Investor Webinar: Written Overview

Claire Shaw – Portfolio Director

- In a recent live webinar, Tom Slater and Lawrence Burns updated shareholders on all things Scottish Mortgage

- The managers answered shareholder questions on the geopolitical environment, the ongoing share buyback and exposure to private companies and China.

- They shared their enthusiasm for the ongoing operational progress of portfolio holdings and the areas in which they see the most exciting opportunities for long-term growth.

As with any investment, your capital is at risk.

At the recent Scottish Mortgage webinar, Claire Shaw, Portfolio Director, was joined by investment managers Tom Slater and Lawrence Burns to answer the questions on shareholders’ minds.

Popular topics included the ongoing share buyback, geopolitical impacts and the performance of key investments, including those in private companies and China.

Reduced Discount and the Impact of Saba

Slater opened with an update on the share buyback, announced in March 2024 when the Board committed to buying back at least £1bn worth of shares.

As of the webinar date (19 February 2025), £1.6bn worth of shares had been repurchased, and the discount had reduced from 14.5 per cent to 8.5 per cent.

Slater explained there was more to do, “The buyback is an attempt to ensure that over time we can match supply and demand to achieve that aim [of facilitating trading around the fund's asset value].”

The investment trust sector has recently been in the news due to the actions of US activist hedge fund Saba Capital.

Shareholders wondered whether the reduced discount and improved share price performance made Scottish Mortgage “safe” from such activity.

Slater suggested that the real question was whether “we are delivering for our shareholders” because if you are not meeting their expectations, that could make you an activist target.

Despite the more volatile ride of the past five years, he believes the Trust is delivering on identifying the right long-term growth opportunities.

“The key for me always is to go back to fundamentals. What are we seeing at the companies? And we’re seeing attractive growth rates. We are seeing improving margins. We are seeing big opportunities.”

Impact of Geopolitical Changes and US Tech Bubble Concerns

Slater discussed the implications of President Trump’s administration on the portfolio and market.

He suggested that the Republican’s clean sweep of Congress, the House, the Senate and the presidency meant that “you’re open to a wide range of outcomes” that are hard to predict.

However, he emphasised that the most important drivers of returns are long-term structural changes in the economy rather than macroeconomics or politics.

He highlighted the portfolio companies' resilience and adaptability in a fast-moving, changing environment, which he believes puts them “in a strong position to deal with whatever may be thrown at them.”

In addressing Elon Musk's connection with Tesla and SpaceX, Slater explained the rationale for the Tesla reduction.

He confirmed this was due to the recent significant share price appreciation without any fundamental change, which made it harder to see the same scale of upside from here.

However, SpaceX remains the largest holding due to its strategic importance for the US and the potential for deregulation to boost the launch cadence.

Burns highlighted that SpaceX’s current valuation has been driven by December 2024’s $1.5bn tender offer that enabled existing shareholders to sell their shares.

On questions of an IPO, he reminded the audience that the company was strong and did not require capital. Therefore, it does not need to IPO and can “choose what it thinks is the best way to maximise long-term value.”

The webinar also covered concerns about valuations in the US market, particularly the NASDAQ, which is at record highs.

Slater suggested that although ‘The Magnificent Seven’, a group of large US technology companies, has driven much of the market's performance, it would be misleading to lump them together, given the “different trends at play”.

He explained that the managers’ focus is on “thinking about the opportunities,” ie, identifying attractive long-term growth companies rather than worrying about market levels.

"I think one of the big drivers of value creation within the Scottish Mortgage portfolio, if you look over the past 20 years, is that we haven’t worried about a top-down asset allocation."

NVIDIA, AI and Technological Advances

Burns highlighted NVIDIA as the perfect example of trends being “driven by a small number of big winners.” He noted that because of that outlier upside, Scottish Mortgage has taken approximately £1.5bn of profit from an initial £64m investment.

Last year, NVIDIA became the world’s most valuable company, meaning it became more difficult to “get a risk-reward that looked attractive enough for it to be the trust’s largest holding.”

Demand is also expected to lower over the very long run. With NVIDIA's “incredible” competitive position in the AI training stage less assured in the inference stage, the decision was taken to reduce the holding.

In contrast, Burns noted, “Our enthusiasm and conviction about the change that generative AI can bring over the next five to ten years has probably never been higher.”

Some of the proceeds from trimmed holdings have gone into companies that the managers believe will benefit from AI, such as Meta in advertising and Shopify with its ecommerce tools.

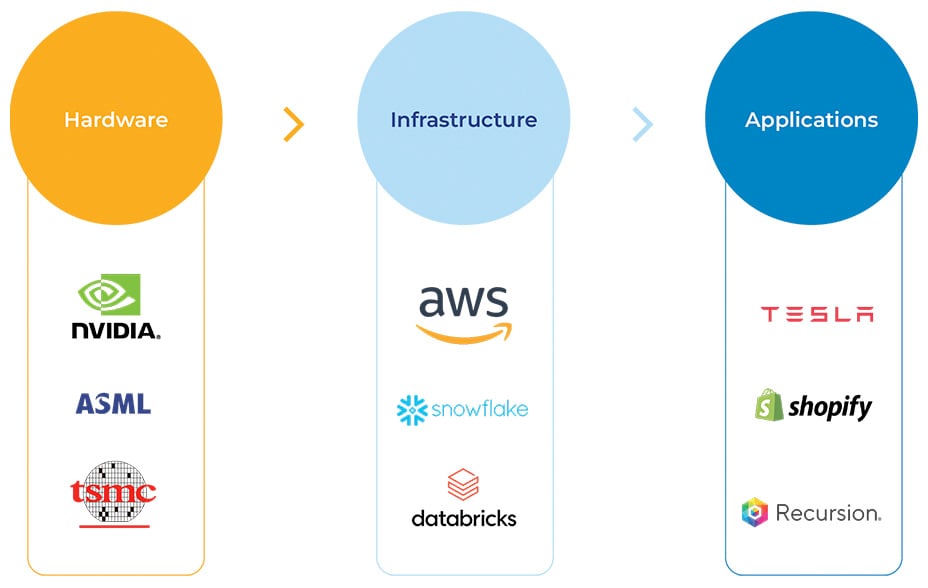

Burns highlighted the portfolio's three layers of AI exposure:

Hardware: where we have already seen a lot of value creation

Infrastructure: companies that are helping other companies to use and access AI

Application: companies that are using AI as part of their commercial products

He noted that with Scottish Mortgage’s range of digital and software companies, the Trust is well-placed to take full advantage as AI becomes more ubiquitous.

“I think there’s probably an argument that there will be a greater degree of value creation on the application side,” he said.

Another question on AI was the impact that DeepSeek will have on portfolio holdings and AI trends more generally. Slater commented that despite short-term volatility, the introduction of another big player is a positive thing: "it’s part of what’s driving the incredibly rapid progress in the capabilities of these AI systems"

He added that the lower price point that DeepSeek is offering "just means much wider deployment of these systems and that you will get intelligence built into more and more of the products and service that we use."

Portfolio Exposure to Chinese Companies

Questions were raised about the Trust’s exposure to Chinese companies and the lessons learned from the fall in share prices in 2021 and 2022.

Burns explained that Chinese exposure has been reduced to reflect regulatory and geopolitical risks. However, our enthusiasm remains because it is the world’s second-largest consumer market, where “companies have shown a huge ability to innovate.”

He believes there are signs of a growing recognition within the government that Chinese companies are more critical to delivering prosperity than was anticipated five years ago.

The Trust concentrates its exposure on a few companies offering significant upside potential. Key holdings include Meituan, PDD and ByteDance, which the managers beleive can withstand a challenging, changing environment.

Private Company Investments

The managers emphasised the importance of investing in private companies, not least for the long-term return potential. Successful private investments include SpaceX, Wise and Spotify.

These investments also provide a broader perspective on the changing world and create a more differentiated knowledge base for decision-making.

Burns adds that investing in private companies makes for “a more close and engaging relationship” than you typically might have in the pressurised environment of public markets.

In response to a question on the level of IPOs, Slater reminded the audience that the most successful private companies have access to vast pools of capital, as a recent capital raise by Databricks confirmed. They do not need to go public.

He suggested that shareholders take a long-term view rather than trying to predict when companies will IPO, knowing that “it will be the underlying operational performance of the business that matters.”

Slater used Revolut as an example of a recent private company investment. He explained that digital banking services such as Revolut have significant growth potential, especially in regions with large populations whose first banking experience is likely to be digital.

Future Focused

Burns reiterated that only a few businesses “have the exceptional characteristics” to deliver outlier returns and are resilient across different conditions.

Therefore, the managers have spent time reflecting on what leads to resilience in an uncertain and volatile world.

However, it is not about managing volatility; as Slater asserted, “[this] is what drives the long-term returns.” Therefore, shareholders need to accept that it will be a volatile ride, but we think it is worth it in the long run.

In closing, the managers shared some aspects of their research that they were excited about.

Burns highlighted the possibility of AI reducing the cost of delivering financial services to the point where it was “a private banker in your pocket” who knows your profile and acts as an agent on your behalf.

Slater spoke to autonomous system development. He highlighted Zipline, a US drone company whose autonomous system has launched commercially in the US. He believes it will be “transformational,” reducing delivery costs and improving efficiency.

As reflected in our Aurora and Joby Aviation holdings, the managers have anticipated autonomous systems becoming a reality for some time. So, he is excited that we are now at the stage where we are seeing real-world physical examples.

To sum up the managers' optimism for these exciting long-term growth trends playing out, Slater concluded: "what matters to us is owning the world’s best long-term growth companies, being upfront with people that it will be a volatile ride, but in the long term, we think it’s worth it.

Listen to the Scottish Mortgage podcast, Invest in Progress, to hear the managers interview the leaders of portfolio companies such as Zipline, Joby Aviation, and Blockchain.com.

Annual Past Performance To 31 December each year (net%)

| 2020 | 2021 | 2022 | 2023 | 2024 | |

| Share Price |

110.5 |

10.5 |

-45.7 |

-12.5 |

18.8 |

| NAV |

106.5 |

13.2 |

-39.0 |

10.1 |

23.9 |

Source: Morningstar, total return, sterling. NAV stands for Net Asset Value.

Past performance is not a guide to future returns.

Risk Factors

Unlisted investments such as private companies, in which the Trust has a significant investment, can increase risk. These assets may be more difficult to sell, so changes in their prices may be greater.

The Trust invests in emerging markets, which includes China, where difficulties with market volatility, political and economic instability including the risk of market shutdown, trading, liquidity, settlement, corporate governance, regulation, legislation and taxation could arise, resulting in a negative impact on the value of your investment.

The trust invests in overseas securities. Changes in the rates of exchange may also cause

the value of your investment (and any income it may pay) to go down or up.

About the author - Claire Shaw

Portfolio Director

Claire Shaw is a portfolio director and plays a prominent role in servicing Scottish Mortgage’s UK shareholder base. Before joining in 2019, she spent over a decade as a fund manager with a focus on managing European equity portfolios for a global client base. With a background in analysing companies and communicating investment ideas, Claire is also responsible for creating engaging content that makes the Scottish Mortgage portfolio accessible to all its shareholders. Beyond that, she works closely with the managers, meeting with portfolio companies and conducting in-depth portfolio discussions with shareholders.

Regulatory Information

This content was produced and approved at the time stated and may not have been updated subsequently. It represents views held at the time of production and may not reflect current thinking. Read our Legal and regulatory information for further details.

A Key Information Document is available by visiting our Documents page. Any images used in this content are for illustrative purposes only.

This content does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 (BGA) holds a Type 1 licence from the Securities and Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes and closed-ended funds such as investment trusts to professional investors in Hong Kong.

Baillie Gifford Asia (Singapore) Private Limited (BGAS) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. BGA and BGAS are wholly owned subsidiaries of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

Europe

Scottish Mortgage Investment Trust PLC (the “Company”) is an alternative investment fund for the purpose of Directive 2011/61/EU (the “AIFM Directive”). Baillie Gifford & Co Limited is the alternative investment fund manager (“AIFM”) of the Company and has been authorised for marketing to Professional Investors in this jurisdiction.

This content is made available by Baillie Gifford Investment Management (Europe) Limited (“BGE”), which has been engaged by the AIFM to carry out promotional activities relating to the Company. BGE is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform promotional, advisory and Individual Portfolio Management activities. BGE has passported its authorisations under the mechanisms set out in the AIFM Directive.

Belgium

The Company has not been and will not be registered with the Belgian Financial Services and Markets Authority (Autoriteit voor Financiële Diensten en Markten / Autorité des services et marchés financiers) (the FSMA) as a public foreign alternative collective investment scheme under Article 259 of the Belgian Law of 19 April 2014 on alternative collective investment institutions and their managers (the Law of 19 April 2014). The shares in the Company will be marketed in Belgium to professional investors within the meaning the Law of 19 April 2014 only. Any offering material relating to the offering has not been, and will not be, approved by the FSMA pursuant to the Belgian laws and regulations applicable to the public offering of securities. Accordingly, this offering as well as any documents and materials relating to the offering may not be advertised, offered or distributed in any other way, directly or indirectly, to any other person located and/or resident in Belgium other than to professional investors within the meaning the Law of 19 April 2014 and in circumstances which do not constitute an offer to the public pursuant to the Law of 19 April 2014. The shares offered by the Company shall not, whether directly or indirectly, be marketed, offered, sold, transferred or delivered in Belgium to any individual or legal entity other than to professional investors within the meaning the Law of 19 April 2014 or than to investors having a minimum investment of at least EUR 250,000 per investor.

Germany

The Trust has not offered or placed and will not offer or place or sell, directly or indirectly, units/shares to retail investors or semi-professional investors in Germany, i.e. investors which do not qualify as professional investors as defined in sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB) and has not distributed and will not distribute or cause to be distributed to such retail or semi-professional investor in Germany, this document or any other offering material relating to the units/shares of the Trust and that such offers, placements, sales and distributions have been and will be made in Germany only to professional investors within the meaning of sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB).

Luxembourg

Units/shares/interests of the Trust may only be offered or sold in the Grand Duchy of Luxembourg (Luxembourg) to professional investors within the meaning of Luxembourg act by the act of 12 July 2013 on alternative investment fund managers (the AIFM Act). This document does not constitute an offer, an invitation or a solicitation for any investment or subscription for the units/shares/interests of the Trust by retail investors in Luxembourg. Any person who is in possession of this document is hereby notified that no action has or will be taken that would allow a direct or indirect offering or placement of the units/shares/interests of the Trust to retail investors in Luxembourg.

Switzerland

The Trust has not been approved by the Swiss Financial Market Supervisory Authority (“FINMA”) for offering to non-qualified investors pursuant to Art. 120 para. 1 of the Swiss Federal Act on Collective Investment Schemes of 23 June 2006, as amended (“CISA”). Accordingly, the interests in the Trust may only be offered or advertised, and this document may only be made available, in Switzerland to qualified investors within the meaning of CISA. Investors in the Trust do not benefit from the specific investor protection provided by CISA and the supervision by the FINMA in connection with the approval for offering.

Singapore

This content has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this content and any other content or material in connection with the offer or sale, or invitation for subscription or purchase, of the Trust may not be circulated or distributed, nor may be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor (as defined in Section 4A of the Securities and Futures Act 2001, as modified or amended from time to time (SFA)) pursuant to Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the SFA) pursuant to Section 275(1), or any person pursuant to Section 275(1A), and in accordance with the conditions specified in Section 275 of the SFA, or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Where the Trust is subscribed or purchased under Section 275 by a relevant person which is:

(a) a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or

(b) a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor, securities or securities-based derivatives contracts (each term as defined in Section 2(1) of the SFA) of that corporation or the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferred within six months after that corporation or that trust has acquired the securities pursuant to an offer made under Section 275 except:

(1) to an institutional investor or to a relevant person or to any person arising from an offer referred to in Section 275(1A) or Section 276(4)(c)(ii) of the SFA,

(2) where no consideration is or will be given for the transfer;

(3) where the transfer is by operation of law; or

(4) pursuant to Section 276(7) of the SFA or Regulation 37A of the Securities and Futures (Offers of Investments) (Securities and Securities-based Derivatives Contracts) Regulations 2018.