Zipline: drones taking flight to save lives

Claire Shaw – Portfolio Director

Key points

- Zipline founder Keller Rinaudo Cliffton explains how the firm’s drones are saving lives all over Africa

- Autonomous drones powered by rechargeable batteries make deliveries cheaper, faster and zero emission

- Listen to the podcast to hear how the company is rolling out a logistics system for one of the world’s biggest retailers, Walmart

This article is a teaser for the Scottish Mortgage Zipline podcast. Having built the world’s first 24/7 autonomous delivery service, Zipline’s drones save lives by delivering medical supplies within minutes. But that’s just the starting point. You can hear directly from Zipline founder Keller Rinaudo Cliffton about his vision of creating a model of logistics that reaches everyone, everywhere here.

As with any investment, capital is at risk.

Zipline’s founder Keller Rinaudo Cliffton is used to people not believing him. When he founded the drone delivery service in 2014, investors and experts in global health alike told him he was foolish. They didn't think his vision of ‘instant logistics’ – building the world’s first automated, on-demand logistics system to serve all humans equally – was achievable.

Cliffton recounts:

The technology wasn’t going to work. Even though the technology worked, we would never get regulatory approval. Even if we could get regulatory approval, there was no chance that a country would pay us money to do this.

But his small team, with their backgrounds in robotics, software and automation, thought differently. Ignoring the experts, they focused on working directly with governments prepared to give Zipline the time and space to make it happen.

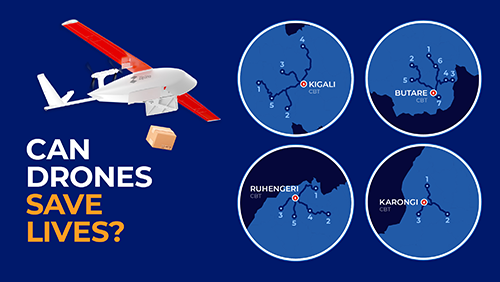

“Rwanda,” says Cliffton, “by virtue of being a small country, very technology forward, innovative, willing to try new things and make decisions quickly”, was an excellent place to start.

His tenacity and perseverance are already paying off and saving lives. And healthcare systems and large corporations across the globe are sitting up and taking notice.

Solving the problems too big for the world’s largest businesses

If it’s said that good things come to those who wait, the number of delivery vehicles on our streets suggests that fewer people believe it. We want items to appear as soon as we have ordered them.

That distracts from the fact that only the wealthiest people on earth – the golden billion as they’re sometimes known – have access to logistics. And that’s costing lives.

Cliffton highlights the, “five-and-a-half million kids under the age of five who lose their lives every year due to lack of access to basic medicinal products”.

Those families, and the healthcare systems providing them, are unlikely to care about the software, control algorithms, ground equipment or regulatory approvals behind Zipline’s automated drone technology.

What’s important is the millions of vaccine doses, infusions, blood transfusions, cancer products and insulin being delivered by autonomous delivery drones within minutes of a nurse or doctor requesting them.

At the outset, Rwanda proved a perfect “partner” and testing ground for the company. Cliffton remembers offering to deliver all medical products to every primary care facility and hospital in the country to its Minister of Health. He says, “She looked at me and said, just do blood.”

Enjoy investment manager Tom Slater’s entire conversation with Keller Rinaudo Cliffton on the Scottish Mortgage podcast. Hear how Zipline is creating universal access to healthcare and other goods by building a new delivery paradigm, and why Zipline deserves its place in the Scottish Mortgage portfolio as it scales its ability to deliver the things you need when you want them.

And for the first nine months, that’s precisely what Zipline did. Except it was only for one hospital.

Cliffton humbly admits it was “a total logistics nightmare” and “way harder than they were expecting”. The company had to factor in the different storage requirements and shelf lives of blood cells, platelets and plasma and replicate this across the blood types.

Today, with over 35 million commercial autonomous miles under its belt, Zipline delivers medical supplies and 67 per cent of the blood to Rwanda’s 450 primary care facilities and hospitals. It supplies 7,000 hospitals and health facilities worldwide.

Zipline’s secret weapon

From an outsider’s perspective, you might assume Zipline’s competitive advantage lies in its small, automated electric aircraft, weighing about 22 kilograms, that can fly 300 kilometres on a single battery charge and deliver products from the sky onto the ground with the precision of two parking spaces.

Cliffton disagrees. He suggests that being “scrappy, frugal problem solvers” is in the company’s DNA and aircraft technology only represents 15 per cent of the complexity they have had to solve in real-time to build a cutting-edge logistics system.

While the company’s product vision is to approximate teleportation, Cliffton confirms, “a huge part of our mission is just that we think that everybody deserves universal access to healthcare”:

I think a lot of people are sick of this paradigm of technology companies being evil and destroying democracy. Many people want to be part of something they can tell their grandkids they created from scratch [to solve these kinds of problems]. And so, I think our mission has been our secret weapon in competing against much bigger companies.

Developing the infrastructure has become a source of national pride in many countries Zipline has launched in. It has always hired entirely local teams, whom Cliffton points out, “are doing what some of the richest technology companies on Earth have tried to do and failed.”

It’s clear from what Cliffton says that fashioning a new kind of global logistics network that is automated, zero emission and 10 times faster than any other delivery form does not phase him. Zipline’s partnership with Walmart in the US demonstrates that once you offer this service for health and wellness products, customers expect everything else to be delivered within the same timeframe (minutes rather than hours) and to-the-door convenience. As we expand on in the podcast, from the starting point of delivering blood in Rwanda to dropping off rotisserie chickens and birthday cakes in the US, drone delivery has the potential to take a significant share of the global logistics network. If the company succeeds, it will tremendously impact humanity, facilitating universal access to healthcare products and everything else.

About the author - Claire Shaw

Portfolio Director

Claire Shaw is a portfolio director and plays a prominent role in servicing Scottish Mortgage’s UK shareholder base. Before joining in 2019, she spent over a decade as a fund manager with a focus on managing European equity portfolios for a global client base. With a background in analysing companies and communicating investment ideas, Claire is also responsible for creating engaging content that makes the Scottish Mortgage portfolio accessible to all its shareholders. Beyond that, she works closely with the managers, meeting with portfolio companies and conducting in-depth portfolio discussions with shareholders.

Regulatory Information

This content was produced and approved at the time stated and may not have been updated subsequently. It represents views held at the time of production and may not reflect current thinking. Read our Legal and regulatory information for further details.

A Key Information Document is available by visiting our Documents page. Any images used in this content are for illustrative purposes only.

This content does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 (BGA) holds a Type 1 licence from the Securities and Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes and closed-ended funds such as investment trusts to professional investors in Hong Kong.

Baillie Gifford Asia (Singapore) Private Limited (BGAS) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. BGA and BGAS are wholly owned subsidiaries of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

Europe

Scottish Mortgage Investment Trust PLC (the “Company”) is an alternative investment fund for the purpose of Directive 2011/61/EU (the “AIFM Directive”). Baillie Gifford & Co Limited is the alternative investment fund manager (“AIFM”) of the Company and has been authorised for marketing to Professional Investors in this jurisdiction.

This content is made available by Baillie Gifford Investment Management (Europe) Limited (“BGE”), which has been engaged by the AIFM to carry out promotional activities relating to the Company. BGE is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform promotional, advisory and Individual Portfolio Management activities. BGE has passported its authorisations under the mechanisms set out in the AIFM Directive.

Belgium

The Company has not been and will not be registered with the Belgian Financial Services and Markets Authority (Autoriteit voor Financiële Diensten en Markten / Autorité des services et marchés financiers) (the FSMA) as a public foreign alternative collective investment scheme under Article 259 of the Belgian Law of 19 April 2014 on alternative collective investment institutions and their managers (the Law of 19 April 2014). The shares in the Company will be marketed in Belgium to professional investors within the meaning the Law of 19 April 2014 only. Any offering material relating to the offering has not been, and will not be, approved by the FSMA pursuant to the Belgian laws and regulations applicable to the public offering of securities. Accordingly, this offering as well as any documents and materials relating to the offering may not be advertised, offered or distributed in any other way, directly or indirectly, to any other person located and/or resident in Belgium other than to professional investors within the meaning the Law of 19 April 2014 and in circumstances which do not constitute an offer to the public pursuant to the Law of 19 April 2014. The shares offered by the Company shall not, whether directly or indirectly, be marketed, offered, sold, transferred or delivered in Belgium to any individual or legal entity other than to professional investors within the meaning the Law of 19 April 2014 or than to investors having a minimum investment of at least EUR 250,000 per investor.

Germany

The Trust has not offered or placed and will not offer or place or sell, directly or indirectly, units/shares to retail investors or semi-professional investors in Germany, i.e. investors which do not qualify as professional investors as defined in sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB) and has not distributed and will not distribute or cause to be distributed to such retail or semi-professional investor in Germany, this document or any other offering material relating to the units/shares of the Trust and that such offers, placements, sales and distributions have been and will be made in Germany only to professional investors within the meaning of sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB).

Luxembourg

Units/shares/interests of the Trust may only be offered or sold in the Grand Duchy of Luxembourg (Luxembourg) to professional investors within the meaning of Luxembourg act by the act of 12 July 2013 on alternative investment fund managers (the AIFM Act). This document does not constitute an offer, an invitation or a solicitation for any investment or subscription for the units/shares/interests of the Trust by retail investors in Luxembourg. Any person who is in possession of this document is hereby notified that no action has or will be taken that would allow a direct or indirect offering or placement of the units/shares/interests of the Trust to retail investors in Luxembourg.

Switzerland

The Trust has not been approved by the Swiss Financial Market Supervisory Authority (“FINMA”) for offering to non-qualified investors pursuant to Art. 120 para. 1 of the Swiss Federal Act on Collective Investment Schemes of 23 June 2006, as amended (“CISA”). Accordingly, the interests in the Trust may only be offered or advertised, and this document may only be made available, in Switzerland to qualified investors within the meaning of CISA. Investors in the Trust do not benefit from the specific investor protection provided by CISA and the supervision by the FINMA in connection with the approval for offering.

Singapore

This content has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this content and any other content or material in connection with the offer or sale, or invitation for subscription or purchase, of the Trust may not be circulated or distributed, nor may be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor (as defined in Section 4A of the Securities and Futures Act 2001, as modified or amended from time to time (SFA)) pursuant to Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the SFA) pursuant to Section 275(1), or any person pursuant to Section 275(1A), and in accordance with the conditions specified in Section 275 of the SFA, or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Where the Trust is subscribed or purchased under Section 275 by a relevant person which is:

(a) a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or

(b) a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor, securities or securities-based derivatives contracts (each term as defined in Section 2(1) of the SFA) of that corporation or the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferred within six months after that corporation or that trust has acquired the securities pursuant to an offer made under Section 275 except:

(1) to an institutional investor or to a relevant person or to any person arising from an offer referred to in Section 275(1A) or Section 276(4)(c)(ii) of the SFA,

(2) where no consideration is or will be given for the transfer;

(3) where the transfer is by operation of law; or

(4) pursuant to Section 276(7) of the SFA or Regulation 37A of the Securities and Futures (Offers of Investments) (Securities and Securities-based Derivatives Contracts) Regulations 2018.