Ocado’s robot retail revolution

Faith Glasgow – Journalist

Key Points

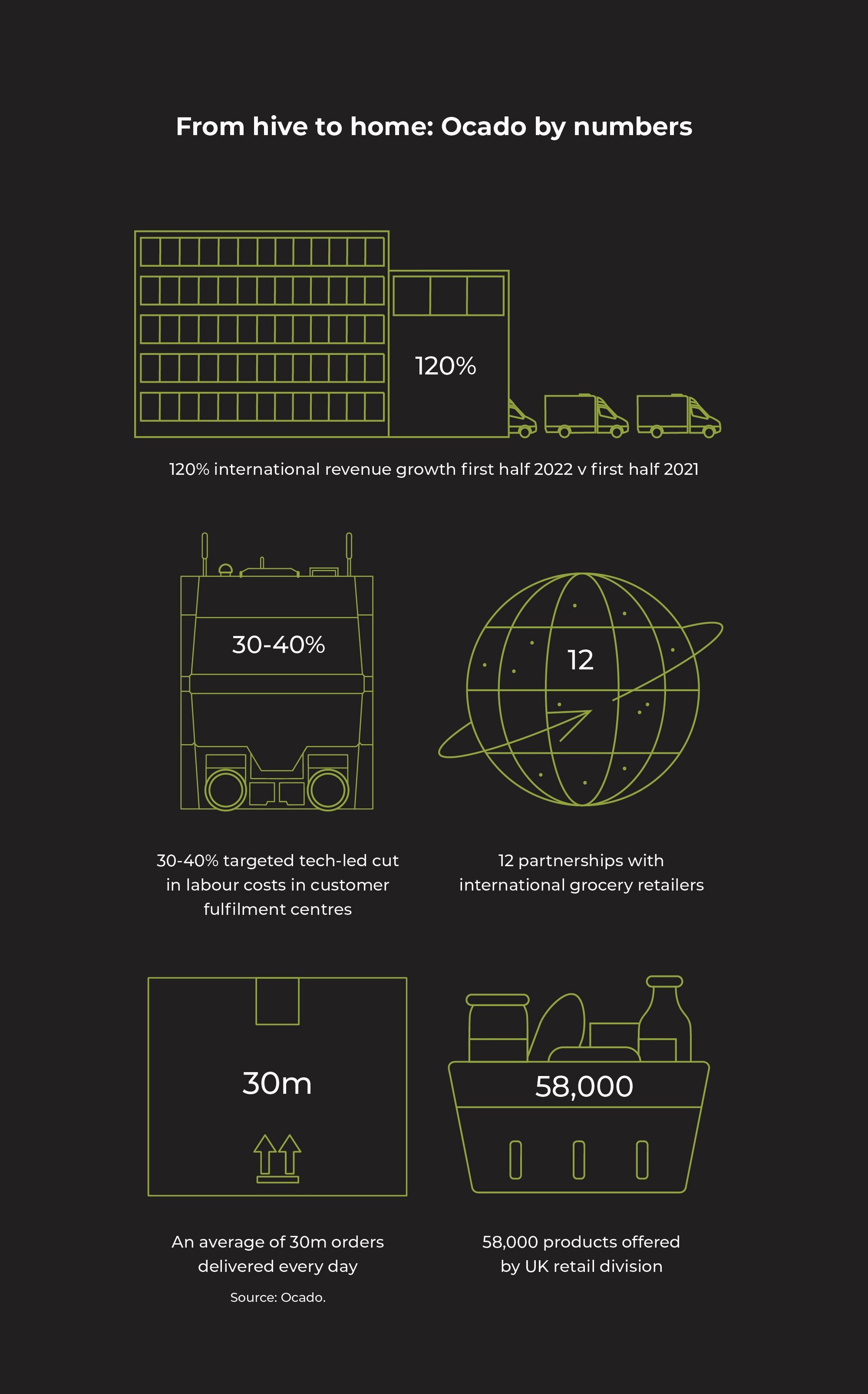

- Ocado is building robotic warehouses across the world in partnership with leading global grocers

- These tie-ups let the firms pool resources to accelerate technological innovation to cut the cost of home deliveries

- Ocado only has to capture a small fraction of the overall market to thrive

Ocado’s 500 Series bots at work in Purfleet, Essex. © Ocado Group

Please remember that the value of an investment can fall and you may not get back the amount invested. This article originally featured in Baillie Gifford’s Spring 2023 issue of Trust magazine.

A mix of automation and artificial intelligence will transform the way we shop within decades. You can see global retail’s future being tried and tested in Andover, a small Hampshire town.

In a warehouse bigger than three football pitches, a swarm of squat, rectangular robotic trolleys blink, pause and glide their way across a giant grid known as ‘the hive’. Around the clock, they collect crates containing tea, Jaffa cakes, toothpaste and cabbages stored below and ferry them to picking stations for packing.

A custom-built traffic control system choreographs this jerky hi-tech ballet at a speed, scale and complexity beyond any human intelligence. “Wifi and 4G [were] incapable of providing the amount of messaging to the amount of independent devices with the frequency that we wanted to do,” CEO Tim Steiner recently told Scottish Mortgage’s Invest in Progress podcast.

“So we created this system to allow us to communicate with the robots frequently enough to know where they all are 10 times a second.”

Using the robots, Ocado takes less than five minutes to prepare a 50-item order. In the average week, the site processes about 60,000 requests from shoppers.

At the end of 2022, Ocado had 19 such customer fulfilment centres (CFCs) in operation, with plans to open dozens more.

“A coming together of technologies makes this possible: data processing, robotics and autonomous decision making,” says Claire Shaw.

“What excites us about Ocado is that it benefits from the scale of the international grocers it partners with, so it’s able to invest in technology on a level that few others can match.”

The firm’s new 600 Series robots are a case in point. The machines use 3D-printed components, making them cheaper to manufacture and 80 per cent lighter than their predecessors. That means they can run on more lightweight grids, cutting the cost and construction time of new fulfilment centres.

Meanwhile, investment in software has led to innovations such as Ocado Swift Router. Overnight, it prepares deliveries that customers booked days in advance. Then, on the morning of the drop-offs, it plots van routes that accommodate last-minute orders on the same vehicles. Shaw explains: “The schedules prioritise the urgent orders while ensuring those with longer lead times still get delivered at the requested hour. This innovation helps its partners offer a premium fast-delivery service at a lower cost than would otherwise be the case.”

Steiner founded the company in 2000 with the help of two other ex-Goldman Sachs bankers. The firm began trading in 2002 in a groceries-selling alliance with the UK supermarket chain Waitrose.

A stock market flotation followed in 2010. Three years later, Ocado struck its first deal to provide its automation technology and online platform to another retailer, Morrisons, which uses them to run its own-brand ecommerce business. Similar tie-ups followed with France’s Groupe Casino, Sweden’s ICA and Canada’s Sobeys in 2018.

In 2020 Marks & Spencer replaced Waitrose as Ocado’s British groceries partner. A further seven overseas partners now make use of its Ocado Smart Platform technologies, including:

- Aeon in Japan

- Coles in Australia

- Kroger in the US

- Lotte Shopping in South Korea

Ocado is already committed to operating more than 60 robot-served customer fulfilment centres. But that figure could be dwarfed by what’s to come.

The global grocery market was worth more than $11tn in 2021. Even if Ocado succeeded in getting 1,000 CFCs up and running, it would still account for less than 5 per cent of that sum.

“There’s still a very long runway of opportunity,” Shaw says. “And as the world’s largest online-only grocery business, Ocado is in a powerful position to build its knowledge and improve efficiency.”

By further optimising its performance, the firm should help its partners cut waste and other costs, leading to lower prices for shoppers.

“It’s an industry that’s measured in the trillions, and it’s an industry that spends probably about a third of its sales on handling and distributing its products,” Steiner told Invest in Progress. “So there are hundreds of billions of dollars a year of efficiencies that could come out to benefit consumers and communities.”

The Hertfordshire-based business sets its fees according to the capacity of the sites it runs and the sales they achieve. It covers the robotic hive’s running costs and typically hosts its partners’ customer-facing apps and websites. But Shaw adds: “It’s the grocers themselves who pay for the lease vehicles, the stock and the staffing. The arrangement shields Ocado from inflation and keeps it focused on extending its lead over rivals.”

Moreover, since the computing capabilities driving advances in robotics and machine learning are improving exponentially, the cost savings Ocado provides its partners should, in time, outpace less technological efficiency savings, helping it win more clients.

“Whether it’s from a lack of entrepreneurial culture or government support, the UK doesn’t have an illustrious recent history of fostering founder-based companies that go global,” says Shaw. “The fact that Tim Steiner is talking about having these CFCs spread across the world reinforces Ocado’s ambition, tenacity and vision. It’s typical of the type of company we look for: one that can gain scale that competitors struggle to challenge.”

The more fulfilment centres Ocado builds, the greater the competitive advantage it should gain. And while giant retail rivals Amazon and Walmart have their own grocery automation ambitions, it’s possible Ocado could become the market-leading technology provider as its hives of activity spread worldwide.

Hear Ocado’s chief executive Tim Steiner talk more about his plans on Scottish Mortgage’s podcast Invest in Progress.

Listen to the podcast here.

About the author - Faith Glasgow

Journalist

Faith Glasgow has been writing about personal finance and investing for almost 30 years and was editor of Money Observer until it was closed last year.

Regulatory Information

This content was produced and approved at the time stated and may not have been updated subsequently. It represents views held at the time of production and may not reflect current thinking. Read our Legal and regulatory information for further details.

A Key Information Document is available by visiting our Documents page. Any images used in this content are for illustrative purposes only.

This content does not constitute, and is not subject to the protections afforded to, independent research. Baillie Gifford and its staff may have dealt in the investments concerned. The views expressed are not statements of fact and should not be considered as advice or a recommendation to buy, sell or hold a particular investment.

Baillie Gifford & Co and Baillie Gifford & Co Limited are authorised and regulated by the Financial Conduct Authority (FCA). The investment trusts managed by Baillie Gifford & Co Limited are listed on the London Stock Exchange and are not authorised or regulated by the FCA.

Baillie Gifford Asia (Hong Kong) Limited 柏基亞洲(香港)有限公司 (BGA) holds a Type 1 licence from the Securities and Futures Commission of Hong Kong to market and distribute Baillie Gifford’s range of collective investment schemes and closed-ended funds such as investment trusts to professional investors in Hong Kong.

Baillie Gifford Asia (Singapore) Private Limited (BGAS) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence to conduct fund management activities for institutional investors and accredited investors in Singapore. BGA and BGAS are wholly owned subsidiaries of Baillie Gifford Overseas Limited, which is wholly owned by Baillie Gifford & Co.

Europe

Scottish Mortgage Investment Trust PLC (the “Company”) is an alternative investment fund for the purpose of Directive 2011/61/EU (the “AIFM Directive”). Baillie Gifford & Co Limited is the alternative investment fund manager (“AIFM”) of the Company and has been authorised for marketing to Professional Investors in this jurisdiction.

This content is made available by Baillie Gifford Investment Management (Europe) Limited (“BGE”), which has been engaged by the AIFM to carry out promotional activities relating to the Company. BGE is authorised by the Central Bank of Ireland as an AIFM under the AIFM Regulations and as a UCITS management company under the UCITS Regulation. BGE also has regulatory permissions to perform promotional, advisory and Individual Portfolio Management activities. BGE has passported its authorisations under the mechanisms set out in the AIFM Directive.

Belgium

The Company has not been and will not be registered with the Belgian Financial Services and Markets Authority (Autoriteit voor Financiële Diensten en Markten / Autorité des services et marchés financiers) (the FSMA) as a public foreign alternative collective investment scheme under Article 259 of the Belgian Law of 19 April 2014 on alternative collective investment institutions and their managers (the Law of 19 April 2014). The shares in the Company will be marketed in Belgium to professional investors within the meaning the Law of 19 April 2014 only. Any offering material relating to the offering has not been, and will not be, approved by the FSMA pursuant to the Belgian laws and regulations applicable to the public offering of securities. Accordingly, this offering as well as any documents and materials relating to the offering may not be advertised, offered or distributed in any other way, directly or indirectly, to any other person located and/or resident in Belgium other than to professional investors within the meaning the Law of 19 April 2014 and in circumstances which do not constitute an offer to the public pursuant to the Law of 19 April 2014. The shares offered by the Company shall not, whether directly or indirectly, be marketed, offered, sold, transferred or delivered in Belgium to any individual or legal entity other than to professional investors within the meaning the Law of 19 April 2014 or than to investors having a minimum investment of at least EUR 250,000 per investor.

Germany

The Trust has not offered or placed and will not offer or place or sell, directly or indirectly, units/shares to retail investors or semi-professional investors in Germany, i.e. investors which do not qualify as professional investors as defined in sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB) and has not distributed and will not distribute or cause to be distributed to such retail or semi-professional investor in Germany, this document or any other offering material relating to the units/shares of the Trust and that such offers, placements, sales and distributions have been and will be made in Germany only to professional investors within the meaning of sec. 1 (19) no. 32 German Investment Code (Kapitalanlagegesetzbuch – KAGB).

Luxembourg

Units/shares/interests of the Trust may only be offered or sold in the Grand Duchy of Luxembourg (Luxembourg) to professional investors within the meaning of Luxembourg act by the act of 12 July 2013 on alternative investment fund managers (the AIFM Act). This document does not constitute an offer, an invitation or a solicitation for any investment or subscription for the units/shares/interests of the Trust by retail investors in Luxembourg. Any person who is in possession of this document is hereby notified that no action has or will be taken that would allow a direct or indirect offering or placement of the units/shares/interests of the Trust to retail investors in Luxembourg.

Switzerland

The Trust has not been approved by the Swiss Financial Market Supervisory Authority (“FINMA”) for offering to non-qualified investors pursuant to Art. 120 para. 1 of the Swiss Federal Act on Collective Investment Schemes of 23 June 2006, as amended (“CISA”). Accordingly, the interests in the Trust may only be offered or advertised, and this document may only be made available, in Switzerland to qualified investors within the meaning of CISA. Investors in the Trust do not benefit from the specific investor protection provided by CISA and the supervision by the FINMA in connection with the approval for offering.

Singapore

This content has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this content and any other content or material in connection with the offer or sale, or invitation for subscription or purchase, of the Trust may not be circulated or distributed, nor may be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor (as defined in Section 4A of the Securities and Futures Act 2001, as modified or amended from time to time (SFA)) pursuant to Section 274 of the SFA, (ii) to a relevant person (as defined in Section 275(2) of the SFA) pursuant to Section 275(1), or any person pursuant to Section 275(1A), and in accordance with the conditions specified in Section 275 of the SFA, or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the SFA.

Where the Trust is subscribed or purchased under Section 275 by a relevant person which is:

(a) a corporation (which is not an accredited investor (as defined in Section 4A of the SFA)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an accredited investor; or

(b) a trust (where the trustee is not an accredited investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor, securities or securities-based derivatives contracts (each term as defined in Section 2(1) of the SFA) of that corporation or the beneficiaries’ rights and interest (howsoever described) in that trust shall not be transferred within six months after that corporation or that trust has acquired the securities pursuant to an offer made under Section 275 except:

(1) to an institutional investor or to a relevant person or to any person arising from an offer referred to in Section 275(1A) or Section 276(4)(c)(ii) of the SFA,

(2) where no consideration is or will be given for the transfer;

(3) where the transfer is by operation of law; or

(4) pursuant to Section 276(7) of the SFA or Regulation 37A of the Securities and Futures (Offers of Investments) (Securities and Securities-based Derivatives Contracts) Regulations 2018.