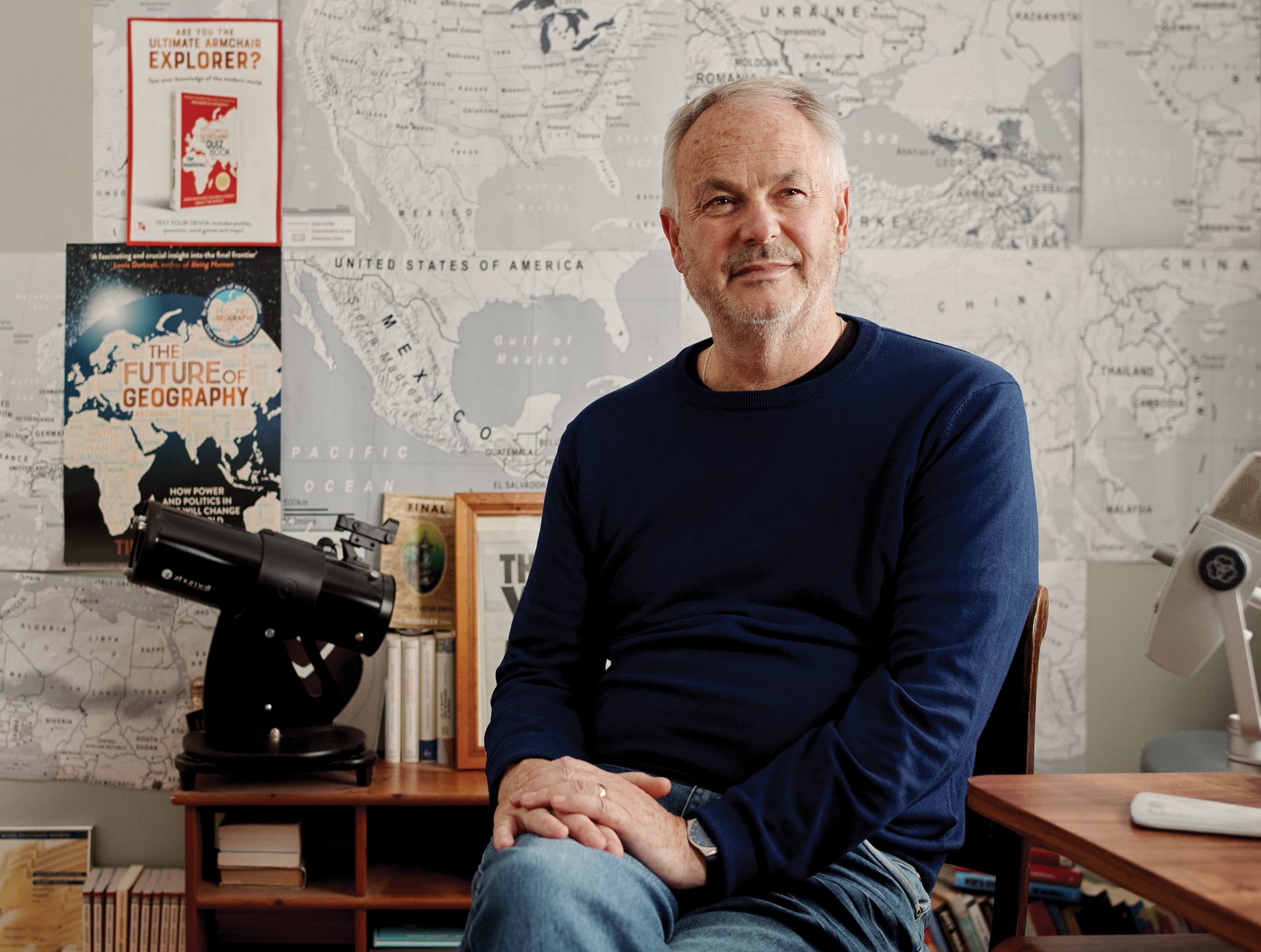

Watch This Space: Tim Marshall on the Future of ‘Astropolitics’

Claire Shaw – Portfolio Director

- Author Tim Marshall says space is the new arena for rivalry over resources and military advantage

- He tells portfolio director Claire Shaw why we need new laws to head off future clashes over territorial and other claims

- But ‘Space race 2.0’ also promises many benefits to our existence back on earth

As with any investment, your capital is at risk.

Great power rivalries are no longer confined to Earth, according to the author Tim Marshall. Portfolio director Claire Shaw asks the author what’s at stake in the new age of ‘astropolitics’.

Claire Shaw: Your latest book, The Future of Geography, contends that the laws governing space are not fit for purpose. Why?

Tim Marshall: They were written in the 1960s and reflect that era. The drafters couldn’t foresee the technological leaps made since. The Outer Space Treaty [1967] needs drastic rewriting to reflect the realities of today and tomorrow. For example, it forbade weapons of mass destruction in space, meaning nuclear weapons, but said nothing about laser weaponry – it didn’t exist then.

The idea that no state or company can own any part of space is outdated. Given that we’re already going to space as nation-states and companies, we need legal language to reflect that.

CS: How has the balance between the big space powers shifted over the last 20 years?

TM: In the last century, there were only two: the US and the Soviet Union, later Russia. In this century, it’s those two plus China. Now, Russia is dropping below the others because its space budget is going more towards the Ukraine war.

What was once state-led in the US and China now involves private companies. SpaceX is the prime example. In China, although the state dominates, there are a lot of small commercial space companies. I suspect that China and the US will put more distance between themselves and Russia.

CS: Will the second Trump presidency change anything?

TM: It was Trump in 2019 who listened to advisers and founded the US Space Force. Its budget has increased year-on-year. There is no big expectation that he’ll cut the military budget. The nexus of state and private enterprise is strong in the US.

Commercial companies’ subsidies would be cut before Space Force. American politicians understand space and its place in critical national infrastructure, the economy and military in a way that Europeans don’t.

CS: How important is it to go to the moon?

TM: In many industries, there’s a debate about the advantages of being first: whether it’s better to let others make mistakes and then leapfrog them. Not when it comes to finding new resources on the moon, which is why there’s a race to get there.

Previously, there was no reason to go back: we’d been lots of times and collected lots of rocks.

Now, 50 years on, you’ve got the rationale of using the moon as a lily pad to hop to Mars. Then you’ve got the commercial aspect of finding and potentially extracting minerals. You can’t not be there because if it does then turn out to be a Klondike of valuable minerals, you’re stuffed.

The lunar south pole is where the action is. It’s a hard landscape with proper mountains, caves and craters. It has interesting geography, and there’s ice there in parts that don’t get any sunshine.

They’ve proven there are minerals there that are needed for the 21st century. They’re less sure about the amount, but with water and minerals, that’s the place to be, though it’s hard territory to land in and build a base on.

Then there’s the military aspect. If you’ve got a moon base and satellites around it that give you a full spectrum view of what’s going on there, as well as on Earth, you’re in a better position to protect your assets.

CS: What minerals would you highlight?

TM: The one that they’d like to find a massive seam of is lithium, which has multiple uses in energy storage and materials science. Also, there are large quantities of helium-3 in the soil, though how useful that is, we still don’t know.

Chinese scientists believe there is enough of it to fuel all of Earth’s power needs for 10,000 years. That’s the theory, but it depends on finding it, getting it, processing it, bringing it back – and cracking nuclear fusion.

CS: How have SpaceX’s reusable rockets and Starlink’s satellite constellations affected the balance of power?

TM: Elon Musk divides opinion. But whatever you think of the founder of those companies, he’s a revolutionary innovator in this industry.

Reusable rockets mean instead of chucking away tens of millions of dollars every time, you bring the rocket back. The knock-on effect is that not only is it cheaper to launch, it’s also cheaper to carry something on the payload.

That has democratised access to space. Before, many lesser powers – Nigeria, say – would find it hard to cover the costs of launching a major satellite constellation. Now, they make CubeSats, satellites the size of a Rubik’s cube.

You can build 20 of them and stick them in the nose cone of a SpaceX rocket, along with those of several other companies or countries.

The cost of the satellites has come down because they can make them so small now, and then the cost of getting them up there and launching them has come down because of reusable rockets. That’s revolutionary. Having said that, there is also a first-come-first-served aspect to space. There are parts where, if you don’t get there in the initial wave, you may never get there.

In the 1960s, there were a handful of countries in space. There are now more than 80. Part of that is down to Musk. He’s been at the forefront of delivering the internet via satellite. Because of that, the Russia-Ukraine war is the first real space war in which both sides have used space assets.

SpaceX is a massive part of why space is becoming interesting again. Musk has gripped people’s imaginations. Anyone who’s seen two of its rockets landing at the same time… it looks like sci-fi. Catching a rocket with those ‘chopstick’ arms is sensational.

CS: We like companies with technologically minded leaders like Musk, Meta’s Mark Zuckerberg or Shopify’s Tobi Lütke. They’re not interested in winning last decade’s technology…

TM: Yes, because you mustn’t make the old military mistake of fighting the last war. Otherwise, it will be like the Azerbaijan-Armenia War of 2020 when Armenia, which hadn’t been keeping up, had its tanks and armoured personnel carriers at the front line. The Azerbaijanis, using Turkish-made drones, also AI, virtually wiped them out in two days.

CS: What role could space play in monitoring climate change?

TM: That’s one of the many positive aspects of Space Race 2.0. We’ve already deflected a small asteroid off its course two million miles away. That was good forward planning in case a much bigger one comes our way.

We use satellites to measure the temperature of the oceans to better understand climate change. We’re working on how to get solar power from space, where there’s very powerful 24/7 sunlight, and it can be directed wherever you want to.

We are doing amazing medical experiments in space. We use satellites to tell farmers where to plant crops, where’s best to build transport infrastructure at the lowest cost.

Rockets do use huge amounts of fuel, but it’s minuscule relative to what comes out of cars every day.

And we have the prospect of cheap, clean solar energy, the metals that we need to build our renewable technology down here: we’re not going to find those solutions if we don’t go into space. So, on balance, we have to go.

And we will. Because humankind has never seen a mountain it didn’t want to conquer.

CS: What will be the big space development in the next 30 to 40 years?

TM: Answering that means imagining the unimaginable. If 200 years ago you’d told people there were things in the air called radio waves, and if you shouted into one, someone could hear you 10,000 miles away, they’d say you were mad. So it will be something similar we haven’t thought of yet.

Things that are completely sci-fi now will be completely part of our everyday lives. Remember Captain Kirk’s flip-phone communicator in Star Trek? That one went from fantasy to reality quite quickly.

About the author - Claire Shaw

Portfolio Director

Claire Shaw is a portfolio director and plays a prominent role in servicing Scottish Mortgage’s UK shareholder base. Before joining in 2019, she spent over a decade as a fund manager with a focus on managing European equity portfolios for a global client base. With a background in analysing companies and communicating investment ideas, Claire is also responsible for creating engaging content that makes the Scottish Mortgage portfolio accessible to all its shareholders. Beyond that, she works closely with the managers, meeting with portfolio companies and conducting in-depth portfolio discussions with shareholders.

Regulatory Information

This content was produced and approved at the time stated and may not have been updated subsequently. It represents views held at the time of production and may not reflect current thinking. Read our Legal and regulatory information for further details.

A Key Information Document is available by visiting our Documents page. Any images used in this content are for illustrative purposes only.

This content does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 (BGA) holds a Type 1 licence from the Securities and Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes and closed-ended funds such as investment trusts to professional investors in Hong Kong.

Baillie Gifford Asia (Singapore) Private Limited (BGAS) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. BGA and BGAS are wholly owned subsidiaries of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

Europe

Scottish Mortgage Investment Trust PLC (the “Company”) is an alternative investment fund for the purpose of Directive 2011/61/EU (the “AIFM Directive”). Baillie Gifford & Co Limited is the alternative investment fund manager (“AIFM”) of the Company and has been authorised for marketing to Professional Investors in this jurisdiction.

This content is made available by Baillie Gifford Investment Management (Europe) Limited (“BGE”), which has been engaged by the AIFM to carry out promotional activities relating to the Company. BGE is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform promotional, advisory and Individual Portfolio Management activities. BGE has passported its authorisations under the mechanisms set out in the AIFM Directive.

Belgium

The Company has not been and will not be registered with the Belgian Financial Services and Markets Authority (Autoriteit voor Financiële Diensten en Markten / Autorité des services et marchés financiers) (the FSMA) as a public foreign alternative collective investment scheme under Article 259 of the Belgian Law of 19 April 2014 on alternative collective investment institutions and their managers (the Law of 19 April 2014). The shares in the Company will be marketed in Belgium to professional investors within the meaning the Law of 19 April 2014 only. Any offering material relating to the offering has not been, and will not be, approved by the FSMA pursuant to the Belgian laws and regulations applicable to the public offering of securities. Accordingly, this offering as well as any documents and materials relating to the offering may not be advertised, offered or distributed in any other way, directly or indirectly, to any other person located and/or resident in Belgium other than to professional investors within the meaning the Law of 19 April 2014 and in circumstances which do not constitute an offer to the public pursuant to the Law of 19 April 2014. The shares offered by the Company shall not, whether directly or indirectly, be marketed, offered, sold, transferred or delivered in Belgium to any individual or legal entity other than to professional investors within the meaning the Law of 19 April 2014 or than to investors having a minimum investment of at least EUR 250,000 per investor.

Germany

The Trust has not offered or placed and will not offer or place or sell, directly or indirectly, units/shares to retail investors or semi-professional investors in Germany, i.e. investors which do not qualify as professional investors as defined in sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB) and has not distributed and will not distribute or cause to be distributed to such retail or semi-professional investor in Germany, this document or any other offering material relating to the units/shares of the Trust and that such offers, placements, sales and distributions have been and will be made in Germany only to professional investors within the meaning of sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB).

Luxembourg

Units/shares/interests of the Trust may only be offered or sold in the Grand Duchy of Luxembourg (Luxembourg) to professional investors within the meaning of Luxembourg act by the act of 12 July 2013 on alternative investment fund managers (the AIFM Act). This document does not constitute an offer, an invitation or a solicitation for any investment or subscription for the units/shares/interests of the Trust by retail investors in Luxembourg. Any person who is in possession of this document is hereby notified that no action has or will be taken that would allow a direct or indirect offering or placement of the units/shares/interests of the Trust to retail investors in Luxembourg.

Switzerland

The Trust has not been approved by the Swiss Financial Market Supervisory Authority (“FINMA”) for offering to non-qualified investors pursuant to Art. 120 para. 1 of the Swiss Federal Act on Collective Investment Schemes of 23 June 2006, as amended (“CISA”). Accordingly, the interests in the Trust may only be offered or advertised, and this document may only be made available, in Switzerland to qualified investors within the meaning of CISA. Investors in the Trust do not benefit from the specific investor protection provided by CISA and the supervision by the FINMA in connection with the approval for offering.

Singapore

This content has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this content and any other content or material in connection with the offer or sale, or invitation for subscription or purchase, of the Trust may not be circulated or distributed, nor may be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor (as defined in Section 4A of the Securities and Futures Act 2001, as modified or amended from time to time (SFA)) pursuant to Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the SFA) pursuant to Section 275(1), or any person pursuant to Section 275(1A), and in accordance with the conditions specified in Section 275 of the SFA, or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Where the Trust is subscribed or purchased under Section 275 by a relevant person which is:

(a) a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or

(b) a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor, securities or securities-based derivatives contracts (each term as defined in Section 2(1) of the SFA) of that corporation or the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferred within six months after that corporation or that trust has acquired the securities pursuant to an offer made under Section 275 except:

(1) to an institutional investor or to a relevant person or to any person arising from an offer referred to in Section 275(1A) or Section 276(4)(c)(ii) of the SFA,

(2) where no consideration is or will be given for the transfer;

(3) where the transfer is by operation of law; or

(4) pursuant to Section 276(7) of the SFA or Regulation 37A of the Securities and Futures (Offers of Investments) (Securities and Securities-based Derivatives Contracts) Regulations 2018.