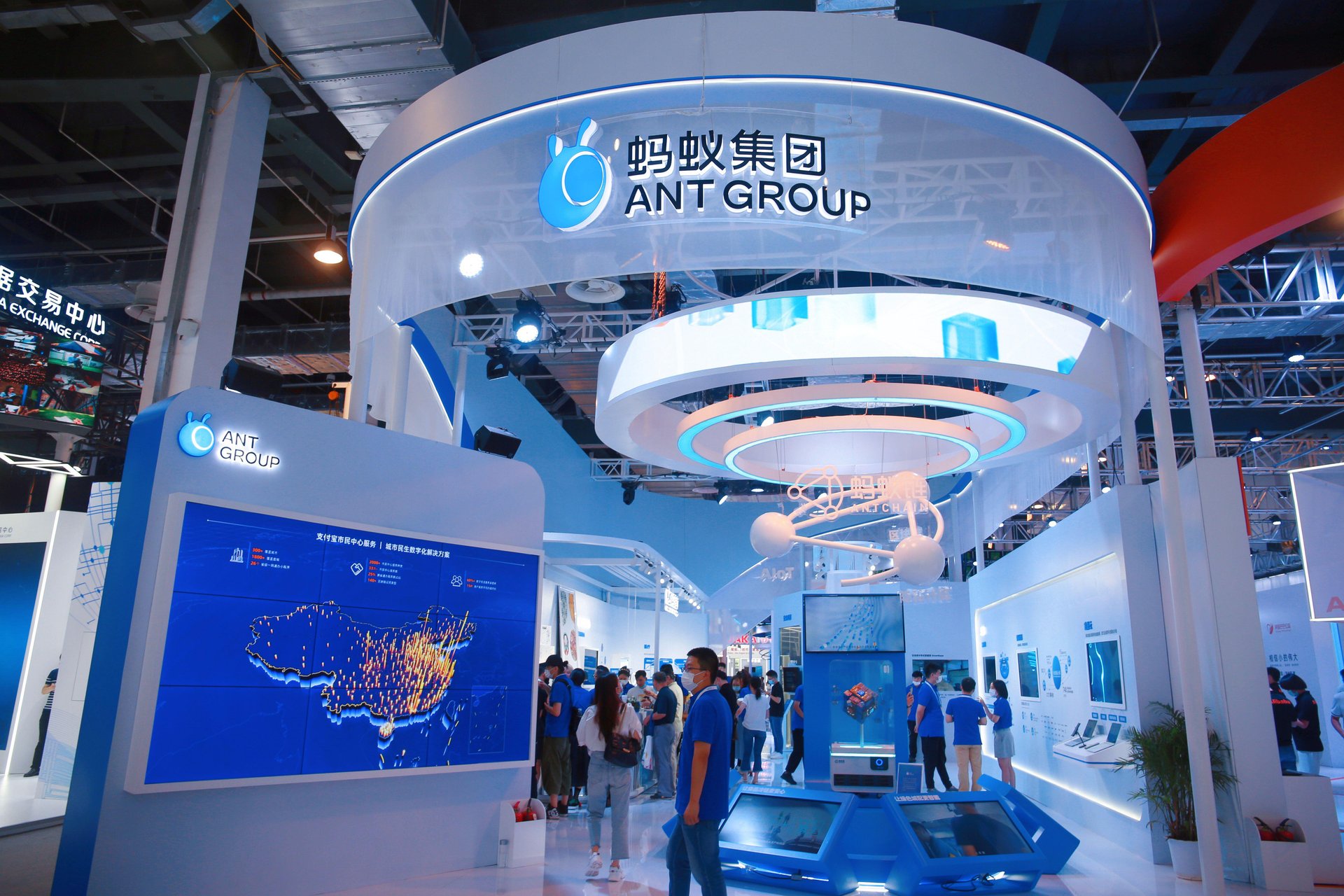

Ant International

Reshaping the global financial services industry

Ant International (formally Ant Financial) was founded by Alibaba in 2014 and is now among the largest fintech platforms in the world, servicing individual customers and small businesses.

Why do we own it?

Ant International offers an easy-to-use platform that is transforming financial services in China by making them available to everyone at a reasonable cost. Its services include online banking, mobile payments, wealth management, credit scoring, small business banking and a financial cloud.

Customers are consistently increasing the number of the platform’s services they use. This reinforces Ant’s extraordinary advantage. It knows who is buying what, and whether they pay their bills on time, so it can create financial products and solutions that (it already knows) customers want.

The business model is capital-light and generates a recurring income that supports existing operations and is reinvested in future growth prospects.

Who is key?

The culture of Alibaba has very much been adopted by Ant International. This means there is a long-term approach and a tech-driven mindset that engenders innovation. The main difference from Alibaba is that Ant International is even more mission-driven.

First bought

in June 2018.

Ant positions itself as an enabler, which works with other institutions to support the future financial needs of society.

The company showcased on this page is part of a diversified portfolio. The commentary should not be taken as advice on an individual stock.

Image Credit - © Cynthia Lee/Alamy Stock Photo

Investment trusts are UK public companies and are not authorised and regulated by the Financial Conduct Authority. You may not get back the amount invested and please bear in mind that past performance is not a guide to future performance.