it’s prepared for failure.

Multiple molecules

Dementia isn’t the company’s only focus – it’s also attempting to tackle Parkinson’s and the motor neuron disease amyotrophic lateral sclerosis (ALS), among other disorders. This broad remit distinguishes it from the narrower approach biotech start-ups traditionally take.

“You can’t be focused on a single idea or hypothesis,” explains Watts. “You can’t found a company based on one molecule. The chances of that succeeding are extremely low. We knew at the beginning that there were two things we needed. We needed a pipeline, which is basically multiple medicines. And we needed a platform that, if successful, would open up all of the nervous system, not just neurodegenerative diseases.”

Denali has seven medicines in clinical development. Three are in the final stages before being submitted for approval. Part of being able to follow the science and take forward multiple potential drugs at once is having a big balance sheet.

“It allows you to fail, to iterate and to accelerate,” says Watts. “You need the capital in order to get data really quickly and understand the direction.

“We have had at least a dozen programmes that we stopped developing. Any one of those programmes would be a single biotech company. But because we had that capital, it allowed us to really invest in the underlying science and the platform.”

Aiming for achievement

Denali’s company culture also comes into the equation. Its employees recognise the firm’s purpose is more important than the organisation itself. That diminishes the impact of setbacks while making successes even more meaningful.

Watts highlights a recent triumph against Hunter syndrome, a rare and harmful inherited disorder in which the body does not properly break down sugar molecules, causing damage to the brain. The firm developed an enzyme replacement therapy that’s capable of crossing the blood-brain barrier.

“We have gotten to know several of the families that have children with Hunter syndrome,” he says. “Some will develop very normally. And by ages three, four or five, learn to walk and talk and then they’ll start to lose their ability. It’s just unbelievably devastating.

“Fast-forward, we get our medicine into the clinic. We get our very first data. [The chief medical officer] called me, and she says, Ryan, four out of the five patients have completely normal levels of the substrate in the brain. And it was unbelievable.”

Denali hopes to replicate this achievement. So, what does the world look like if it succeeds? For Watts, it’s about creating a future where people live longer and can die with dignity.

For now, its clinical data is encouraging. And if its drugs are approved, they have the potential to advance medical science, save people’s lives and propel the company along the path to long-term growth.

About the author - Claire Shaw

Portfolio Director

Claire Shaw is a portfolio director and plays a prominent role in servicing Scottish Mortgage’s UK shareholder base. Before joining in 2019, she spent over a decade as a fund manager with a focus on managing European equity portfolios for a global client base. With a background in analysing companies and communicating investment ideas, Claire is also responsible for creating engaging content that makes the Scottish Mortgage portfolio accessible to all its shareholders. Beyond that, she works closely with the managers, meeting with portfolio companies and conducting in-depth portfolio discussions with shareholders.

Regulatory Information

This content was produced and approved at the time stated and may not have been updated subsequently. It represents views held at the time of production and may not reflect current thinking. Read our Legal and regulatory information for further details.

A Key Information Document is available by visiting our Documents page. Any images used in this content are for illustrative purposes only.

This content does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 (BGA) holds a Type 1 licence from the Securities and Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes and closed-ended funds such as investment trusts to professional investors in Hong Kong.

Baillie Gifford Asia (Singapore) Private Limited (BGAS) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. BGA and BGAS are wholly owned subsidiaries of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

Europe

Scottish Mortgage Investment Trust PLC (the “Company”) is an alternative investment fund for the purpose of Directive 2011/61/EU (the “AIFM Directive”). Baillie Gifford & Co Limited is the alternative investment fund manager (“AIFM”) of the Company and has been authorised for marketing to Professional Investors in this jurisdiction.

This content is made available by Baillie Gifford Investment Management (Europe) Limited (“BGE”), which has been engaged by the AIFM to carry out promotional activities relating to the Company. BGE is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform promotional, advisory and Individual Portfolio Management activities. BGE has passported its authorisations under the mechanisms set out in the AIFM Directive.

Belgium

The Company has not been and will not be registered with the Belgian Financial Services and Markets Authority (Autoriteit voor Financiële Diensten en Markten / Autorité des services et marchés financiers) (the FSMA) as a public foreign alternative collective investment scheme under Article 259 of the Belgian Law of 19 April 2014 on alternative collective investment institutions and their managers (the Law of 19 April 2014). The shares in the Company will be marketed in Belgium to professional investors within the meaning the Law of 19 April 2014 only. Any offering material relating to the offering has not been, and will not be, approved by the FSMA pursuant to the Belgian laws and regulations applicable to the public offering of securities. Accordingly, this offering as well as any documents and materials relating to the offering may not be advertised, offered or distributed in any other way, directly or indirectly, to any other person located and/or resident in Belgium other than to professional investors within the meaning the Law of 19 April 2014 and in circumstances which do not constitute an offer to the public pursuant to the Law of 19 April 2014. The shares offered by the Company shall not, whether directly or indirectly, be marketed, offered, sold, transferred or delivered in Belgium to any individual or legal entity other than to professional investors within the meaning the Law of 19 April 2014 or than to investors having a minimum investment of at least EUR 250,000 per investor.

Germany

The Trust has not offered or placed and will not offer or place or sell, directly or indirectly, units/shares to retail investors or semi-professional investors in Germany, i.e. investors which do not qualify as professional investors as defined in sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB) and has not distributed and will not distribute or cause to be distributed to such retail or semi-professional investor in Germany, this document or any other offering material relating to the units/shares of the Trust and that such offers, placements, sales and distributions have been and will be made in Germany only to professional investors within the meaning of sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB).

Luxembourg

Units/shares/interests of the Trust may only be offered or sold in the Grand Duchy of Luxembourg (Luxembourg) to professional investors within the meaning of Luxembourg act by the act of 12 July 2013 on alternative investment fund managers (the AIFM Act). This document does not constitute an offer, an invitation or a solicitation for any investment or subscription for the units/shares/interests of the Trust by retail investors in Luxembourg. Any person who is in possession of this document is hereby notified that no action has or will be taken that would allow a direct or indirect offering or placement of the units/shares/interests of the Trust to retail investors in Luxembourg.

Switzerland

The Trust has not been approved by the Swiss Financial Market Supervisory Authority (“FINMA”) for offering to non-qualified investors pursuant to Art. 120 para. 1 of the Swiss Federal Act on Collective Investment Schemes of 23 June 2006, as amended (“CISA”). Accordingly, the interests in the Trust may only be offered or advertised, and this document may only be made available, in Switzerland to qualified investors within the meaning of CISA. Investors in the Trust do not benefit from the specific investor protection provided by CISA and the supervision by the FINMA in connection with the approval for offering.

Singapore

This content has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this content and any other content or material in connection with the offer or sale, or invitation for subscription or purchase, of the Trust may not be circulated or distributed, nor may be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor (as defined in Section 4A of the Securities and Futures Act 2001, as modified or amended from time to time (SFA)) pursuant to Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the SFA) pursuant to Section 275(1), or any person pursuant to Section 275(1A), and in accordance with the conditions specified in Section 275 of the SFA, or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Where the Trust is subscribed or purchased under Section 275 by a relevant person which is:

(a) a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or

(b) a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor, securities or securities-based derivatives contracts (each term as defined in Section 2(1) of the SFA) of that corporation or the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferred within six months after that corporation or that trust has acquired the securities pursuant to an offer made under Section 275 except:

(1) to an institutional investor or to a relevant person or to any person arising from an offer referred to in Section 275(1A) or Section 276(4)(c)(ii) of the SFA,

(2) where no consideration is or will be given for the transfer;

(3) where the transfer is by operation of law; or

(4) pursuant to Section 276(7) of the SFA or Regulation 37A of the Securities and Futures (Offers of Investments) (Securities and Securities-based Derivatives Contracts) Regulations 2018.