A World of Opportunities: Forum Write-Up

Claire Shaw – Portfolio Director

- Scottish Mortgage invests in exceptional companies globally and sees significant opportunities in public and private markets worldwide

- The diverse portfolio spans global themes such as AI, electric vehicles and semiconductors

- Cost-focused US companies, European luxury brands, innovation in China and digital transformation in developing markets are exciting areas

As with any investment, your capital is at risk.

At the Scottish Mortgage Forums for professional investors in early 2025, manager Tom Slater and deputy Lawrence Burns invited attendees on a tour around the world. On the journey, they explored the significant progress in public and private markets in every corner of the globe.

US: Resilience and Adaptability

The first point of arrival was the United States. Slater acknowledged the uncertainty surrounding the impact of the new Trump administration, which has accelerated a shift back to a more conservative social and political stance, on the stock market.

He anticipates a lighter-touch regulatory environment that could benefit certain industries and a re-embrace of free markets. However, he notes that there is a wide range of possible outcomes, and the impact on the anti-trust environment for Big Tech remains uncertain.

As such, Slater stressed the importance of resilience and adaptability for companies. He referenced Meta, Amazon, Doordash and Roblox, all of which have focused on controlling their cost base and driving efficiency post-Covid. This has led to a rebound in productivity and driven profits to new highs.

He also noted the potential for growth in space exploration, cryptocurrency and transport under the new administration's lighter regulatory touch. This could benefit companies such as SpaceX (the Trust’s largest holding), Blockchain.com and Tesla.

The Trust significantly reduced its Tesla holding in the fourth quarter of 2024 after the sharp valuation rise in the absence of fundamental news. However, the managers remain excited about Tesla’s prospects and will be alert to opportunities to reinvest.

The birthplace of innovation isn’t always a founder in their garage; sometimes, it’s a poker game. Solugen chief executive Gaurab Chakrabarti tells the tale of how friendship sparked a revolution in chemical production in the first episode of Season 3’s Invest in Progress podcast.

Listen to the podcast here.

Another US holding where the Trust has been making changes is NVIDIA, the dominant supplier of artificial intelligence (AI) software and hardware.

“It is because AI is so important that we think it must be commoditised. It will be so ubiquitous that you can’t have one company at the heart of the ecosystem making $100bn of profit,” explained Slater.

As AI models evolve, Slater anticipates its company-specific advantages will become less pronounced. This led to the Trust selling $1bn in shares last year.

Elsewhere, Tempus AI is applying the power of data and AI to healthcare. It IPO’d in the summer of 2024. Scottish Mortgage has held it since 2018, and when it went public, it was the Trust’s sixth-largest private holding company.

China: Why Bother?

The journey continued to China. In explaining the rationale for persisting despite the geopolitical tensions, Slater suggested, “It has much in common with the US, with driven entrepreneurs, a focus on innovation, deep capital markets and large domestic opportunities.”

He highlighted the importance of recognising China's rapid progress in high-tech industries such as electric vehicles, drones, robotics, semiconductors, renewable energy and advanced manufacturing.

Meituan, a leading Chinese food delivery company, has delivered strong performance for the Trust. BYD is a Chinese electric vehicle manufacturer with the potential to become a global leader. It is growing its revenue at 40 per cent annually while maintaining a remarkable return on equity.

China is also home to Horizon Robotics, the second of Scottish Mortgage’s holdings to go public in 2024. Slater expressed the view that the worst of the regulatory challenges may be behind us, noting that the potential return of Ant International's IPO is seen as a positive signal for the market.

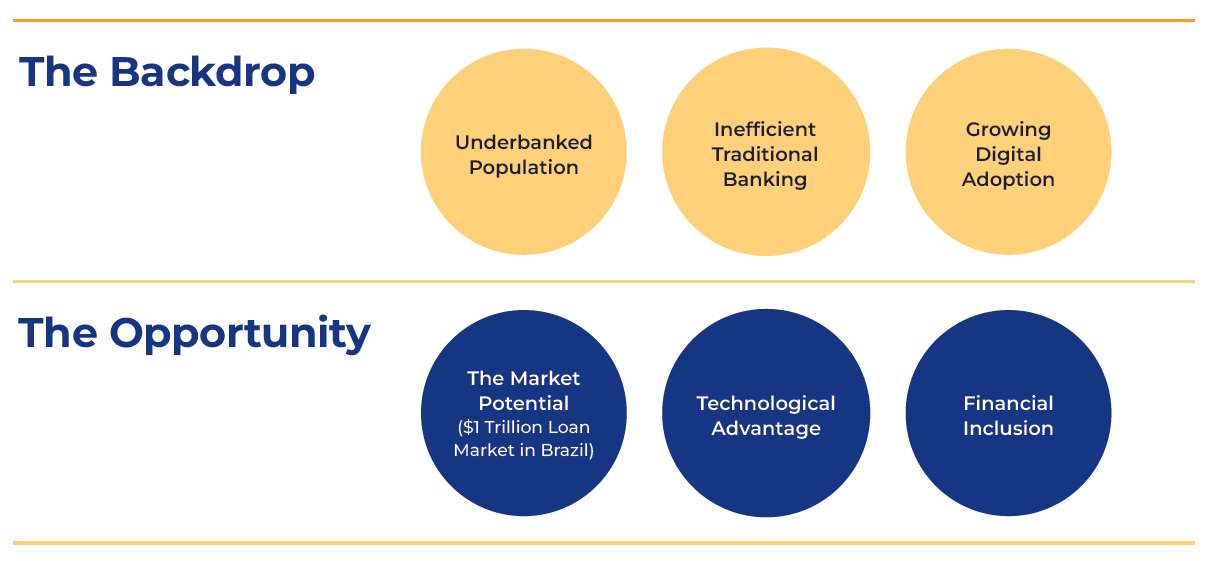

Latin America: Digital Transformation in the Financial Landscape

Lawrence Burns proceeded to Latin America, where he explained, “Digitisation in the developing world is not just at an earlier stage, but it has the potential to be more meaningful...The existing offline services and infrastructure are less developed, which means the upgrade you get from shifting to online becomes radical.”

Burns showcased Mercadolibre, the leading digital platform in Latin America. Despite the region's weak economic backdrop, it has grown significantly by offering a greater range of goods, lower prices and faster delivery.

The company is expanding into financial services (payments and digital banking) and digital advertising, leveraging its ecommerce data to inform lending decisions and target advertisements.

Burns said that this ability to deliver multiple acts, where a company leverages success in one area into another, will be important in enabling outlier returns.

Another notable company in the region is Nubank, the world's largest digital bank outside of China. He noted that as it is unencumbered by legacy IT systems or branch infrastructure, it charges less than traditional banks while still being highly profitable.

From selling additional financial products to Brazilian customers to expanding into Mexico and Colombia, it has the potential to become a global digital bank.

Southeast Asia: Digital Pioneers in Fast-Growing and Dynamic Sectors

The next destination was Southeast Asia, home to some of the world's fastest-growing ecommerce markets.

Scottish Mortgage invested in SEA last year, following a steep share price fall, the managers’ growing conviction in the longevity of the company’s competitive edge and management’s ability to execute.

SEA is the region's leading digital platform, excelling in gaming, ecommerce and financial services. Its market shares have steadily increased, and Burns pointed out that it is another excellent example of “a digital company delivering multiple acts.”

He noted that the company has shown remarkable growth, taking logistics in-house to improve delivery speed and cost efficiency.

In South Korea, Coupang stands out as a dominant ecommerce player. Its highly efficient logistics network allows it to deliver 99 per cent of orders within one day. The company is also expanding into new areas, such as food delivery and streaming, showcasing its ability to diversify and grow.

Europe: Iconic Luxury Brands

Closer to home, the next stop was Europe, where Scottish Mortgage has invested in iconic luxury brands. While these do not make for explosive growth, the combination of excellent financial characteristics, resilience and longevity can enable outlier-like outcomes over time.

Ferrari and Hermes are prime examples of companies that have cultivated unparalleled brand equity and pricing power. Ferrari has been one of the Trust’s top ten contributors over the past five years.

Ferrari’s strategy of producing fewer cars than market demand maintains its allure and cachet with price-agnostic customers. Likewise, Hermes' Birkin and Kelly bags have waiting lists measured in years.

Taiwan and the Netherlands: At the Heart of Technological Progress

The final destinations were Taiwan and the Netherlands, which though geographically apart are linked by a global theme.

Burns said, “The semiconductor may be our entire species' largest and most important endeavour. Improving the amount of compute in the world has near endless possibilities … and we will never reach the point of being saturated with intelligence.”

The Taiwanese company TSMC is the world's largest integrated circuit manufacturer, producing nearly 90 per cent of the world's most advanced chips. TSMC's scale and dominance make it a linchpin of the global semiconductor industry.

He noted the company’s dependence on ASML in the Netherlands, which has a monopoly on advanced lithography machines essential for chip manufacturing.

ASML's machines are among the most complex in the world, making both companies critical enablers of technological advances that hold up the world economy.

Around the Globe in One Portfolio

Burns concluded that one of Scottish Mortgage’s key advantages is its unrestricted access to a rich and diverse opportunity set, both in public and private markets and regarding geography. The Trust will continue to invest in exceptional companies and change wherever they might be on our shareholders’ behalf.

Risk Factors

Unlisted investments such as private companies, in which the Trust has a significant investment, can increase risk. These assets may be more difficult to sell, so changes in their prices may be greater.

The Trust invests in emerging markets, which includes China, where difficulties with market volatility, political and economic instability including the risk of market shutdown, trading, liquidity, settlement, corporate governance, regulation, legislation and taxation could arise, resulting in a negative impact on the value of your investment.

The trust invests in overseas securities. Changes in the rates of exchange may also cause

the value of your investment (and any income it may pay) to go down or up.

About the author - Claire Shaw

Portfolio Director

Claire Shaw is a portfolio director and plays a prominent role in servicing Scottish Mortgage’s UK shareholder base. Before joining in 2019, she spent over a decade as a fund manager with a focus on managing European equity portfolios for a global client base. With a background in analysing companies and communicating investment ideas, Claire is also responsible for creating engaging content that makes the Scottish Mortgage portfolio accessible to all its shareholders. Beyond that, she works closely with the managers, meeting with portfolio companies and conducting in-depth portfolio discussions with shareholders.

Regulatory Information

This content was produced and approved at the time stated and may not have been updated subsequently. It represents views held at the time of production and may not reflect current thinking. Read our Legal and regulatory information for further details.

A Key Information Document is available by visiting our Documents page. Any images used in this content are for illustrative purposes only.

This content does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 (BGA) holds a Type 1 licence from the Securities and Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes and closed-ended funds such as investment trusts to professional investors in Hong Kong.

Baillie Gifford Asia (Singapore) Private Limited (BGAS) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. BGA and BGAS are wholly owned subsidiaries of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

Europe

Scottish Mortgage Investment Trust PLC (the “Company”) is an alternative investment fund for the purpose of Directive 2011/61/EU (the “AIFM Directive”). Baillie Gifford & Co Limited is the alternative investment fund manager (“AIFM”) of the Company and has been authorised for marketing to Professional Investors in this jurisdiction.

This content is made available by Baillie Gifford Investment Management (Europe) Limited (“BGE”), which has been engaged by the AIFM to carry out promotional activities relating to the Company. BGE is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform promotional, advisory and Individual Portfolio Management activities. BGE has passported its authorisations under the mechanisms set out in the AIFM Directive.

Belgium

The Company has not been and will not be registered with the Belgian Financial Services and Markets Authority (Autoriteit voor Financiële Diensten en Markten / Autorité des services et marchés financiers) (the FSMA) as a public foreign alternative collective investment scheme under Article 259 of the Belgian Law of 19 April 2014 on alternative collective investment institutions and their managers (the Law of 19 April 2014). The shares in the Company will be marketed in Belgium to professional investors within the meaning the Law of 19 April 2014 only. Any offering material relating to the offering has not been, and will not be, approved by the FSMA pursuant to the Belgian laws and regulations applicable to the public offering of securities. Accordingly, this offering as well as any documents and materials relating to the offering may not be advertised, offered or distributed in any other way, directly or indirectly, to any other person located and/or resident in Belgium other than to professional investors within the meaning the Law of 19 April 2014 and in circumstances which do not constitute an offer to the public pursuant to the Law of 19 April 2014. The shares offered by the Company shall not, whether directly or indirectly, be marketed, offered, sold, transferred or delivered in Belgium to any individual or legal entity other than to professional investors within the meaning the Law of 19 April 2014 or than to investors having a minimum investment of at least EUR 250,000 per investor.

Germany

The Trust has not offered or placed and will not offer or place or sell, directly or indirectly, units/shares to retail investors or semi-professional investors in Germany, i.e. investors which do not qualify as professional investors as defined in sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB) and has not distributed and will not distribute or cause to be distributed to such retail or semi-professional investor in Germany, this document or any other offering material relating to the units/shares of the Trust and that such offers, placements, sales and distributions have been and will be made in Germany only to professional investors within the meaning of sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB).

Luxembourg

Units/shares/interests of the Trust may only be offered or sold in the Grand Duchy of Luxembourg (Luxembourg) to professional investors within the meaning of Luxembourg act by the act of 12 July 2013 on alternative investment fund managers (the AIFM Act). This document does not constitute an offer, an invitation or a solicitation for any investment or subscription for the units/shares/interests of the Trust by retail investors in Luxembourg. Any person who is in possession of this document is hereby notified that no action has or will be taken that would allow a direct or indirect offering or placement of the units/shares/interests of the Trust to retail investors in Luxembourg.

Switzerland

The Trust has not been approved by the Swiss Financial Market Supervisory Authority (“FINMA”) for offering to non-qualified investors pursuant to Art. 120 para. 1 of the Swiss Federal Act on Collective Investment Schemes of 23 June 2006, as amended (“CISA”). Accordingly, the interests in the Trust may only be offered or advertised, and this document may only be made available, in Switzerland to qualified investors within the meaning of CISA. Investors in the Trust do not benefit from the specific investor protection provided by CISA and the supervision by the FINMA in connection with the approval for offering.

Singapore

This content has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this content and any other content or material in connection with the offer or sale, or invitation for subscription or purchase, of the Trust may not be circulated or distributed, nor may be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor (as defined in Section 4A of the Securities and Futures Act 2001, as modified or amended from time to time (SFA)) pursuant to Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the SFA) pursuant to Section 275(1), or any person pursuant to Section 275(1A), and in accordance with the conditions specified in Section 275 of the SFA, or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Where the Trust is subscribed or purchased under Section 275 by a relevant person which is:

(a) a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or

(b) a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor, securities or securities-based derivatives contracts (each term as defined in Section 2(1) of the SFA) of that corporation or the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferred within six months after that corporation or that trust has acquired the securities pursuant to an offer made under Section 275 except:

(1) to an institutional investor or to a relevant person or to any person arising from an offer referred to in Section 275(1A) or Section 276(4)(c)(ii) of the SFA,

(2) where no consideration is or will be given for the transfer;

(3) where the transfer is by operation of law; or

(4) pursuant to Section 276(7) of the SFA or Regulation 37A of the Securities and Futures (Offers of Investments) (Securities and Securities-based Derivatives Contracts) Regulations 2018.