Biofacturing

Claire Shaw – Portfolio Director

Synthetic biology is making truly remarkable progress. Find out how it can help solve some of the world’s biggest problems.

All investment strategies have the potential for profit and loss, your or your clients' capital may be at risk.

Synthetic biology conjures images of Frankenstein’s monster, with mad scientists poring over boiling beakers to bring to life the beast. The reality of modern labs is significantly different however. Truly remarkable progress is being made in solving some of the world’s biggest problems by unlocking nature at its most granular level.

How will we reduce plastic waste or protect crops from ever more volatile and extreme weather brought about by climate change? Is there a different way to lessen the impact of insect borne disease, such as malaria, which remains one of the biggest causes of death worldwide? Whilst populations and consumption grow, we must seek innovation to tackle these huge issues, and the building blocks of these solutions are often being provided by the natural world, albeit with some tweaking and tuning.

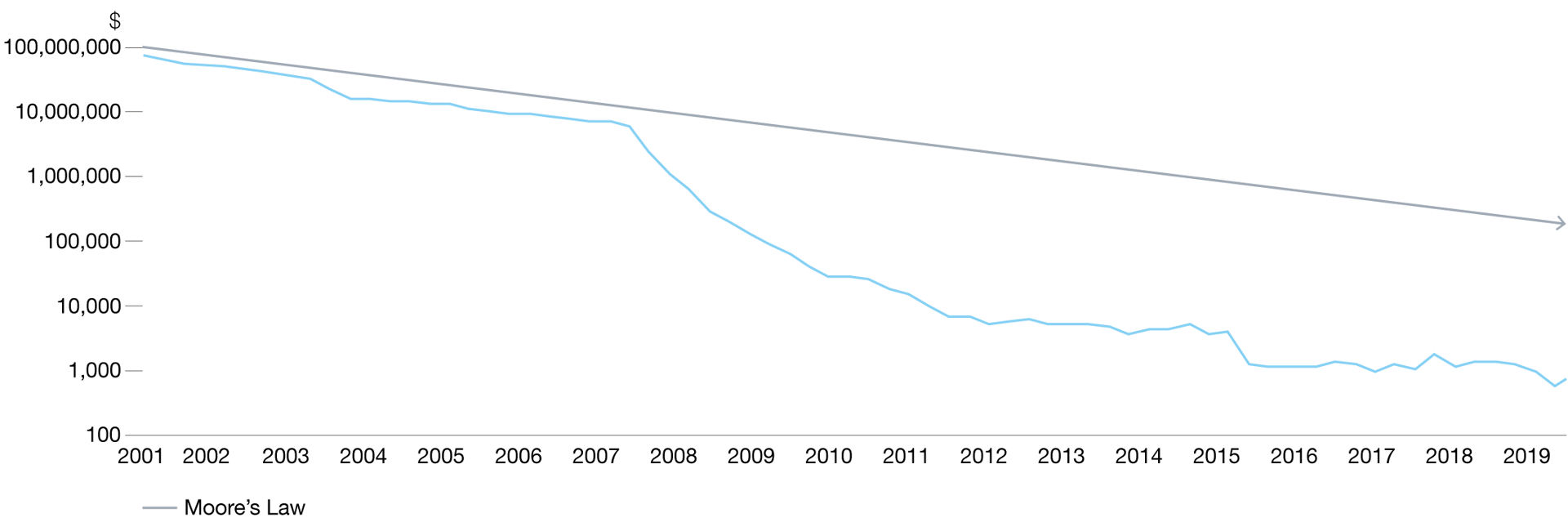

Synthetic biology is a loose term for a group of genetic engineering techniques which edit the DNA of an existing organism to produce a desired product. Advances in gene sequencing, driven by companies like Illumina, have made the mapping and understanding of DNA more prevalent with their next generation sequencing (NGS) devices. This is shining a light on the possibilities in fields as varied as materials science, agriculture and nutrition. The declining cost of NGS has accelerated far quicker than Moore’s law, speeding the propagation into other areas.

Innovation in areas such as robotics, machine learning and 3D printing has converged with the quantum leaps in understanding brought about by NGS, allowing us to get under the bonnet of the code of life and tune it for other purposes.

Ginkgo Bioworks, a private company in which we first invested in May 2016, has identified that for average lab protocols, 80 per cent of the cost is scientist labour, prohibiting economies of scale. In their ‘foundry’ their significant use of automation and software enables 10-15 staff to match the output of 100 PhDs. This allows them to produce customisable enzymes at scale for industrial purposes as varied as flavourings and fragrances and insect control, reducing the spread of diseases such as malaria and dengue fever, where mosquitoes and flies act as vectors , and traditional pesticides and insect repellents can be harmful to the wider environment.

Beyond this automation, Ginkgo’s additional edge lies in their ‘codebase’ – an encyclopaedia of genetic data to speed up the accuracy and applicability of synthetic biology solutions. This is the equivalent of a proprietary software library which is written in DNA. The potential competitive advantage of Ginkgo Bioworks lies in their licensing model, which means that virtually all licensing revenue should fall to the bottom line. The management team’s focus on automation creates an opportunity to scale significantly, at speed, without significantly increasing labour costs. This has the potential to create highly profitable business.

Synthetic biology is poised to play a crucial role in the energy transition, helping us to reimagine the composition of many goods that are currently produced from petrochemical derivatives, and in turn helping to reduce our reliance on fossil fuels.

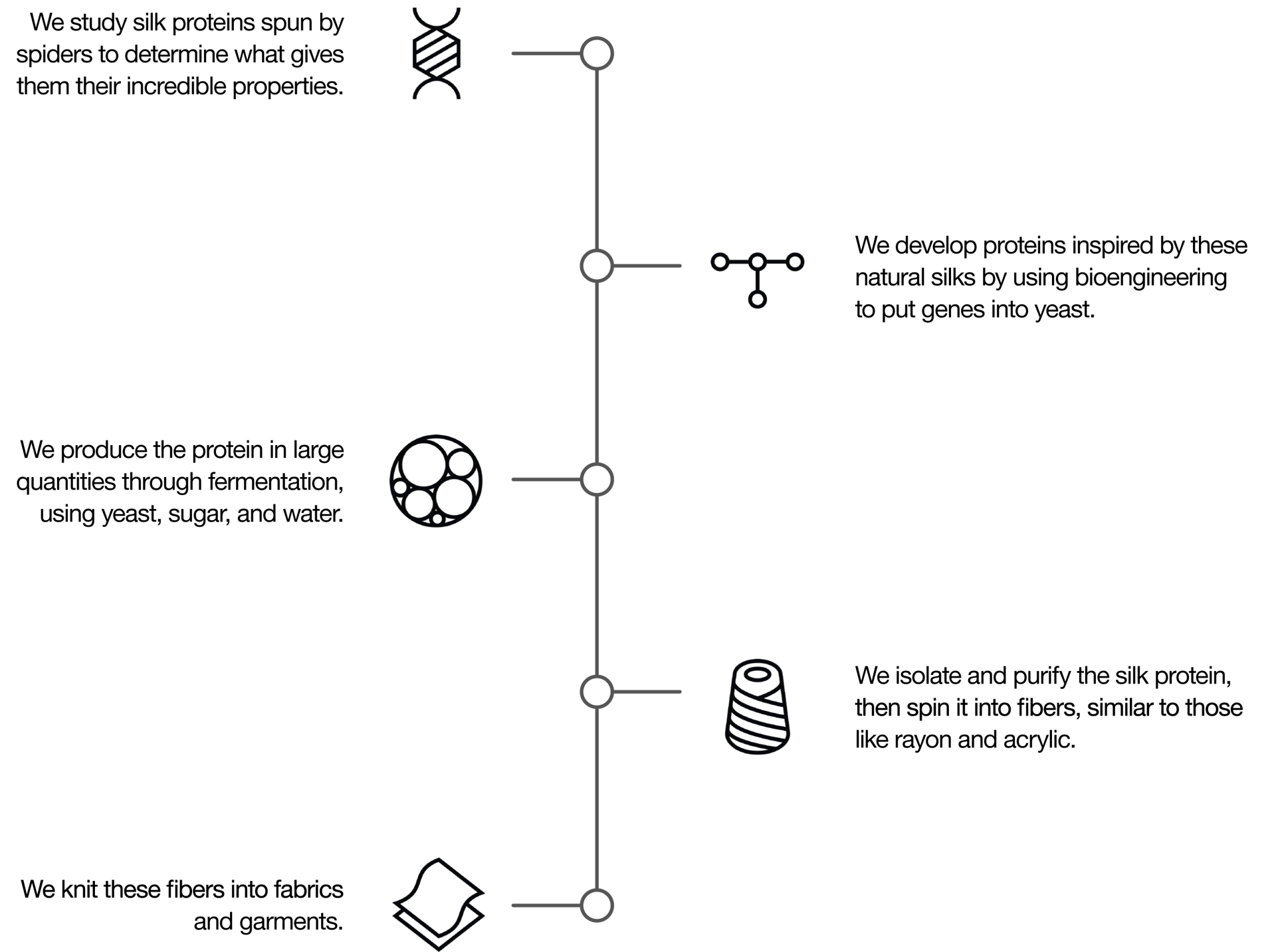

Bolt Threads is a materials solutions company, first purchased for Scottish Mortgage in 2017, which seeks to reduce the impact of traditional materials manufacturing. Most of the innovations in textiles over the last 85 years have come from petrochemicals; Gore-Tex, Nylon and Lycra are all familiar household names; however, these textiles rely on manufacturing processes and raw materials that are harmful to the planet, and they are also unable to bio-degrade at the end of their useful life. Bolt Threads has sought to address these issues by synthesising Microsilk® from yeast - coded to spider silk proteins, and grown in a bioreactor to provide high tensile strength, elasticity, durability and softness.

Bolt Threads Technology

Whilst the potential for spider silk is exciting, it could not be tapped without the skillset and infrastructure that Bolt Threads have built. Bolt Threads already have agreements with Stella McCartney and Patagonia to incorporate Microsilk® into their clothing, but as they continue to scour flora and fauna for specific qualities, they are looking to produce highly customised and durable materials for a much broader spectrum of applications, with sustainable alternatives to oil based. To give a feel for the potential scale of impact, in 2019 average global spend on apparel (spanning all 7.7 billion of earth’s inhabitants) was a remarkable US$2311. Capturing even a very thin slice of this addressable market, could translate into exceptional outcomes not only for Bolt Threads, but also for the environment.

The co-founder of Ginkgo Bioworks, Tom Knight, thinks ‘predicting the future of synthetic biology is like asking Bardeen, the inventor of the transistor, to predict the iPhone in 1948’. We are at the dawn of a new industry; which is beginning to provide solutions to some of society’s most wicked problems.

Enabled by technologies that we have already seen flourish within Scottish Mortgage, synthetic biology capitalises on their convergence to unlock and tweak the strengths of nature.

We are struck by the strength of developments and the degree of exponential change in the area, but the opportunities in this exciting area reside entirely within the private markets. This perfectly illustrates why our ability to span both the public and private markets expands the opportunity set, enabling us to deploy capital in the most promising and exciting companies in the world.

[1] https://www.commonobjective.co/article/the-size-of-the-global-fashion-retail-market

Scottish Mortgage Annual Past Performance (%) To 31 December each year

|

|

2017 |

2018 |

2019 |

2020 |

2021 |

|

The Scottish Mortgage Investment Trust PLC |

41.1 | 4.6 | 24.8 | 110.5 | 10.5 |

About the author - Claire Shaw

Portfolio Director

Claire Shaw is a portfolio director and plays a prominent role in servicing Scottish Mortgage’s UK shareholder base. Before joining in 2019, she spent over a decade as a fund manager with a focus on managing European equity portfolios for a global client base. With a background in analysing companies and communicating investment ideas, Claire is also responsible for creating engaging content that makes the Scottish Mortgage portfolio accessible to all its shareholders. Beyond that, she works closely with the managers, meeting with portfolio companies and conducting in-depth portfolio discussions with shareholders.

Important information

This communication was produced and approved at the time stated and may not have been updated subsequently. It represents views held at the time of production and may not reflect current thinking.

This content does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

A Key Information Document is available by visiting our Documents page.

Any images used in this content are for illustrative purposes only.